The Significance of Eco-Friendly Packaging in eCommerce

This article provides actionable insights for businesses ready to embark on a sustainable packaging journey!

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

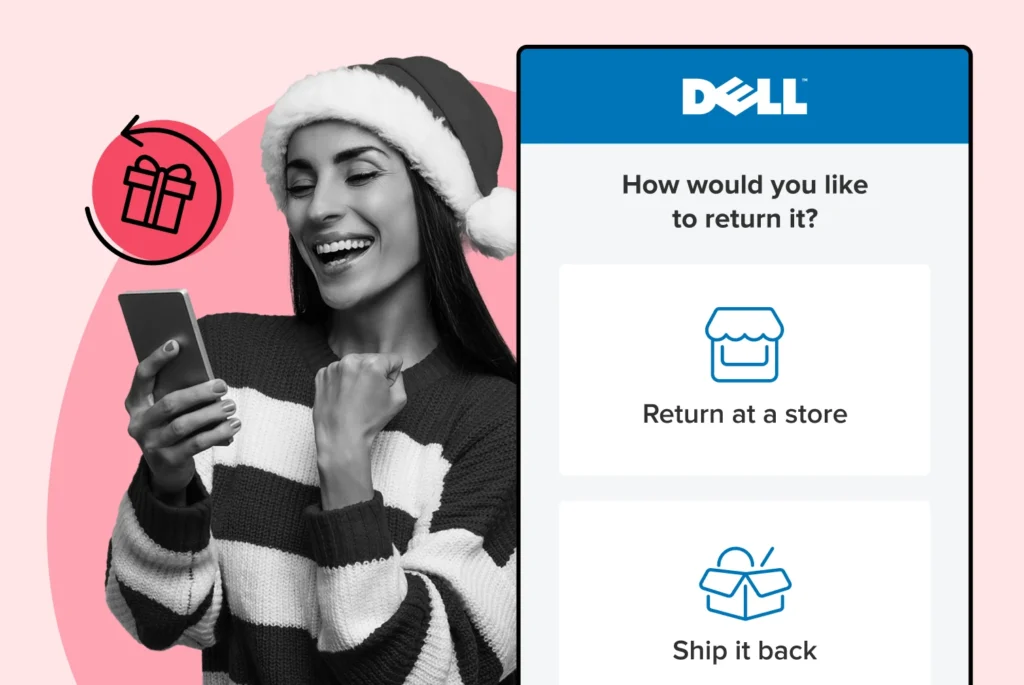

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Easy claims and smart upsells

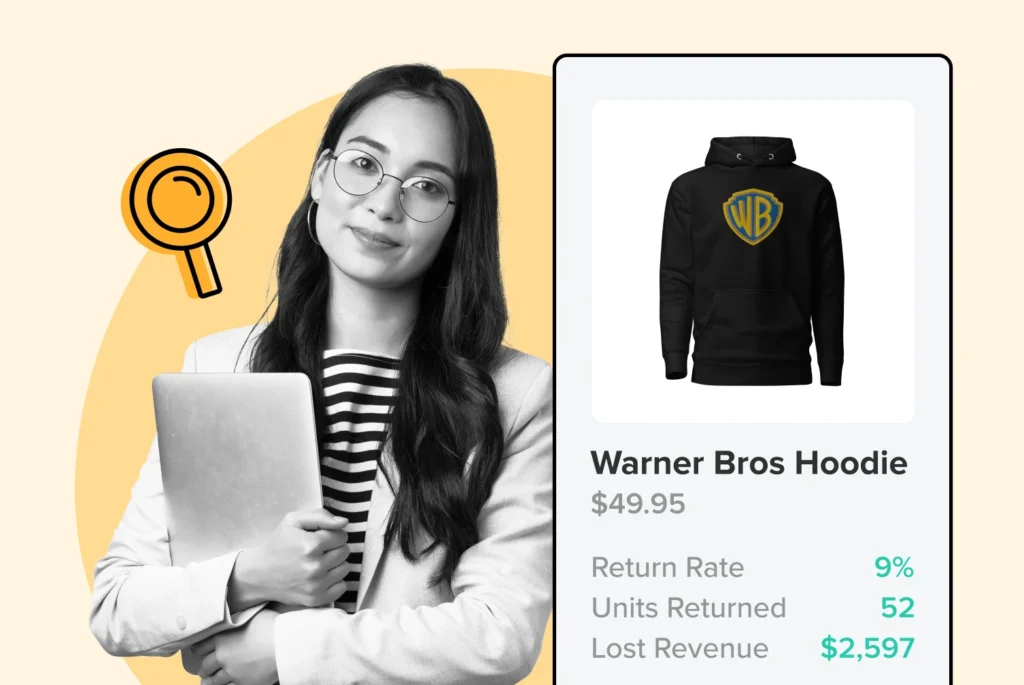

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

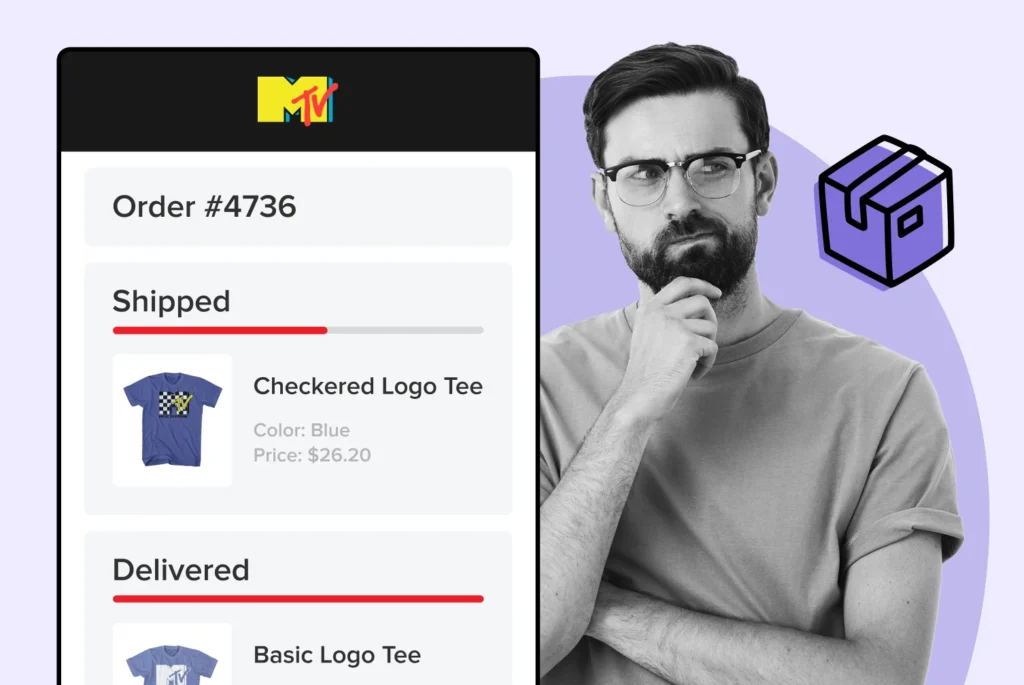

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

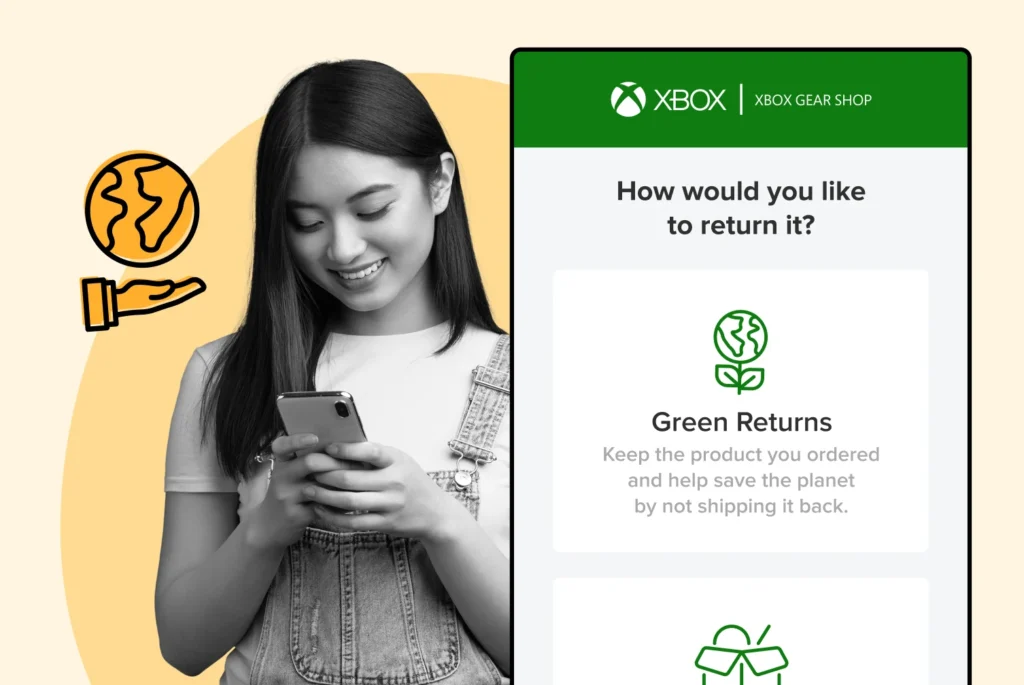

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Equip your team for precise return checks.

Easy claims and smart upsells

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Find the answer to all your questions

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Explore the most comon questions about WeSupply

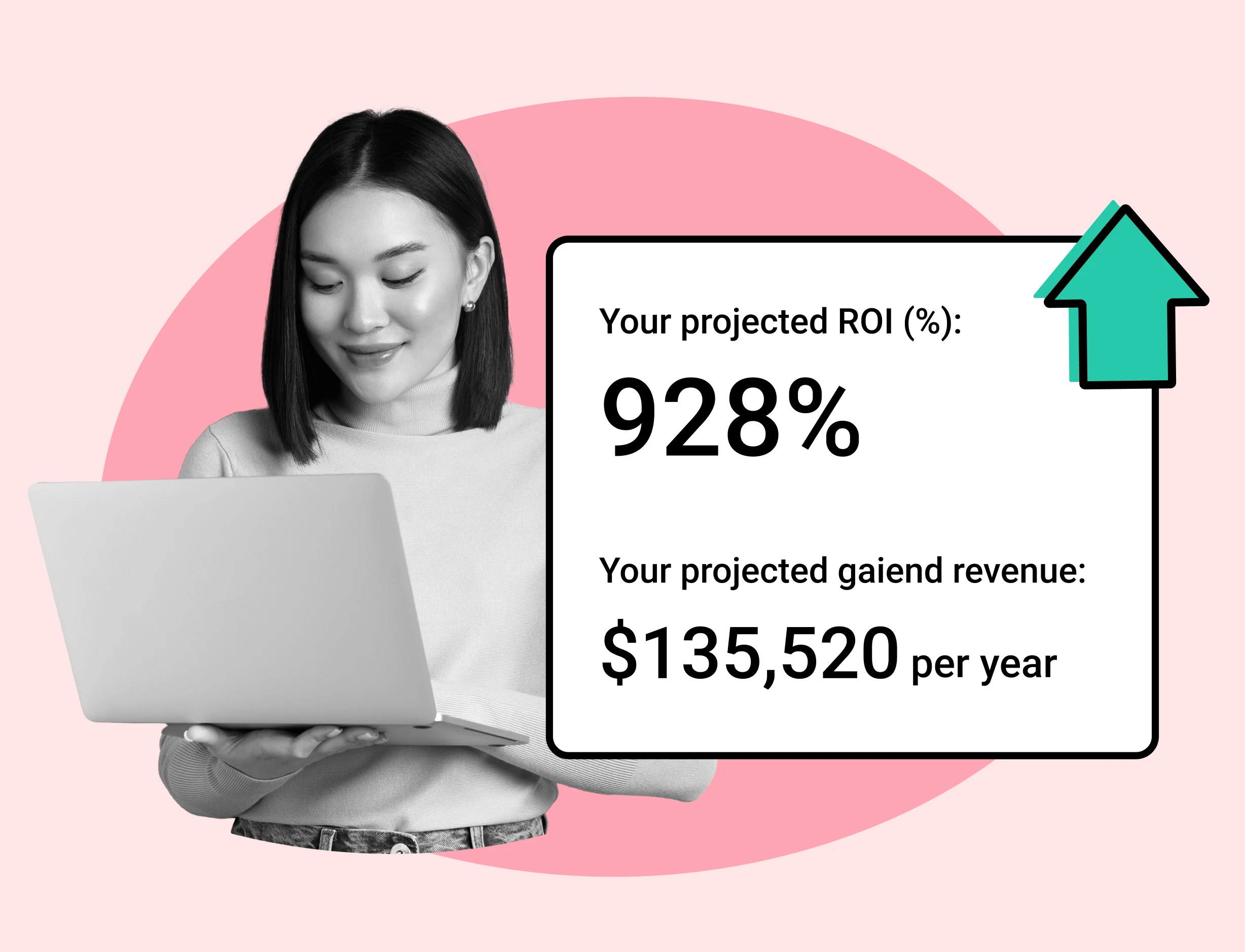

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Find the answer to all your questions

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

Managing money smartly is the backbone of your ecommerce success. For those looking for straightforward, effective ecommerce money management tips, you’re in the right place. This guide strips away complexity to provide you with the golden rules for financial savvy: optimizing cash flow, cutting needless costs, and strategic planning. Each tip promises a step towards sustainable profitability without overwhelming you with jargon or theoretical fluff.

Proper money management in ecommerce is critical for profitability, requiring precise budgeting, consistent sales tracking, thorough analysis, and separate personal and business finances.

Maintaining a healthy cash flow is essential, achieved through strategies like Just-In-Time inventory, auditing recurring costs, optimizing platform payouts, and utilizing credit lines responsibly.

Understanding and planning for both recurring and unexpected costs, and optimizing them through efficient inventory management and strategic marketing spend, are key to sustainable business growth.

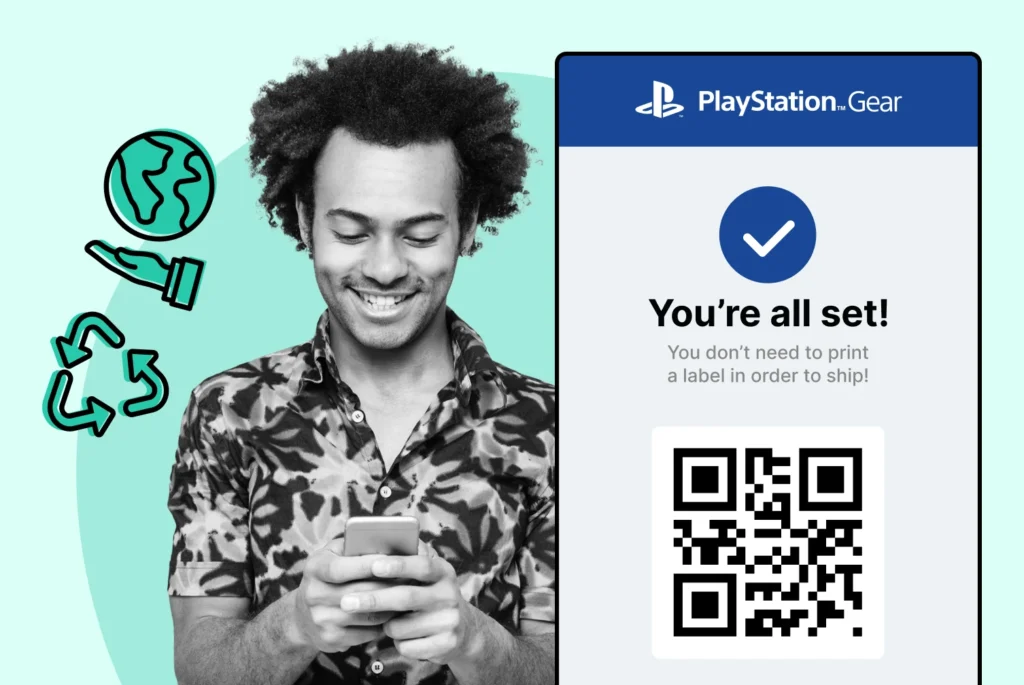

WeSupply streamlines eCommerce with features like Buy Online Pickup in Store, curbside and ship-to-store options, enhancing cost efficiency and customer satisfaction. It encourages exchanges over refunds, offers a branded returns portal, and simplifies returns with QR codes and self-service processes. With comprehensive returns tracking, proactive notifications, and options for in-store returns, WeSupply ensures a seamless customer experience. Additionally, transparent order tracking and accurate delivery estimates build customer trust. Optimize your eCommerce operations and profitability with WeSupply. Ready to transform your post-purchase process? Get started with WeSupply today!

Managing money in ecommerce is a complex task that goes beyond just balancing the books. It requires:

Precise budget setting

Consistent sales tracking

Thorough financial analysis

Maintaining detailed records of revenue and expenditures

This is crucial for ensuring profitability, avoiding debt, and making informed investment decisions. It’s not about counting every penny, but rather about understanding where each penny goes and how it contributes to your business’s success.

Separating personal and business finances is a recommended practice for achieving financial clarity and simplifying bookkeeping. This separation is foundational for any successful ecommerce business. Moreover, the key to a business’s financial health is monitoring cash flow, as poor cash flow management can lead to small business failures. It’s essential to manage your inventory levels accurately and implement strategies like offering prepayment discounts to encourage prompt customer payments, thus improving cash flow.

Positive cash flow is akin to the heartbeat of your ecommerce business, keeping it vibrant and alive. Understanding what positive cash flow means is crucial, as it’s what enables you to cover business expenses, invest in growth, and keep your business afloat in the face of uncertainties. Let’s delve into some strategies to maintain a healthy cash flow and steer clear of financial pitfalls.

Some strategies for improving cash flow include:

Implementing Just-In-Time (JIT) inventory management to prevent excess capital tied up in inventory

Regularly auditing software and service subscriptions to eliminate unnecessary recurring costs

Choosing an ecommerce platform that provides frequent payouts to alleviate cash flow constraints

Running pre-order campaigns for new product launches to drive revenue before production

Offering discounts for early payments from wholesale customers to speed up the payment process

Negotiating improved payment terms with suppliers to enhance cash flow.

Integrating short-term invoice factoring and lending based on receivables from platforms like Shopify or Amazon can provide immediate cash flow improvements. Lastly, careful use of credit lines or loans, when managed responsibly, can bolster cash flow for ecommerce businesses.

In money management, a clear distinction between personal and business finances is paramount. It’s not just about maintaining order; it’s about achieving a level of financial clarity that can streamline accounting, simplify tax filing, and protect personal assets. By properly managing personal and business expenses, you can ensure a healthy financial future for both aspects of your life.

Creating distinct financial accounts for your business helps maintain an independent overview of the company’s cash flow. By choosing the correct business structure, such as a corporation or LLC, you can protect your personal assets from business liabilities and debts. This separation also helps in building a separate credit history for the business, improving its standing with creditors and assisting in obtaining financing.

Business accounts offer features tailored for commercial operations, such as advanced payment solutions and integration with accounting software, which can simplify your bookkeeping process. By maintaining separate financial records for your business, the process of keeping accurate financial records becomes simpler. Obtaining a business tax ID, like an EIN, is crucial for tax identification and can strengthen the separation between an individual and their business entity.

Moreover, utilizing a business credit card can help segregate business expenses from personal ones and potentially aid in building the business’s credit profile.

Business money management in business extends beyond tracking monthly expenses to encompass understanding and planning for recurring costs. These could be quarterly, semi-annual, or annual expenses that might not be part of your monthly budget, but still need to be accounted for to avoid financial surprises. Proper business’s money management ensures that these expenses are taken into consideration.

To budget for non-monthly expenses, follow these steps:

List all irregular expenses and their amounts.

Divide the total by 12. This will give you an idea of how much you need to save each month for these year-end costs.

For expenses due before year-end, create a chart with 12 columns for each month.

Estimate costs and divide by the remaining months to know the monthly savings needed.

Review past bank and credit card statements to identify irregular expenses and anticipate future non-monthly costs. Use a calendar to foresee events requiring extra funds and proactively save for them. You can even estimate vehicle maintenance costs such as tire purchases and oil changes based on your monthly mileage to prepare for these recurring expenses.

Conducting an inventory of household items can help predict when appliances or furniture may need replacement, and you can start saving accordingly.

Running an ecommerce business requires effective inventory management as a critical aspect. With the dual challenges of managing costs and meeting customer demand, efficient inventory management can significantly impact your business’s cash flow and profitability.

The first step towards efficient inventory management is to understand your customers’ needs and behavior during peak seasons like holidays. It requires:

Accurate prediction of consumer trends

Maintenance of a diverse product range to meet demand

Being prepared to adjust strategies promptly to address unexpected shifts in consumer behavior or supply chain issues.

Inventory management involves activities such as tracking, storing, replenishing, and efficiently using inventory to align with customer demand while minimizing associated costs. Just-In-Time (JIT) inventory principles can be employed to minimize excess inventory by timing deliveries from suppliers to coincide with production or sales demands. Investing in inventory management software can aid in automating tracking, improving the accuracy of demand forecasting, and providing insightful data for decision making.

The maintenance of a safety stock level is another strategy to safeguard against unexpected increases in demand or disruptions in the supply chain. Regular physical inventory audits and cycle counts ensure the accuracy of recorded inventory levels and identify any discrepancies. An ABC analysis categorizes inventory items by importance or value, allowing for prioritized management and resource allocation.

WeSupply, a leading post-purchase optimization software, revolutionizes inventory management by enabling a seamless integration of product restocking and returns processing. This innovative approach eliminates the manual effort typically associated with inventory management, streamlining operations to address both cost and demand effectively. By adopting WeSupply, businesses can embrace a dual strategy that optimizes inventory levels and ensures customer satisfaction. Learn more about enhancing your inventory management strategy by exploring our insights on Safety Stock calculation and its critical role in your supply chain.

Speed up returns process

Book a quick call with our experts to see how WeSupply’s self-service returns makes it super easy for your customers to return anything, anytime – without needing to submit customer support tickets or call in!

Any ecommerce business inherently incorporates marketing as an integral part. However, it’s not just about reaching out to the maximum number of people; it’s about reaching the right people at the right time with the right offer through the right channel. This delicate balancing act between reach and investment is crucial for a healthy return on marketing spend.

The goal of marketing optimization is to increase customer equity and return on marketing investments. Effective marketing optimization involves understanding customer preferences and behaviors, which inform resource allocation and optimization processes. A comprehensive marketing optimization methodology integrates customer insights with company goals and constraints to effectively match customer-offer combinations. Continual monitoring and revision are necessary to improve and adapt marketing optimization strategies over time.

The process should include inputs such as marketing components, channels, targets and constraints, and analytics to determine the distribution of the marketing budget. Marketing optimization objectives should be clearly defined, focusing on strategic goals such as acquisition, growth, and retention.

Choosing the right ecommerce platform represents one of the most crucial decisions while setting up an online store. This platform will be the foundation of your online business, handling everything from product listings and payments to your website’s design and layout.

When choosing an ecommerce platform, businesses should consider the following factors:

The platform’s features

Customer support options

Ease of use

Scalability

Integration with payment gateways and shipping providers

Overall cost

There are both hosted and self-hosted ecommerce solutions available, each with their own pros and cons.

Popular ecommerce platforms for starting an e commerce business include:

Shopify

BigCommerce

Magento

WooCommerce

Squarespace

Wix

Each platform offers different features, pricing, and suitability for various business sizes and needs. It’s also important to assess the platform’s long-term impact on your business, taking into account potential future growth and the need for third-party app compatibility.

Aside from eCommerce platforms, it is equally important to choose the best post-purchase software for your business needs. WeSupply stands out by offering extensive integrations with hundreds of third-party tools and platforms such as Shopify, BigCommerce, Magento and more, effortlessly connecting order and returns data to your existing API-driven tools. This capability not only delivers an incredible experience for your customers but also contributes to significant cost savings. By integrating WeSupply into your eCommerce strategy, you align your operational costs with business needs, ensuring a seamless, efficient, and cost-effective post-purchase experience. Ready to elevate your post-purchase experience? Book a demo with WeSupply today and discover how to transform your operations.

Both ecommerce businesses and customers often find shipping costs to be a challenging aspect. High shipping costs can deter customers, while free or low-cost shipping options can eat into your profit margins. Therefore, it’s crucial to manage shipping costs effectively, balancing efficiency and customer satisfaction.

Implementing an effective shipping strategy is critical for ecommerce business success, helping to enhance customer experience, increase conversions, and improve business efficiency. Offering free shipping can boost convenience for customers and influence purchase decisions, but it’s vital for businesses to understand their profit margins to ensure shipping costs do not negatively impact their bottom line.

Charging real-time carrier rates allows customers to choose and pay for the exact shipping services they prefer, which can build trust through transparency. Flat-rate shipping offers a straightforward option for customers, but requires a clear understanding of average shipping costs to avoid losing profit. Providing options for free local pickup or delivery can save on carrier fees and increase customer satisfaction by offering more convenience and avoiding delivery delays.

Selecting reliable shipping carriers and ensuring proper product packaging are essential practices to manage shipping costs effectively. Including insurance for high-value items and establishing a seamless return shipping strategy are important aspects of a comprehensive shipping approach. Ecommerce stores can utilize various shipping solutions and tools to automate the shipping process, compare rates, and streamline shipping label printing.

WeSupply offers innovative solutions to manage shipping costs efficiently while enhancing customer satisfaction. By leveraging WeSupply’s key features, businesses can offer flexible and cost-effective delivery options:

Buy Online Pickup at Curbside: Provides a safe, contactless delivery option at curbside pick-up points, with automated notifications.

Buy Online Ship to Store: Enables customers to order online and ship directly to the store, boosting in-store traffic.

These features not only optimize shipping costs but also meet diverse customer preferences, leading to improved satisfaction and loyalty.

For ecommerce businesses, tax regulations can often appear as a daunting labyrinth. With over 12,000 tax jurisdictions in the U.S. alone, staying informed of sales tax laws requires considerable effort. However, having a firm grasp of these regulations is crucial for compliance and minimizing tax liabilities.

The Supreme Court case South Dakota v. Wayfair in 2018 determined that ecommerce businesses have sales tax obligations similar to physical stores, based on economic nexus thresholds. Although ecommerce platforms offer automated sales tax calculations, business owners still need to register with local tax authorities and file taxes manually. Understanding ‘economic nexus’ is essential for ecommerce businesses to determine tax liability based on the consumer’s location and transaction thresholds.

Sales tax compliance can be facilitated by:

Using sales tax software that integrates with ecommerce platforms to automatically include taxes in product pricing

Opening a separate bank account for collected sales taxes to avoid using these funds for other purposes and to maintain cash flow

Taking advantage of incentives offered by some states, such as allowing retailers to keep a small percentage of the collected sales tax as compensation for the collection process.

Beyond being an accounting necessity, monitoring revenue and expenses serves as the key to making informed decisions. Consistent tracking of revenue and expenses can provide valuable insights into your business’s financial health, profitability, and potential areas for improvement.

Monitoring revenue and expenses is crucial for comprehending the financial health of a business and its success in generating income. Analyzing detailed records of revenue and expenses assists in noticing trends, which aids in forecasting and strategic decision-making. Maintaining updated financial records has several benefits, including:

Reducing stress during tax season by ensuring that income and expenditures are well-documented and current

Providing a clear picture of the financial health of the business

Assisting in making informed decisions based on financial data

Identifying areas for cost-cutting or revenue growth

By regularly monitoring and updating your business’s finances, you can ensure the long-term success and stability of your business, as well as maintain your business’s financial health.

A balance sheet and profit and loss statement are essential tools for tracking a business’s financial standing and performance over time. Familiarity with key financial terms such as revenue, expenses, return on investment (ROI), and profit margins is important for effective revenue and expense monitoring. Accounts such as cash, inventory, accounts payable and receivable, payroll, sales, purchases, loans payable, owners’ equity, and retained earnings are frequently encountered when managing revenue and expenses.

At times, your business may require a financial boost to address unexpected costs, capitalize on scaling opportunities, or maintain smooth operations. This is when external funding comes into play.

Businesses often need outside funding at the start-up stage to cover initial overhead costs such as equipment, warehousing, and marketing. Outside financing may be required for growth when profits are insufficient for business expansion, including research, development, and acquisitions. Entrepreneurs can utilize personal savings to invest in their business operations, but must weigh the risks and budget accordingly. Friends and family can be approached for funding, offering them a clear business plan and potential return on investment.

Venture debt financing allows businesses to borrow against anticipated growth without relinquishing equity. Revenue-based financing is an option for businesses with consistent revenue growth, allowing them to borrow against future earnings.

When entrepreneurs seek financing to acquire real estate for operations, as purchasing can sometimes be more financially sensible than renting. Short-term financing might be necessary for immediate business challenges like increasing inventory before a peak shopping period. Businesses often seek external funding when they need to cover unexpected expenses or want to capitalize on scaling opportunities. One method for accessing external funding is researching government and private grants which may provide capital for startups and expansions.

There are several sources of external funding for businesses, including:

Venture capitalists, who offer funding in exchange for equity

Crowdfunding platforms, which allow businesses to raise money from a large number of contributors

Angel investors, who invest their own money in promising startups

Small business loans from banks, credit unions, or online lenders

These options can provide the necessary capital for businesses to grow and succeed.

Even though day-to-day financial management is vital, it’s the long-term financial objectives that chart the path for your business’s future expansion. These objectives provide a roadmap, guiding your business towards sustainable success.

When setting long-term financial objectives, consider both immediate needs and future aspirations to ensure a balanced financial strategy for the business. To achieve long-term financial goals, create an action plan with specific tasks and set deadlines to maintain focus and make prompt progress. Regular tracking of performance metrics related to each financial goal is crucial for measuring success and identifying areas for improvement.

Identify clear business objectives like increasing sales or lowering expenses as a first step to setting actionable long-term financial goals. When setting goals, ensure they are specific, measurable, and achievable within a realistic time frame to avoid setting up for failure. Conduct regular reviews, such as monthly meetings, to monitor progress towards financial goals and make necessary adjustments.

Within the dynamic realm of ecommerce, businesses must stay prepared to adjust to the influence of seasonal trends. Seasonal trends can significantly affect your business, causing fluctuations in demand, changes in consumer behavior, and variations in sales performance.

Businesses must identify and understand their target audience’s seasonal behaviors to adjust their offerings accordingly. Here are some key steps to take:

Create seasonal promotions and campaigns to align with consumer trends and preferences.

Adapt your supply chain and inventory management to meet fluctuating demands during various seasons.

Use data analysis to identify and leverage seasonal trends in consumer behavior to optimize business performance.

Employ technology such as data analytics software to discern seasonal patterns and tailor marketing strategies.

By following these steps, you can effectively adapt your business to seasonal changes and maximize your success.

Effective seasonal marketing campaigns can attract and engage customers, increasing sales during key seasons. Here are some strategies to consider:

Utilize social media platforms to create seasonal content and host contests to drive customer engagement.

Collaborate with influencers to help reach new audiences and promote seasonal products effectively.

Offer deals and discounts during seasonal trends to motivate purchases and foster customer loyalty.

After a seasonal sales period, a thorough analysis helps businesses prepare and improve for the next season.

Dealing with returns is an unavoidable aspect of operating an ecommerce business. While no business likes dealing with returns, having a well-thought-out plan for handling them can make the process less daunting and more efficient.

Around 30% of all products ordered online are returned, and 92% of consumers are more likely to repeat purchases if the return process is straightforward. Returns management, also known as reverse logistics, encompasses the process of handling returned items, deciding on their subsequent action, and managing customer resolutions such as refunds, exchanges, or repairs.

To mitigate controllable returns, retailers can improve product descriptions, packaging, delivery times, and inventory management systems. Uncontrollable returns can be addressed by potentially shortening the return window, although longer time frames may decrease the likelihood of returns due to the endowment effect. Retailers must comprehend the financial impact of returns, considering the cost of return shipping, tracking, and labor for restocking and managing the returns process.

A clear return policy should be easily accessible and provided with the shipped product to align expectations and reduce misunderstandings with customers. Analyzing returns can reveal insights about product issues and customer behavior, allowing retailers to address underlying causes and identify patterns among returns. Providing tracking information and timely updates about the status of returns and refunds improves transparency and aligns with consumer expectations for fast service.

Utilizing a fulfillment center can streamline the returns management process, offering services such as packing, shipping, and after-sales support, including dealing with couriers and replacing returned items.

WeSupply offers a suite of features designed to empower eCommerce businesses with smart money management strategies and a comprehensive plan for handling product returns, boosting profits while maintaining high customer satisfaction. Key features include:

Branded Returns Portal: Enhances customer loyalty with a branded, omnichannel returns experience, avoiding generic third-party interfaces.

Self-Service Returns Process: Offers a frictionless return experience, giving customers complete control over the process.

Flexible Returns Rules: Tailors return policies with smart rules and customizable logics to fit every use case, including intelligent dispositions for physical returns sorting.

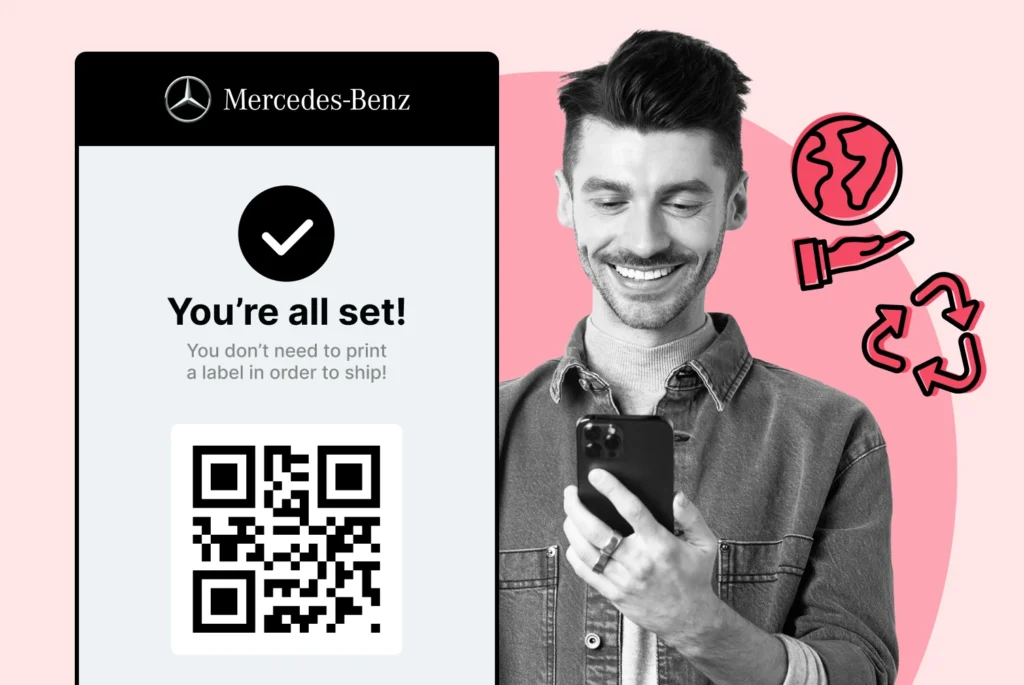

Autogenerated QR Code Return Labels: Simplifies returns for customers with easy-to-use QR code labels, eliminating the need for printing.

Returns Tracking: Keeps customers informed with real-time tracking of their returns, enhancing transparency and trust.

Post-purchase Notifications: Utilizes high open-rate email and SMS notifications for return shipping updates and personalized offers.

“Buy Online, Return In Store”: Encourages in-store traffic and reduces cart abandonment by allowing in-store returns, saving on transportation costs.

Order Tracking & Delivery Instructions: Provides detailed order tracking and flexible delivery instructions to reduce anxiety and increase loyalty.

Estimated Delivery Date: Displays estimated delivery dates at various purchase stages, setting realistic expectations and fostering trust.

By integrating WeSupply, businesses can not only streamline their returns process but also enhance overall efficiency, leading to higher customer satisfaction and increased profitability. Discover how to transform your returns process and boost profitability. Book a demo with WeSupply today!

In this post, we’ve delved into numerous aspects of effective money management pertinent to ecommerce businesses. Some key points to remember include:

Maintaining positive cash flow

Separating personal and business finances

Understanding and planning for recurring costs

Efficient inventory management

Optimizing marketing expenses

By implementing these strategies, you can ensure that your ecommerce business is financially healthy and successful.

Implementing these strategies in concert can create a symphony of success, enhancing cash flow and ensuring the health of your ecommerce business. The goal isn’t just to avoid losing money, but to maintain profitability and set the course for future growth.

By weaving together these money management techniques, you can build a robust financial foundation for your ecommerce business, ready to face challenges and seize opportunities.

In conclusion, managing business finances effectively is the cornerstone of a successful ecommerce business. By applying the strategies discussed in this blog post, you can maintain a healthy cash flow, make informed decisions, plan for recurring costs, manage inventory efficiently, optimize marketing expenses, select the right ecommerce platform, manage shipping costs, prepare for tax regulations, monitor revenue and expenses, access external funding when needed, establish long-term financial objectives, adapt to seasonal trends, and create a plan for product returns. It’s a lot to take in, but remember, every journey begins with a single step. Start implementing these strategies today, and set your ecommerce business on the path to financial success.

WeSupply revolutionizes eCommerce operations by optimizing inventory management and enhancing the returns process, saving businesses time and costs while improving customer satisfaction. Its integration with numerous third-party tools streamlines post-purchase activities, offering solutions like Buy Online Pickup in Store (BOPIS), curbside and ship-to-store options, which adapt to various customer preferences and contribute to cost efficiency.

Key features such as incentivizing exchanges over refunds, a branded returns portal, and a self-service process reduce return rates and elevate order values. Autogenerated QR codes for returns, comprehensive tracking, and proactive notifications ensure a seamless return experience, fostering customer loyalty. By facilitating in-store returns and providing transparent order tracking and delivery estimates, WeSupply builds trust and encourages repeat business. Streamline your eCommerce strategy and boost profitability with WeSupply. Ready for an upgrade? Get started with WeSupply today!

Combat inconvenience with proactivity & self service

Book a quick call with our experts to see how WeSupply can help you make returns easy for your customers with a beautiful, self-service solution that makes their experience easier while also providing new ways to lower costs and earn back revenue.

Yes, ecommerce is profitable and is projected to make up 23% of retail sales by 2025, so it is a viable way to earn money.

The 3 basic steps in money management are creating a realistic budget, tracking your spending, and setting attainable savings goals. By breaking these tasks down into smaller steps, you can achieve success in managing your money.

To manage cash flow in ecommerce, practice impeccable bookkeeping, put safeguarding margins in your calculations, shorten the time between expenses and getting paid, and organize expenses based on revenue patterns. Additionally, take advantage of forecasting and planning, review payment terms, and streamline order fulfillment to effectively manage cash flow in ecommerce.

WeSupply revolutionizes inventory management by integrating product restocking with returns processing, eliminating manual efforts and streamlining operations. This dual approach addresses both cost and demand efficiently, enhancing customer satisfaction.

Yes, WeSupply offers extensive integrations with hundreds of third-party tools and platforms such as Shopify, BigCommerce, and Magento, allowing seamless connections between order and returns data and your API-driven tools.

WeSupply provides flexible and cost-effective delivery options including Buy Online Pickup in Store (BOPIS), Buy Online Pickup at Curbside, and Buy Online Ship to Store. These options optimize shipping costs and cater to various customer preferences.

Yes, WeSupply does have an official Shopify App. You can download and begin to integrate it with your Shopify store.

Yes, WeSupply has an official extension for Magento. The WeSupply x Magento integration allows for automating order tracking experiences, reducing customer inquiries, automating shipping email and SMS notifications, and providing a fully branded order tracking experience

Yes, WeSupply has an official BigCommerce App. You can integrate WeSupply with your BigCommerce store to improve your post-purchase customer experience.

Learn How To Create Successful Post Purchase Email Campaigns

Build an effective post-purchase email flow that helps you increase customer satisfaction and drive revenue growth!

WeSupply is transforming the way businesses build Customer Lifetime Value by offering positive exchange experiences. By making exchanges effortless, WeSupply encourages customers to revisit your website for any product, without price constraints. Key features like using store credits or gift cards as partial payments not only increase order values but also reinforce customer loyalty. This approach is instrumental in enhancing Customer Lifetime Value, as it turns a simple exchange into a delightful shopping experience, fostering long-term customer relationships and ongoing business growth.

This article provides actionable insights for businesses ready to embark on a sustainable packaging journey!

Let’s navigate the complexities of inventory, shipping policies, and customer communication with confidence!

Let’s examine the underlying factors of return trends and identify sustainable practices crucial for the future of retail!

How to marry profitability with responsibility: From choosing eco-friendly packaging to implementing low-carbon shipping methods.

This article demystifies dropshipping, offers clear steps for getting started, and divulges expert tactics for thriving in online retail!

This guide distills the crucial mistakes that could be undermining your eCommerce success and equips you with the insights to avoid them!

This isn’t about reinventing the wheel: it’s about making smarter, evidence-based decisions that propel your eCommerce venture forward!

Discover practical, actionable advice for incorporating sustainable eCommerce into the core of holiday commerce practices!

The essential guide to making circular economy eCommerce returns practical and profitable, helping you step away from waste!