Choosing the Perfect Niche for Your Online Store

Let’s delve into return windows, their influence on brand loyalty, and the balancing act businesses perform when setting these timeframes.

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

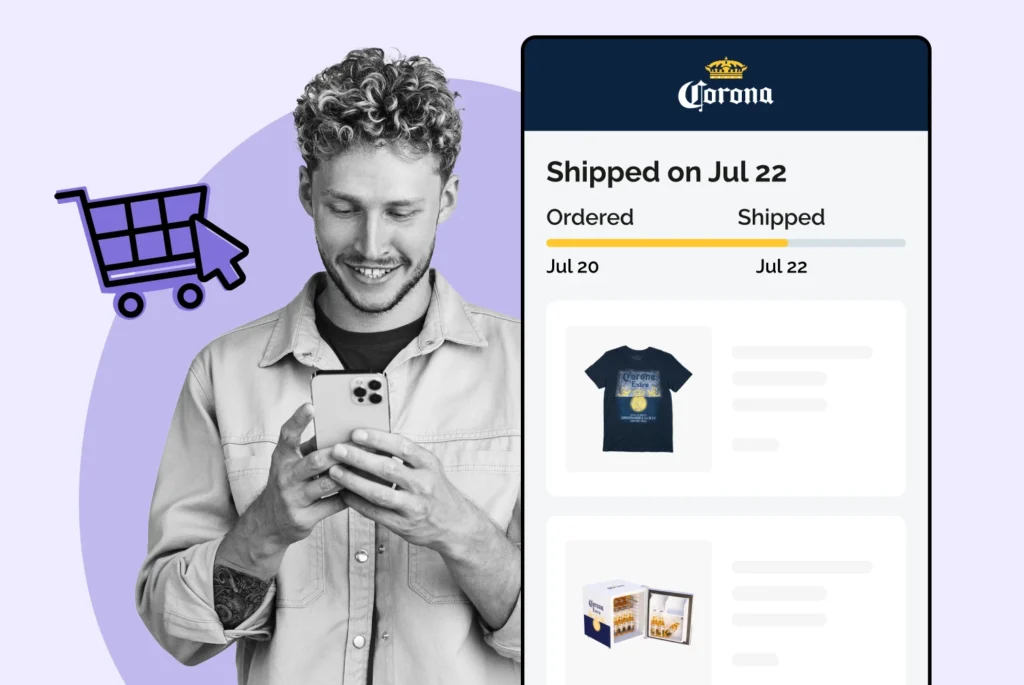

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

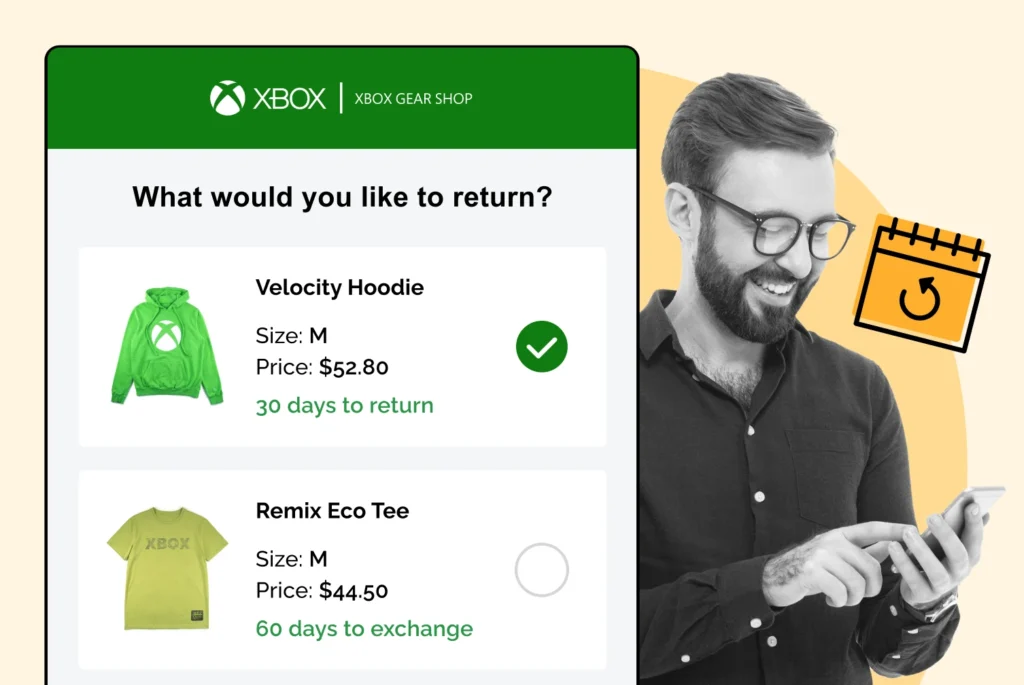

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Easy claims and smart upsells

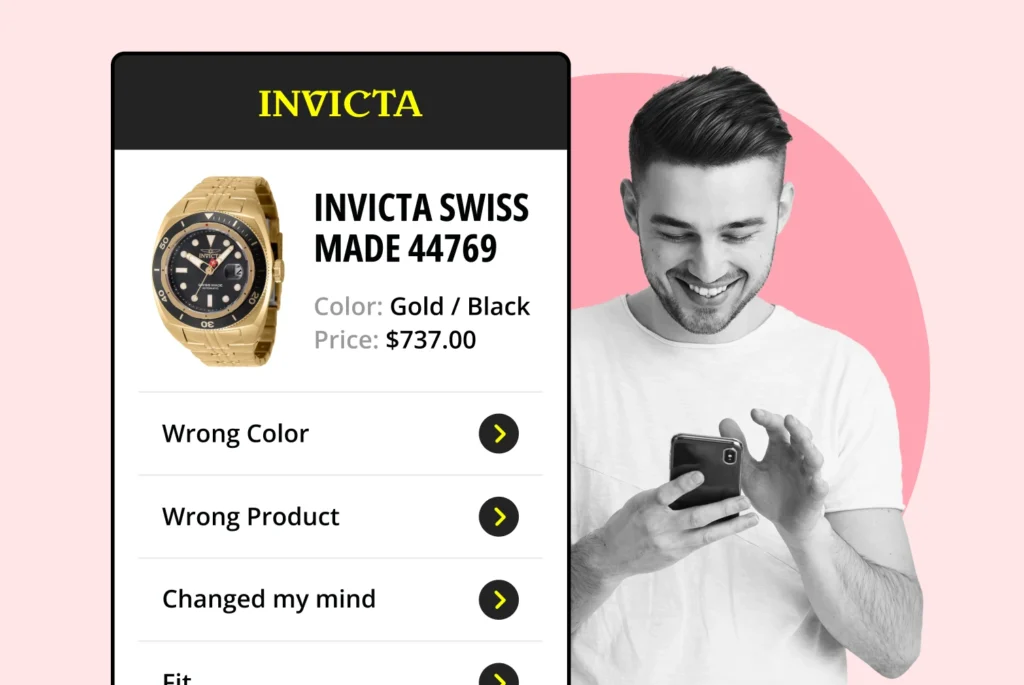

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

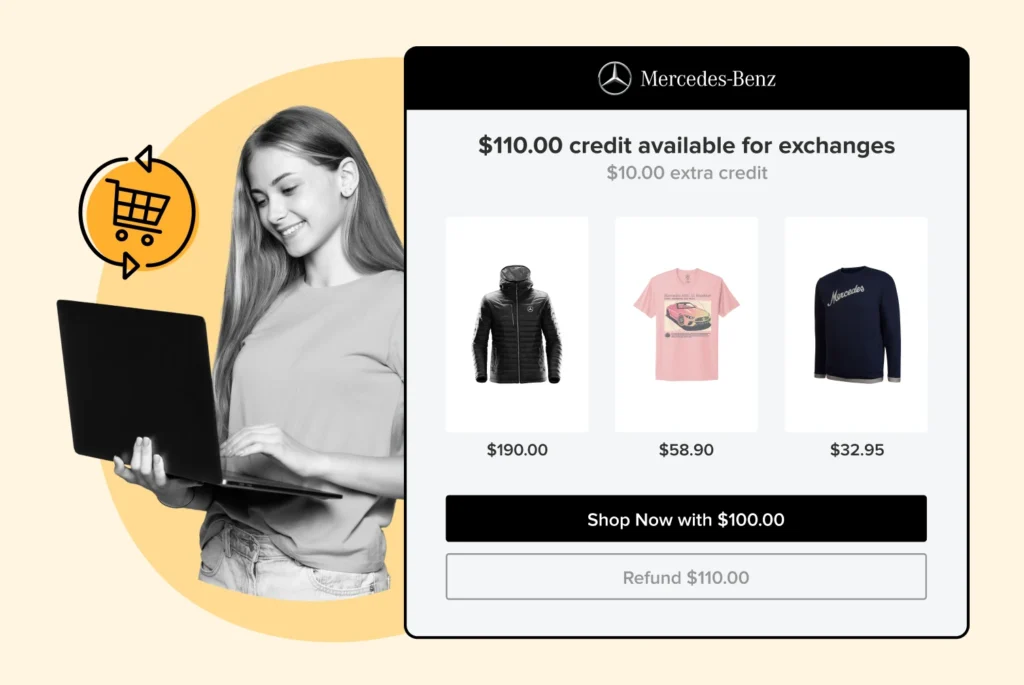

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

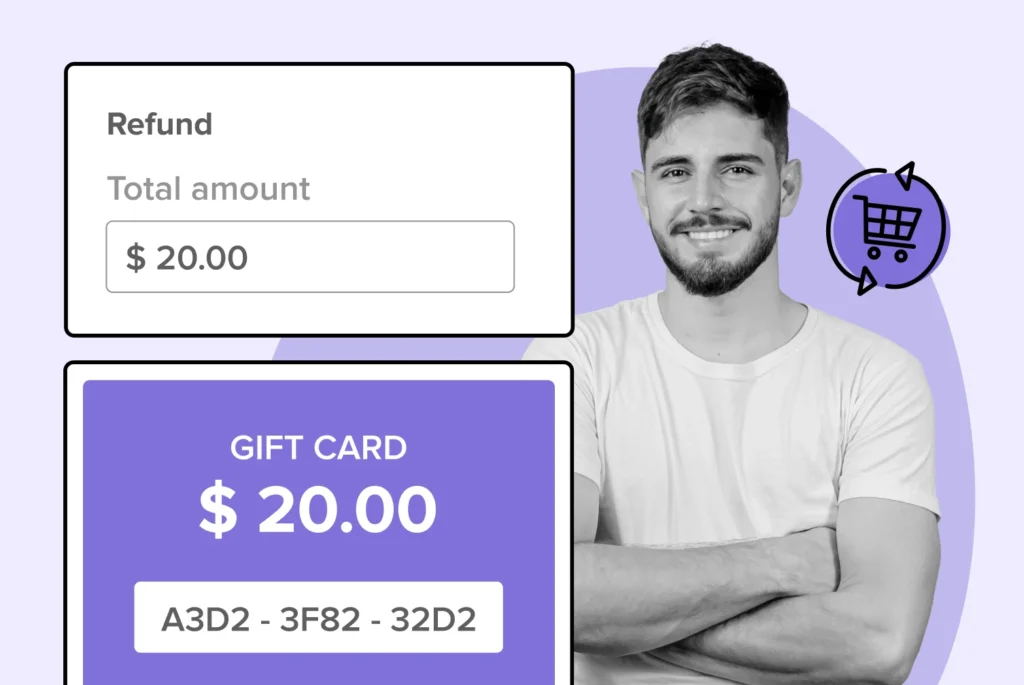

Incentivize exchanges over returns

Returns management made easy for your team

Equip your team for precise return checks.

Easy claims and smart upsells

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Find the answer to all your questions

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Find the answer to all your questions

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

Considering shipping insurance ecommerce for your business? Shipping insurance offers financial protection against transit losses and keeps customers satisfied. Detailed here is what you’ll need to navigate this essential safeguard: its importance, coverage specifics, cost factors, and strategic integration into your shipping insurance e-commerce model.

Shipping insurance is integral to ecommerce for safeguarding against the financial impact of lost, damaged, or stolen goods, thereby enhancing customer satisfaction and loyalty.

Shipping insurance policies have specific coverage limitations and exclusions, such as certain product categories, inherent defects, and loss due to improper packaging, which businesses need to consider when selecting the right policy.

Third-party insurance providers can offer more competitive rates and broader coverage options compared to carrier insurance, becoming a strategic choice for ecommerce businesses aiming to protect their operations and improve customer service.

WeSupply simplifies shipping insurance for ecommerce by streamlining exchanges, integrating with third-party tools, and offering flexible refund options. Enhance customer trust and operational efficiency in one go. Ready to elevate your shipping process? Get Started with WeSupply today.

Shipping insurance is designed to provide financial security against the loss, damage, or theft of packages during transit. Its significance in the ecommerce industry is undeniable, as it assists in managing the risk of financial loss and upholding customer satisfaction. However, the absence of shipping insurance can lead to financial repercussions for businesses, as they would bear the responsibility of compensating for lost, damaged, or stolen items in the shipping process.

Offering shipping insurance helps ecommerce businesses create a secure and trustworthy environment for customers, thereby maintaining customer satisfaction and loyalty.

Shipping insurance plays a vital role in protecting businesses from a range of typical shipment issues such as delivery delays, item damage, and lost packages. It is seamlessly integrated into ecommerce platforms through strategic partnerships with shipping software companies, offering customers the option to purchase insurance during the checkout process.

Providing this layer of security allows ecommerce businesses to boost customer trust and satisfaction, thereby fostering a safe and reliable shopping environment.

With the substantial growth in ecommerce in recent years, the need for reliable shipping insurance has become more pressing. As logistics companies manage larger shipment volumes, the risk of loss has also increased, necessitating adequate protection.

In response to the increased risks associated with the surge in shipment volumes, ecommerce businesses employ package insurance to better protect consumers and improve profitability.

While Shipping Insurance is an important part of the eCommerce experience, shoppers’ post-purchase experiences are just as, if not more important. WeSupply enhances this crucial phase with features designed to maintain profitability and customer loyalty:

Branded Returns Portal: Creates a cohesive, brand-centric returns experience, fostering customer loyalty.

Self-Service Returns: Empowers customers with a frictionless return process, saving businesses time.

Flexible Returns Rules: Allows customization of return policies to suit various use cases.

QR Code Return Labels: Simplifies returns with easy-to-use QR code labels, eliminating the need for printing.

Returns Tracking and Proactive Notifications: Keeps customers informed about their return status with high open-rate email and SMS notifications, reducing the need for customer service calls and enhancing the post-purchase experience.

Discover how WeSupply can revolutionize your post-purchase process and significantly enhance customer satisfaction. Book a demo today to see the difference for yourself!

Grasping the basics of shipping insurance coverage is crucial for deciding whether it’s a necessary investment for your business. Shipping insurance covers risks including:

Stock damage

Physical damage

Customs rejection risks

Exhibition risks

Direct cargo loss and damage caused by external factors

In the event of such issues, businesses can file a claim with the insurance provider to seek compensation for the loss or damage through insurance claims.

Shipping insurance serves as a protective measure for securing products during transit. It offers financial security by compensating for the value of the lost package, enabling the replacement of the item for the customer while still maintaining profitability.

Should a shipment encounter issues such as theft, damage, or improper handling during transit, the insurance provider will cover the goods. To claim shipping insurance, businesses need to submit a claim to the insurance provider, ensuring that accurate records of the shipment are provided and that the claim is filed promptly and correctly.

Shipping insurance covers a range of risks to mitigate the potential losses that can occur during transit. It provides coverage for:

Physical damage

Stock damage

Rejection risks

Exhibition risks

It also offers protection against physical loss and damage during transit through specialized services.

While shipping insurance offers extensive coverage for various risks, it’s also important to understand its limitations and exclusions. Policies typically exclude:

Inherent vice

Latent defects

Loss due to improper packaging

Willful misconduct by the assured

Certain product categories, such as jewelry and currency, are also commonly excluded from coverage.

Understanding these exclusions can help businesses navigate their insurance policies more effectively and ensure they’re adequately protected.

Shipping insurance policies often have limitations and exclusions that businesses should be aware of. These include:

Liability limits

Product category

Volume of sales

Potential risk

Coverage requirements

Understanding these limitations enables businesses to effectively manage their coverage and ensure they are adequately protected against potential losses.

Shipping insurance might not cover certain items or situations, thus it’s important to be aware of what’s excluded. Typical exclusions include:

Damage resulting from the fragile nature of the item

Negligence on the part of the shipper

Acts of nature

Natural wear and tear

Damage due to improper packing

Understanding these exclusions can help businesses choose the right policy for their needs.

The cost of shipping insurance is influenced by various factors such as:

Annual or shipment-by-shipment coverage

Items being shipped

Loss history

Risk management

Distance, origin, and destination of the shipment

Shipping method

Type of goods being shipped

Grasping these factors can assist businesses in calculating the cost of shipping insurance and making well-informed decisions.

Shipping insurance costs vary depending on several factors, including the value of the shipped items and the volume of packages being shipped. Businesses can often get volume discounts if they buy insurance in large quantities, leading to substantial cost reductions compared to carrier insurance.

Comprehending these factors can aid businesses in analyzing the cost of shipping insurance and selecting the most suitable coverage for their needs.

When it comes to shipping insurance rates, different carriers offer different rates. For instance, USPS offers insurance for values up to $50 at a cost of $2.70, whereas FedEx provides insurance for values up to $100 without any additional fees.

Recognizing the differences in carrier rates among major carriers and other shipping carriers can assist businesses in selecting the most suitable option for their shipping needs.

A post-purchase optimization solution like WeSupply can significantly alleviate costs and guarantee a high ROI by streamlining returns and exchanges, offering branded tracking, and providing proactive customer notifications. These features enhance customer satisfaction, reduce operational expenses, and encourage repeat business. Unlock your business’s potential with WeSupply’s and use our ROI Calculator to see how much you can save and earn.

Every business has unique insurance needs based on factors such as:

the type of products sold

the sales channels used

storage and shipping methods

industry regulations

In addition, businesses can choose between carrier insurance options and third-party insurance options provided by an insurance company, based on their specific needs.

When deciding on insurance options, businesses should take into account both carrier and third-party insurance possibilities. While carrier insurance requires proof of carrier fault for any loss or damage, third-party insurance offers broader coverage, protecting against a wider range of risk scenarios. Each option has its own advantages and disadvantages, and businesses should choose the one that best fits their needs.

Considering the pros and cons of shipping insurance, businesses might question whether it’s worth the expense. For businesses with high shipping volumes or high-value items, shipping insurance can be a crucial investment to:

Protect against potential losses

Provide peace of mind

Ensure customer satisfaction

Minimize financial risks

A case study of Mighty Jaxx shows how third-party insurance can provide substantial cost savings for ecommerce businesses.

The need for shipping insurance can vary depending on a business’s shipping volume and the value of its products. Businesses with high shipping volumes are at increased risk of package loss, making insurance a crucial consideration.

Similarly, businesses that ship high-value items may require shipping insurance to protect against financial loss.

High-value items, typically parcels with values exceeding $1,000, may require shipping insurance to protect against financial loss due to their declared value.

Shipping insurance offers financial protection and can lessen the impact of potential losses for businesses.

Third-party insurance companies can offer additional benefits compared to carrier insurance. These providers offer:

Reduced rates

Expanded coverage

A more efficient process with specialized insurance options

Faster claims processing

In selecting a third-party insurance provider, businesses should take into account aspects such as their customers’ location, the value of their products, and the trustworthiness of the provider.

Third-party insurance provides several benefits over carrier insurance. These benefits include:

More affordable rates

Greater coverage

Better customer service

Faster claims processing

By offering these advantages, third-party insurance can provide an attractive option for businesses looking for comprehensive shipping insurance.

WeSupply streamlines your business operations by integrating seamlessly with a wide range of third-party providers and tools. This capability enhances the customer experience and offers significant cost savings by connecting order and returns data to your existing API-driven systems, ensuring both operational efficiency and security.

Choosing the right insurance provider is crucial for getting the best coverage and service. Businesses should look for providers with:

A good reputation

Reasonable rates

A broad range of coverage options

Financial strength

Strong customer service capabilities

Shipping insurance can significantly contribute to enhancing customer relationships. By providing peace of mind and handling damaged shipments effectively, businesses can build trust and maintain customer satisfaction. Shipping insurance also plays a key role in managing customer expectations and addressing customer complaints.

Shipping insurance plays a key role in customer service by providing protection for lost, stolen, or damaged items during transit. This added security provides customers with reassurance regarding the safety of their items and enables businesses to facilitate the replacement of lost items, thereby reinforcing customer confidence in the overall process.

Handling damaged shipments effectively is crucial for maintaining positive customer relationships. Here are some steps to follow:

Quickly acknowledge the issue

Express empathy

Provide a clear explanation

Ensure a swift resolution

By following these steps, businesses can manage customer expectations and maintain their satisfaction.

Shipping insurance plays a vital part in safeguarding businesses from unpredicted circumstances. By offering coverage for a variety of scenarios, including accidents, loss, and theft, shipping insurance provides businesses with the financial protection they need to operate with confidence.

Different coverage options are available to protect businesses from various risks. These options include:

Coverage for physical damage

Coverage for stock damage

Coverage for rejection risks

Coverage for exhibition risks

Understanding these options can help businesses choose the best coverage for their needs.

Both full and partial coverage can provide businesses with the protection they need. Full coverage offers comprehensive protection for the entire value of the goods being shipped, whereas partial coverage only provides coverage for a portion of the value.

WeSupply streamlines your business’s returns process, turning potential losses from unforeseen circumstances into opportunities for customer retention and increased sales. By encouraging exchanges over returns and offering flexible refund options, WeSupply helps maintain customer loyalty and safeguard your business’s revenue.

Key features include:

Variable Exchanges: Exchange return items for any product or for the same/higher value item.

Incentivize Exchanges Over Returns: Encourage customers to opt for exchanges or store credit to save sales and enhance order values.

Refund to Store Credit, Gift Card, or Coupon Code: Offer flexible refund options to encourage repeat business and build a trusting relationship with customers.

Discover how WeSupply can transform your returns process and fortify your business against challenges. Book a demo today and see the difference for yourself.

Incentivize exchanges over returns

Book a quick call with our experts to see how WeSupply can help you save sales through exchanges and boost the average order value using instant store credit.

Implementing best practices in managing shipping insurance can help businesses optimize their ecommerce strategy. These practices include integrating insurance into the ecommerce strategy, regularly monitoring insurance needs, and using online tools and platforms to manage insurance tasks.

Integrating shipping insurance into an ecommerce strategy can help businesses protect themselves from potential losses and maintain customer satisfaction. By embedding insurance as a crucial element of the customer experience and incorporating insurance-buying processes into the shopping experience, businesses can effectively manage their insurance needs.

As businesses grow, their insurance needs may change. Regularly monitoring and adjusting insurance needs can ensure businesses have the right coverage. Factors to consider include:

Claim trends

Income

Debts

Savings

Existing coverage

Family size

Future needs

Assets

Liabilities

Shipping insurance plays a central role in ecommerce success by:

Safeguarding businesses from potential losses

Guaranteeing customer satisfaction

Mitigating the risk of lost, damaged, or stolen goods

Enhancing customer trust and satisfaction

Shipping insurance is a key component of a successful ecommerce operation, so it’s important to add shipping insurance to your packages and offer shipping insurance to your customers. Encourage them to purchase shipping insurance for added protection and understand how shipping insurance work can benefit them. With UPS shipping insurance, you can ensure that your packages are protected throughout the entire shipping process.

In conclusion, shipping insurance is an essential element of a thriving ecommerce business. By providing financial protection and enhancing customer satisfaction, shipping insurance can help businesses navigate the challenges of the ecommerce landscape and achieve success.

In the ever-evolving landscape of ecommerce, the need for shipping insurance continues to grow. Whether it’s protecting against potential losses, enhancing customer satisfaction, or managing risk, shipping insurance plays a pivotal role in the success of ecommerce businesses. As businesses continue to navigate the challenges and opportunities of ecommerce, shipping insurance will remain a key component of their strategy.

WeSupply offers a comprehensive solution for ecommerce businesses focusing on shipping insurance, combining robust returns and exchanges management with seamless integration with third-party providers. This integration enhances customer satisfaction through flexible exchange options and secures shipping processes, optimizing operational efficiency and building customer trust. With features like incentivizing exchanges, variable exchange options, and refund alternatives like store credit, WeSupply is pivotal for businesses aiming to streamline their shipping insurance strategy.

Combat inconvenience with proactivity & self service

Book a quick call with our experts to see how WeSupply can help you make returns easy for your customers with a beautiful, self-service solution that makes their experience easier while also providing new ways to lower costs and earn back revenue.

Yes, shipping insurance is worth it as a consumer, as it provides an extra layer of protection during the shipping process and safeguards you from potential financial loss due to package mishaps or theft.

Ecommerce businesses should have general liability and product liability insurance to protect against damage, faulty products, and third-party claims. Additional protection can be considered based on individual business needs.

WeSupply seamlessly integrates with a wide range of third-party tools, connecting order and returns data with your existing API-driven tools to enhance the shipping process.

WeSupply offers flexible exchange options, allowing customers to swap products, opt for items of the same or higher value, and choose refunds in the form of store credit, gift cards, or coupon codes. This flexibility ensures a positive customer experience even in the case of returns.

Yes, by optimizing the returns process and integrating with third-party tools, WeSupply helps businesses save on operational costs while ensuring efficient management of orders and returns.

Learn How To Create Successful Post Purchase Email Campaigns

Build an effective post-purchase email flow that helps you increase customer satisfaction and drive revenue growth!

Let’s delve into return windows, their influence on brand loyalty, and the balancing act businesses perform when setting these timeframes.

Let’s target the core of cross-border e-commerce for Canadians, outlining how shoppers leverage the global market! What you need to know.

Strategies to navigate and maximize digital sales channels, optimize mobile commerce, and establish a strong direct-to-consumer foundation!

This article will teach you how to grow while staying sustainable as consumers increasingly favor responsible brands.

Let’s delve into return windows, their influence on brand loyalty, and the balancing act businesses perform when setting these timeframes.

Effective strategies for mobile return optimized returns in e-commerce: enhance customer satisfaction and streamline your operations!

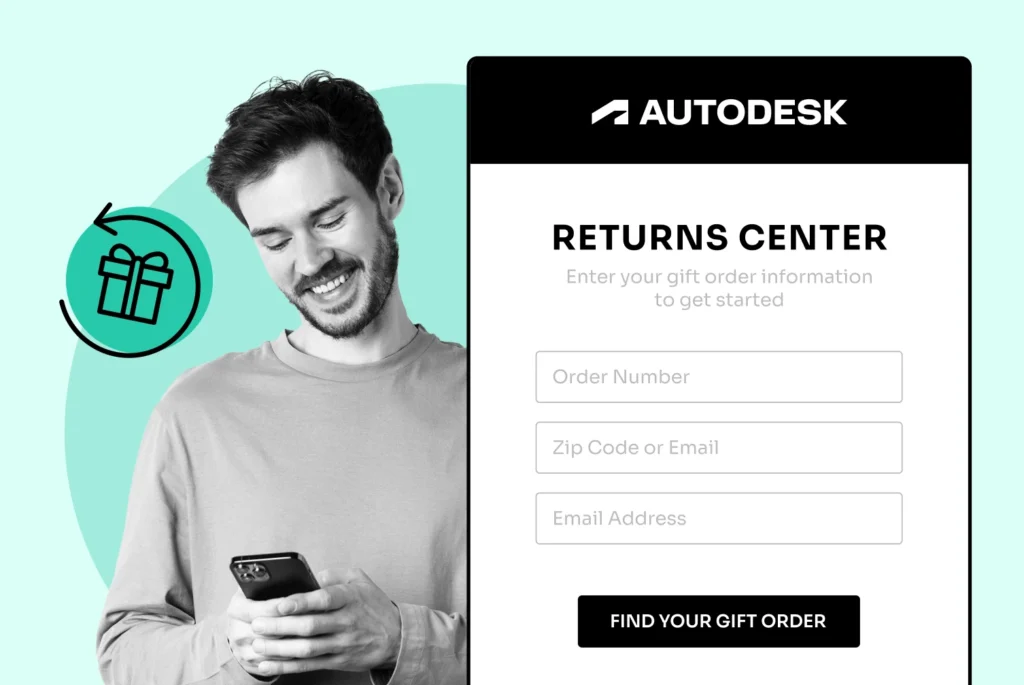

Elevate your online gift exchange e-commerce operations: proven tactics that enhance customer satisfaction and reduce hassle!

Effortless Online Gift Exchanges: Your Essential Guide Online gift exchanges can be tricky, but with the right approach, they’re a breeze.

Face today’s digital-first marketplace: actionable insights to successfully transition your physical store to a competitive online presence.