How to Handle Shipping Delays from FedEx, UPS, or USPS

Discover effective strategies to manage your shipments with ease. Streamline your process and enhance your shipping efficiency!

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Easy claims and smart upsells

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Equip your team for precise return checks.

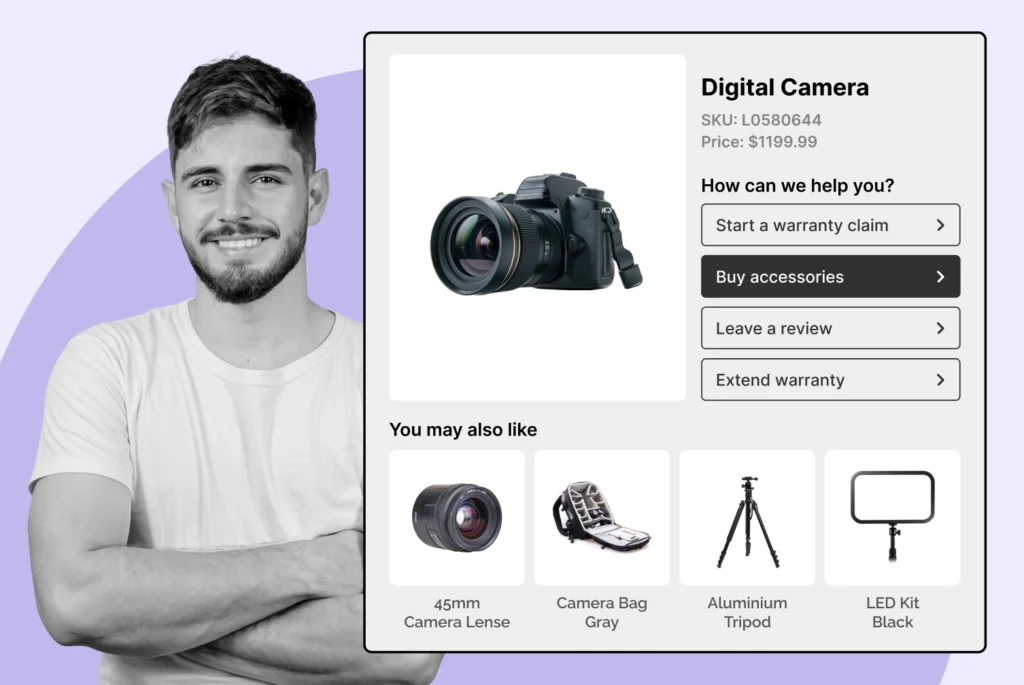

Easy claims and smart upsells

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Find the answer to all your questions

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Find the answer to all your questions

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

In today’s fast-paced ecommerce landscape, customers expect quick deliveries, hassle-free returns, and complete reliability from the brands they shop with. However, even with the best logistics partners, things can go wrong: packages get damaged, lost, or stolen in transit. That’s where shipping insurance comes in.

Shipping insurance protects your business from financial losses related to these unforeseen events. Instead of absorbing the cost of replacing high-value items or refunding customers out of pocket, insurance ensures you can maintain profitability and customer satisfaction even when issues arise. It also gives your customers peace of mind, knowing their purchase is covered in case of mishaps.

For ecommerce brands aiming to scale while maintaining trust, integrating shipping insurance into fulfillment workflows isn’t just a nice-to-have—it’s a must.

Traditional, manual insurance processes can be time-consuming and error-prone. Integrated shipping insurance solutions automate coverage, filing, and even claims, making operations more efficient. Integrated solutions combine insurance services with shipping and order management platforms, enabling seamless automation across your business systems.

With integration, insurance becomes part of your existing order management or shipping workflow. This means fewer steps, less human error, and faster service. For instance, with platforms like Shopify or ShipStation, you can set up rules to automatically apply insurance to specific shipments. This saves time and ensures every eligible order is covered.

Another major benefit is claims transparency. Integrated platforms often provide real-time tracking updates and instant claim filing through digital portals. Your customers stay informed, and your team isn’t bogged down with paperwork. The result? A smoother post-purchase experience and a stronger brand reputation.

Before jumping into integration, it’s important to understand what kind of shipments you should insure. Start by analyzing your product catalog:

Are you shipping high-value items like electronics, art, or jewelry?

Are your products fragile or prone to breakage?

Do you ship internationally, where customs delays and theft risks are higher?

For low-cost items, insurance might not be worth the premium. But for high-value or irreplaceable goods, it’s essential. Also, consider your shipping volume. If you’re processing hundreds or thousands of orders weekly, the financial risk from even a small percentage of losses adds up quickly.

Small businesses can use selective coverage, while high-volume retailers may benefit from automating insurance for every shipment over a certain threshold. Having a clear understanding of your shipping risk profile ensures you don’t over- or under-insure.

When choosing shipping insurance, you generally have two options: carrier-provided insurance or third-party providers.

Carrier insurance is built into services from USPS, FedEx, and UPS. For example, USPS includes up to $100 of insurance with Priority Mail. While convenient, this option often comes with limitations. Claims can be slower, coverage amounts may be restricted, and exclusions (like porch piracy or weather-related losses) are common.

Third-party providers, on the other hand, like U-PIC, Shipsurance, and InsureShield, often offer broader coverage at lower rates. They may cover a wider range of scenarios, process claims faster, and integrate more easily with ecommerce platforms. Many also offer international coverage and options like “all-risk” protection, which includes things like theft after delivery and damage due to improper handling.

The trade-off? You’ll need to set up a separate account and possibly manage an additional integration—but the cost savings and expanded coverage often make it worth it. Third-party providers can also help businesses select the best carrier and price for each shipment, using automation and AI-driven insights to optimize shipping costs.

Not all insurance providers are created equal. To choose the right one, consider the following criteria:

Coverage Scope: Does the policy protect against all common risks? Does it include international, domestic, and last-mile issues?

Cost and Premiums: How are premiums calculated? Are there discounts for volume? Make sure there are no hidden fees.

Claims Process: Is the claims process fast and user-friendly? Are digital portals available?

Integrations: Can the insurer integrate with your current shipping software or ecommerce platform?

Reputation: Look at online reviews and case studies. Do other ecommerce brands recommend them?

Some providers also offer customizable coverage based on your SKUs or business rules. This flexibility is especially valuable for brands shipping a variety of products with different risk profiles.

There are several ways to integrate shipping insurance depending on your technical capabilities and business scale:

Manual Entry: Suitable for small operations, this involves logging into a portal to insure each shipment individually. It works, but it’s time-consuming and prone to human error.

Plugins and Apps: Many third-party insurers offer apps for platforms like Shopify, WooCommerce, and BigCommerce. These apps allow users to apply insurance during checkout or label creation. For example, InsureShield’s Shopify app can add coverage rules directly into your store setup.

API Integration: Larger or more tech-savvy businesses can implement full API integrations. This allows automatic coverage for eligible shipments, voiding of unused transactions, and programmatic claim filing—all from within your own order management system. It’s the most efficient and scalable option.

Partial Integration: A good middle ground for growing businesses. This might include CSV uploads or rule-based logic without full automation. It’s faster than manual entry but easier to implement than a full API.

These integration methods provide businesses with access to a wide range of features and carrier options, allowing you to choose the best fit for your needs and technical capabilities.

Choose an integration method that matches your current capacity while leaving room to scale.

Partial integration offers a smart, flexible pathway for growing businesses looking to enhance their shipping insurance operations without the commitment or complexity of a full API integration. This approach allows companies to selectively connect key elements of their shipping and insurance solutions—such as linking shipping labels and tracking numbers—so they can more efficiently manage claims and provide insurance coverage for their shipments.

For small businesses and high volume shippers, partial integration is an ideal way to balance operational growth with manageable complexity. By integrating only the most essential features, businesses can quickly insure packages, track shipments, and manage claims, all while minimizing disruption to their existing workflow. This not only reduces the risks associated with lost or delayed packages but also boosts customer satisfaction by ensuring that insurance coverage is consistently applied where it matters most.

Partial integration is also a great stepping stone for businesses that anticipate scaling up. It allows for incremental improvements in shipping insurance management, giving teams the chance to adapt and optimize their processes before moving to a more comprehensive solution. Ultimately, this approach empowers businesses to deliver reliable insurance solutions and a better customer experience, no matter their current size or shipping volume.

No-code label creation is revolutionizing how non-technical teams handle shipping insurance. With this feature, businesses can generate shipping labels, apply insurance coverage, and manage claims—all without writing a single line of code. Simple API calls make it easy to create and print shipping labels, void transactions, and file claims, streamlining the entire process from order to delivery.

This user-friendly approach is especially valuable for small businesses and merchants who want to focus on their core operations rather than getting bogged down in technical details. By removing the barriers of complex software or IT expertise, no-code label creation enables teams to efficiently insure valuable items, track packages, and manage claims with confidence. The result is a more efficient workflow, reduced errors, and a smoother customer experience.

With no-code tools, businesses can ensure that every shipment is properly covered and tracked, giving both merchants and customers peace of mind. This streamlined management of shipping labels and insurance coverage not only saves time but also helps businesses deliver a higher level of service, making it easier to grow and scale their operations.

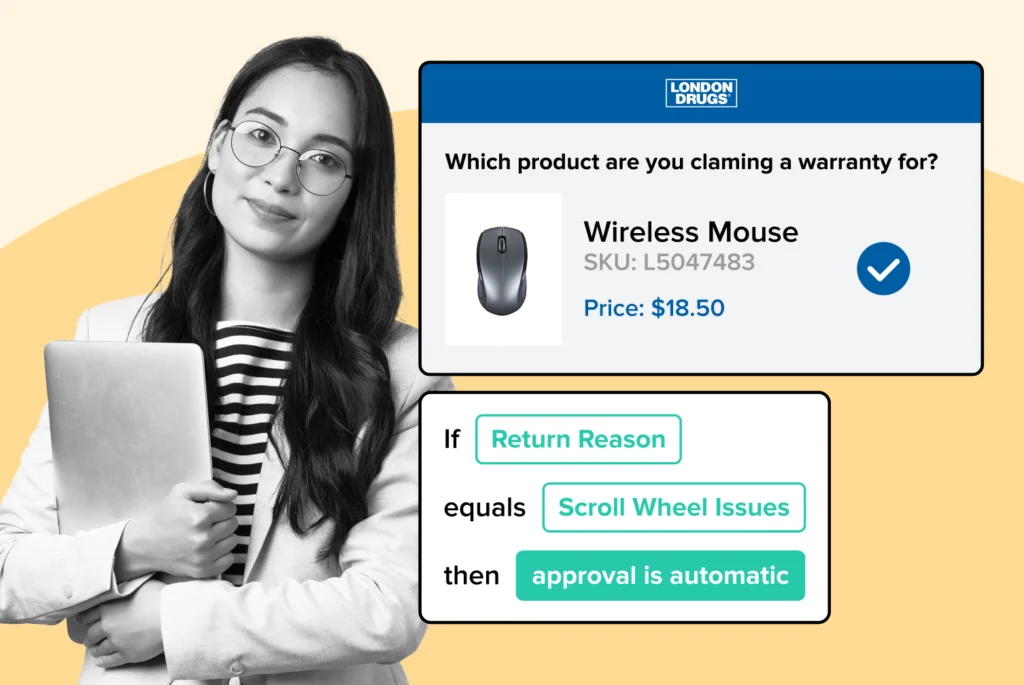

A big advantage of integration is the ability to automate which orders get insured. Here’s how:

Value-based rules: Automatically insure orders over a certain dollar amount.

SKU-based rules: Apply insurance to specific fragile or high-risk products.

Destination-based rules: Automatically add coverage for international shipments or deliveries to high-theft regions.

Carrier-based rules: Insure shipments with specific carriers if their track record shows higher loss or damage rates.

Additionally, automated label generation tools can include insurance details directly in the shipping label. No-code tools make this easy even if your team lacks technical expertise.

These automation rules not only reduce risk but also improve fulfillment speed and accuracy.

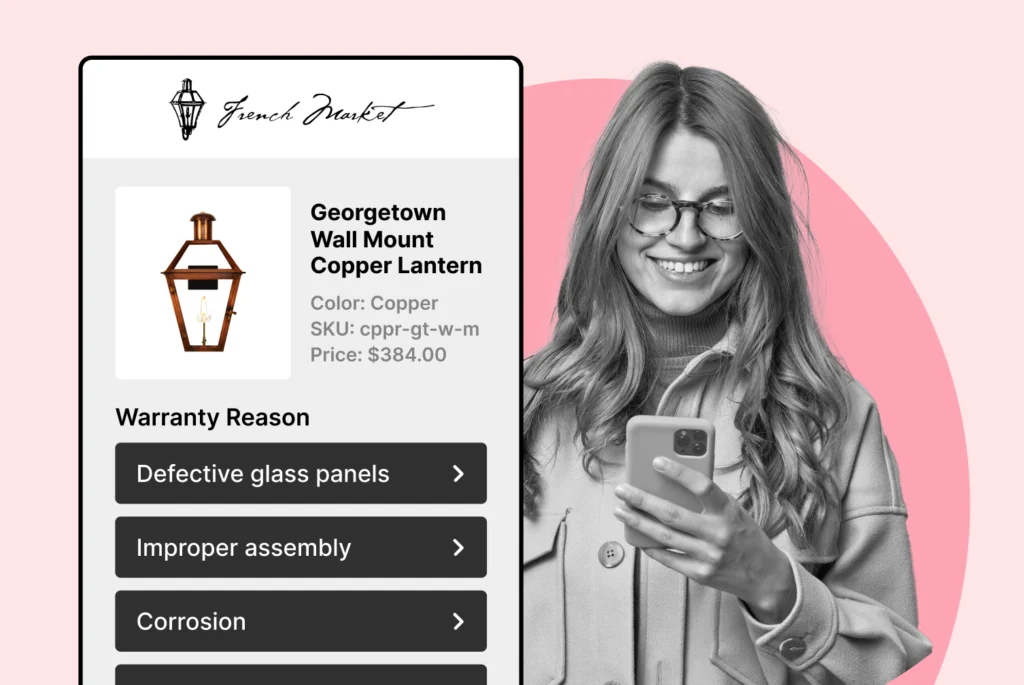

Even with the best preparation, some shipments will go wrong. When they do, it’s important to have a streamlined claims process.

First, maintain complete documentation: invoices, tracking numbers, proof of value, and photos of the product and packaging. This will make filing claims faster and more effective.

Train your support team to walk customers through reporting a lost or damaged package. Your team should always be ready to assist customers throughout the claims process, providing guidance and support as needed. Clear, proactive communication builds trust and sets realistic expectations. Let customers know what to expect, including timelines for reimbursement or replacement.

Many third-party insurers now allow digital claim submission with fast turnaround (4–10 business days). This can be a huge win for customer satisfaction and operations.

Seamless insurance integration is a cornerstone of exceptional customer experience in the shipping and logistics industry. By tightly connecting insurance solutions with shipping operations, businesses can offer customers real-time tracking, instant updates, and the reassurance that their packages are protected every step of the way.

This integrated approach allows businesses to manage claims quickly and efficiently, minimizing the time and cost involved in resolving issues. Customers benefit from tailored insurance coverage options that match their needs, while businesses demonstrate their commitment to customer satisfaction and peace of mind. The ability to provide transparent, reliable insurance coverage not only builds trust but also encourages repeat business and positive word-of-mouth.

Moreover, seamless integration streamlines internal operations, reducing manual work and freeing up resources to focus on delivering outstanding service. As a result, businesses can increase sales, improve client relationships, and stand out in a competitive market—all while ensuring that every package is covered and every customer journey is supported by robust insurance solutions.

For small ecommerce brands, shipping issues can be disproportionately damaging. One lost $200 order might erase the profit from 10 smaller sales.

By integrating insurance, small businesses can:

Offset risks for high-value shipments.

Reduce time spent manually filing claims.

Improve customer retention by offering guaranteed protection.

Even simple tools like checkout opt-ins or CSV claim uploads can make a big difference. Integration doesn’t need to be complex to be effective.

Larger retailers processing tens of thousands of shipments a day can’t afford inefficiencies or missed coverage. Automation and rules-based insurance systems are essential.

High-volume shippers benefit from:

Bulk discounts from third-party insurers.

Real-time coverage and automatic claim processing.

Data insights on loss patterns, helping optimize shipping strategies.

For example, if you find that a specific carrier or route has higher loss rates, you can set rules to auto-insure or even switch providers. Integrated systems make this level of insight possible.

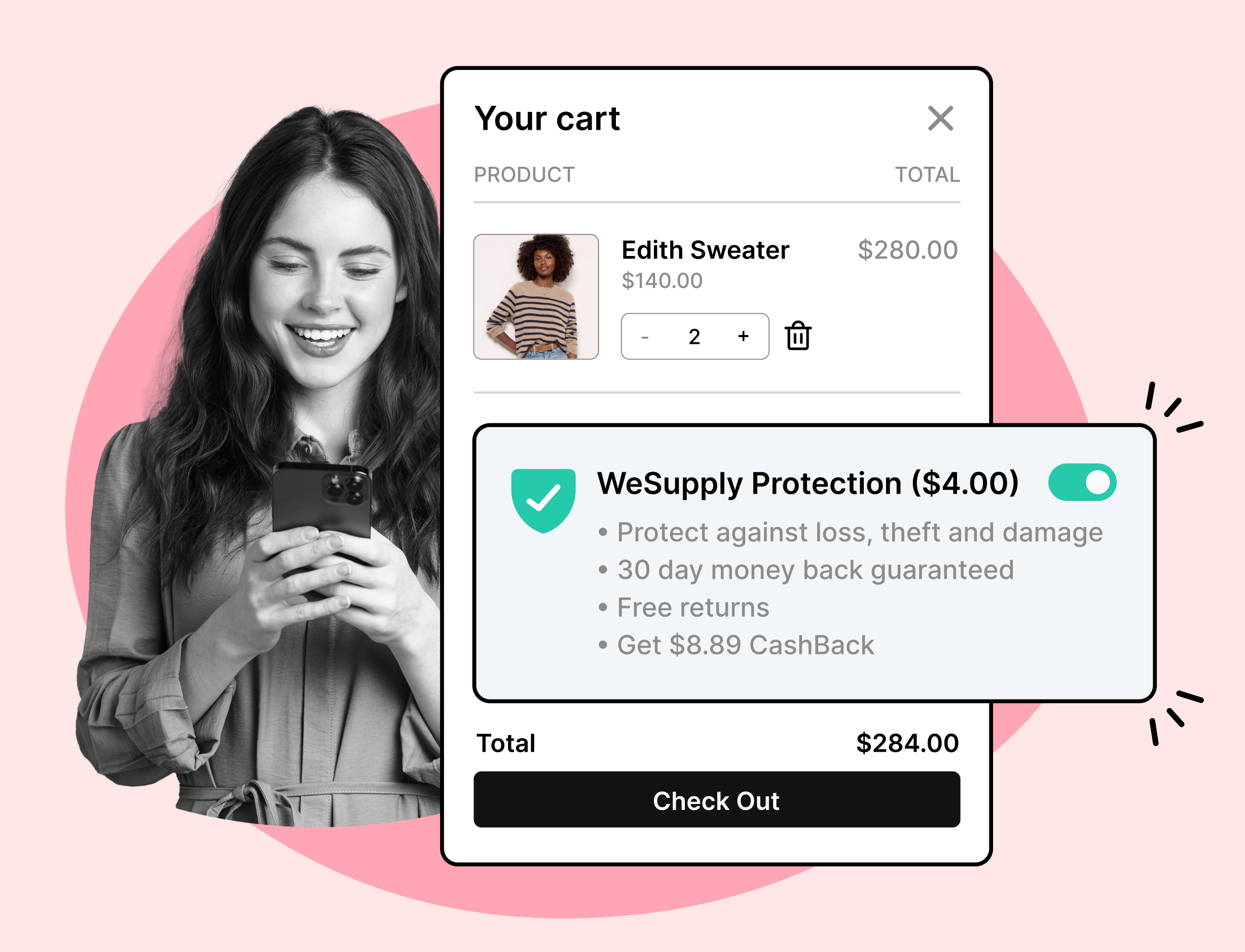

Reassure Your Shoppers with Shipping & Returns Protection

Book a quick call with our experts to see how WeSupply can help you: Keep 100% of the revenue from your Return & Shipping Protection Program; Cover the total cost of Return Labels and Software fees; Eliminate returns cost from the P&L; Make returns profitable.

To maximize efficiency, your shipping software and insurance provider must work hand in hand. Platforms like ShipStation, EasyPost, and ShipBob already offer integration points for major insurers.

This enables features like:

Label printing with insurance baked in

Automatic claim filing through the same interface

Customer notifications with insured tracking numbers

Choosing compatible platforms makes integration smoother and minimizes tech headaches.

Achieving successful insurance integration hinges on meeting several key technical requirements. First, businesses must ensure their systems are compatible with their insurance provider’s API, allowing for seamless data exchange and real-time synchronization of shipping and insurance information. This compatibility is essential for automating processes like tracking number generation, insurance coverage application, and claims management.

A robust technical infrastructure is also critical. Businesses should have reliable servers, secure data storage, and efficient workflow management tools to support high volumes of shipments and insurance claims. Automation plays a vital role here—using software and services that can handle tasks such as automated label creation, tracking, and claims filing ensures operations remain efficient and scalable.

Security and reliability are non-negotiable. Systems must safeguard sensitive client and shipment data, while also providing consistent uptime and support for business operations. By investing in the right tools and infrastructure, businesses can streamline their insurance solutions, reduce operational costs, and deliver a higher level of customer satisfaction. With a solid technical foundation, companies are well-positioned to grow, serve more clients, and provide reliable shipping and insurance services at scale.

Begin by identifying your insurance priorities: protecting high-value items, improving claims speed, reducing manual work, or all of the above.

Then, follow these steps:

Choose a provider aligned with your needs.

Assess your tech stack and select an integration method.

Configure automation rules to apply insurance logically.

Test your setup with a small batch of orders.

Train your support team to handle customer concerns and claims.

Contact your chosen insurance provider for support or to discuss integration options.

Start small, evaluate, and expand as needed.

Integrating shipping insurance into your post-purchase flow doesn’t have to be complicated—and that’s where WeSupply comes in. Whether you’re a small business or an enterprise-level retailer, WeSupply makes it easy to embed insurance into your shipping, tracking, and returns workflows to protect both your business and your customers from damage, loss, and theft.

By connecting with your existing ecommerce platform, shipping software, and third-party insurers, WeSupply delivers a streamlined experience from checkout to claim resolution—ensuring every eligible shipment is covered with minimal effort.

Here’s how WeSupply contributes to a smarter, more scalable insurance strategy:

✅ Automated label generation with embedded insurance coverage

✅ Dynamic rules-based logic to apply coverage based on order value, SKU, destination, or carrier

✅ Branded tracking pages with clear insurance information and customer reassurance

✅ Self-service claim support portals to reduce strain on your support team

✅ Full visibility into shipping status with real-time tracking updates and notifications

✅ Data-driven insights to identify risk patterns and optimize coverage strategy

✅ Easy compatibility with platforms like Shopify and BigCommerce

With WeSupply, you don’t just insure packages—you deliver peace of mind and a frictionless post-purchase experience that strengthens trust and loyalty. Whether you’re scaling fast or just starting to streamline operations, WeSupply’s flexible tools help you protect every order while enhancing the customer journey.

Want to turn shipping insurance into a competitive advantage? Let WeSupply help you automate, customize, and deliver better post-purchase protection—at scale. Book a demo today!

Combat inconvenience with proactivity & self service

Book a quick call with our experts to see how WeSupply can help you make returns easy for your customers with a beautiful, self-service solution that makes their experience easier while also providing new ways to lower costs and earn back revenue.

Integrated shipping insurance isn’t just about minimizing risk—it’s about creating a smoother, more trustworthy customer experience. With WeSupply, you can automate coverage, streamline claims, and eliminate manual steps through no-code integration and dynamic rule-based logic. But the benefits go even further. WeSupply enhances the entire post-purchase journey with features like branded returns portals, instant credit for exchanges, self-service returns, QR code labels, and proactive email and SMS updates. This unified approach ensures your business isn’t just protected against loss, damage, or theft—it’s also positioned to build loyalty, increase repeat purchases, and reduce support volume. Whether you’re shipping high-value items or managing thousands of orders, WeSupply helps you scale with confidence, offering a seamless insurance and returns experience your customers will remember.

1. What is shipping insurance and why is it important for ecommerce businesses?

Shipping insurance protects you from financial loss if packages are lost, damaged, or stolen. It ensures customer satisfaction and preserves profit margins.

2. How does integrated shipping insurance improve the customer experience?

It provides automatic coverage, faster claims, and real-time updates—giving customers peace of mind and reducing post-purchase frustration.

3. What’s the difference between carrier-provided and third-party shipping insurance?

Carrier insurance is basic and slower. Third-party providers offer broader coverage, quicker claims, and better platform integration.

4. Does WeSupply offer integrated shipping insurance for ecommerce orders?

Yes. WeSupply lets merchants embed shipping insurance into their fulfillment flow, automatically covering orders against loss, theft, or damage—without complex setup or manual steps.

5. How does shipping insurance work with WeSupply’s post-purchase experience?

Shipping insurance is applied using rules based on order value, SKU, or destination. Coverage details appear on branded tracking pages, and customers can file claims through a self-service portal.

6. What platforms support WeSupply’s shipping insurance integration?

WeSupply integrates with platforms like Shopify and BigCommerce, making it easy to automate insurance coverage and manage claims across your existing shipping systems.

7. Does WeSupply have an Official Shopify App?

Yes. WeSupply has an Official Shopify App. You can download it and start integrating with your Shopify Store.

8. Does WeSupply have an official Magento extension?

Yes, WeSupply has an official extension for Magento. The WeSupply x Magento integration allows for automating order tracking experiences, reducing customer inquiries, automating shipping email and SMS notifications, and providing a fully branded order tracking experience

9. Does WeSupply have an official BigCommerce App?

Yes, WeSupply has an official BigCommerce App. You can integrate WeSupply with your BigCommerce store to improve your post-purchase customer experience.

Learn How To Create Successful Post Purchase Email Campaigns

Build an effective post-purchase email flow that helps you increase customer satisfaction and drive revenue growth!

Discover effective strategies to manage your shipments with ease. Streamline your process and enhance your shipping efficiency!

Discover how effective warranty returns management can enhance customer loyalty and strengthen your brand. Read on to transform your return process!

Learn how to streamline warranty returns at scale with practical strategies for efficiency and effectiveness. Read the article for actionable insights.

Create an effective warranty return flow for fragile goods to minimize losses and enhance customer satisfaction. Discover practical steps in our article.

Discover effective strategies to combat warranty fraud and protect your business. Learn best practices for prevention and safeguard your assets. Read more!

Master the essentials of electronics warranty return management with our comprehensive guide. Streamline your process and reduce hassle. Read more now!

Learn effective strategies for offering self-service warranty returns that enhance customer satisfaction and streamline your process!

Discover how warranties can boost customer loyalty and drive repeat purchases in online stores. Learn effective strategies to enhance your sales. Read more!

Discover the top 10 ecommerce warranty management software solutions to enhance your business efficiency and customer satisfaction. Read the article now!