How to Prepare for Holidays Returns Rush

Learn effective strategies to handle the holiday returns rush with ease. Get ready to streamline your process and minimize stress.

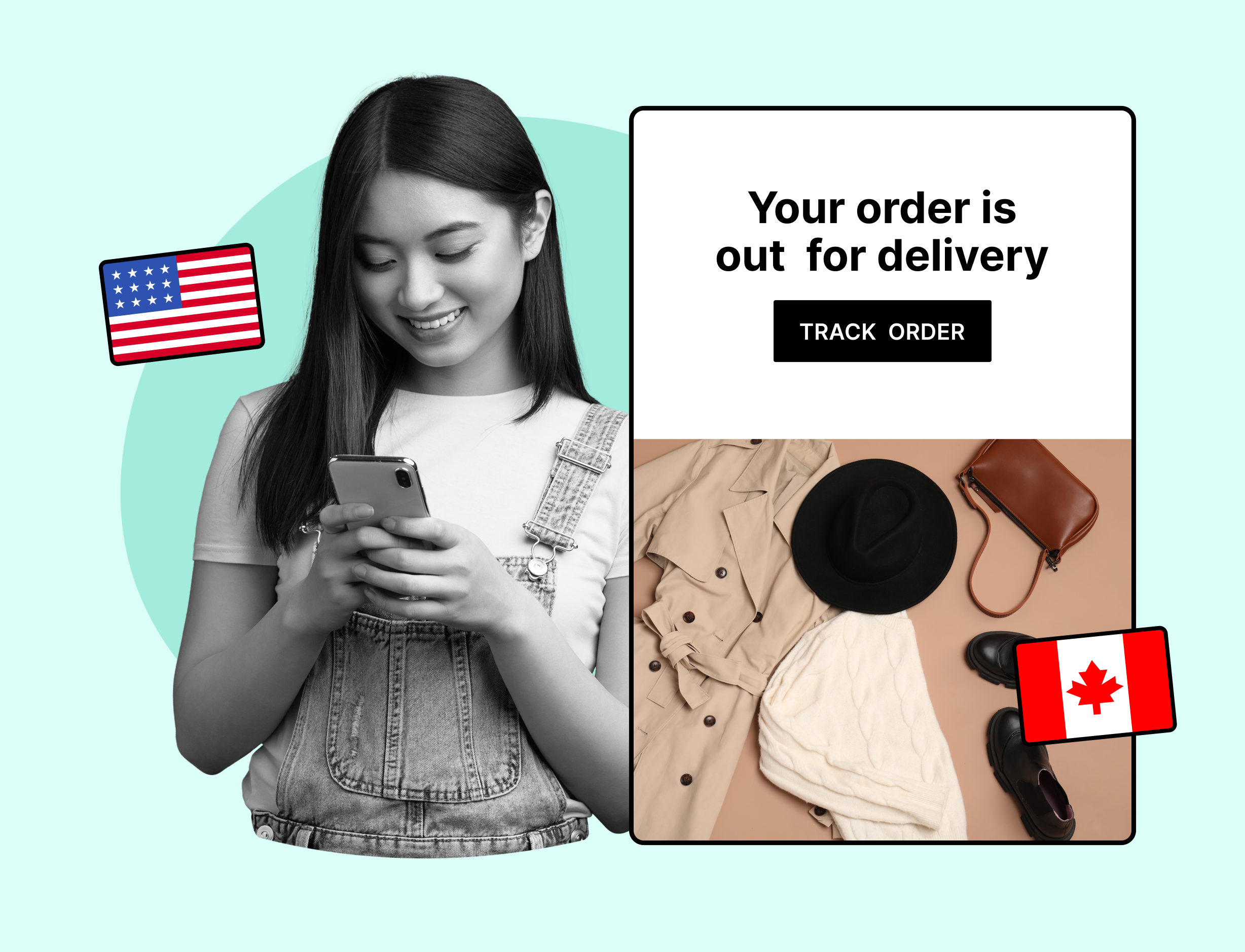

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

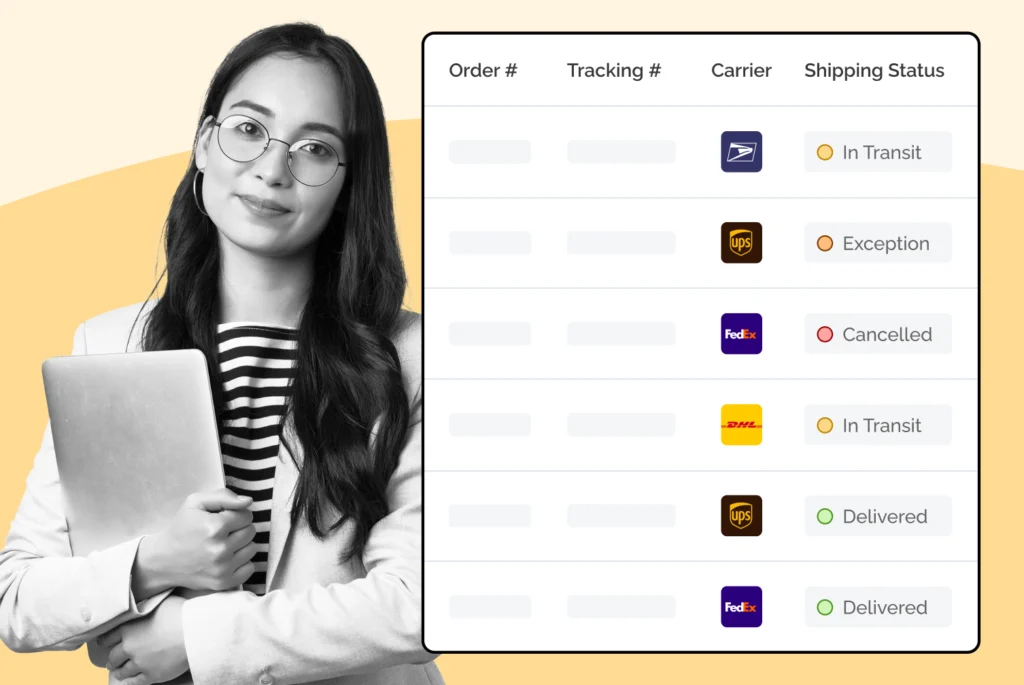

Realtime order and shipment tracking

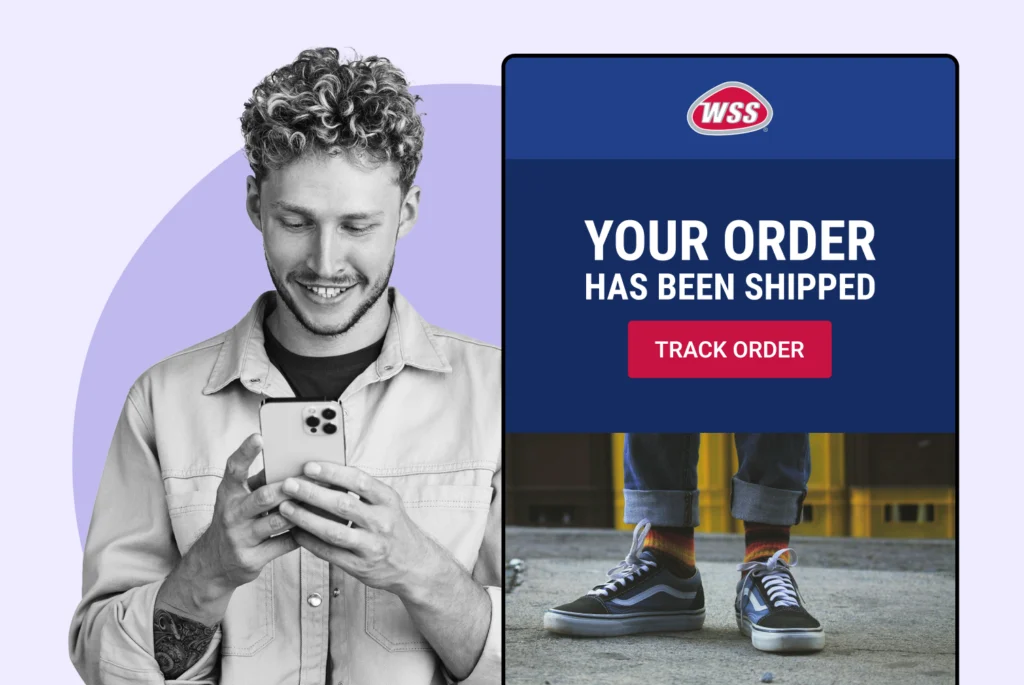

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

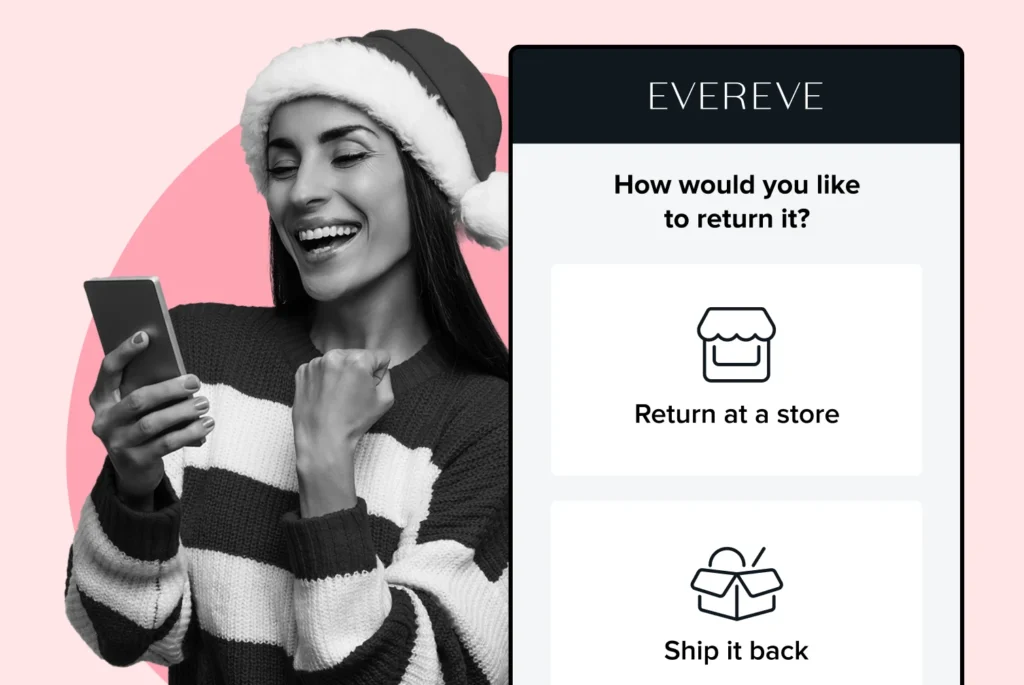

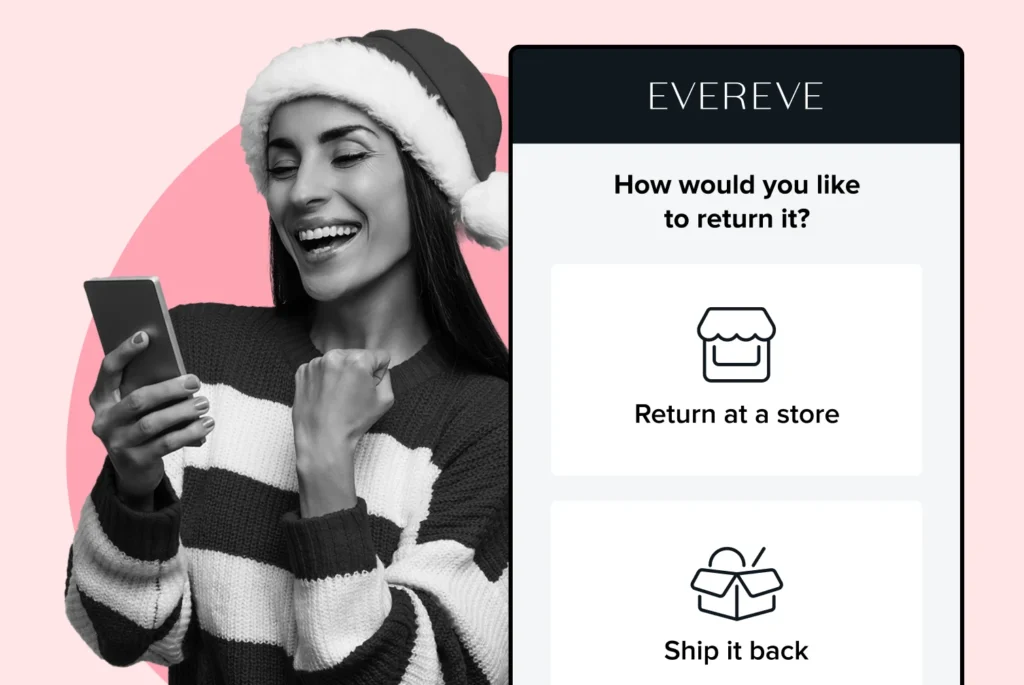

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Easy claims and smart upsells

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Equip your team for precise return checks.

Easy claims and smart upsells

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Find the answer to all your questions

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Find the answer to all your questions

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

Every day, millions of dollars’ worth of goods move across U.S. borders by air, sea, and land. According to U.S. Customs and Border Protection (CBP), in 2023 alone, the agency processed over 41 million entries of imported goods, valued at more than $3.3 trillion. These numbers show how important international trade is to the U.S. economy. But they also reveal something else: with this much trade happening, the government has to make sure that everything entering the country follows strict rules.

That’s where U.S. customs compliance comes in. If importers do not follow the rules, shipments can be delayed, fined, or even seized. This not only costs money but can also disrupt entire supply chains. In an era when many businesses rely on “just-in-time” shipping, even a short delay at customs can mean missed deadlines, lost sales, or disappointed customers.

The good news is that customs compliance does not have to be complicated or scary. With the right knowledge, preparation, and systems in place, companies of all sizes can move their goods smoothly and legally. This article breaks down everything you need to know about U.S. customs compliance in shipping, using clear and simple language.

U.S. Customs and Border Protection (CBP) is the agency responsible for enforcing customs laws. CBP officers are stationed at ports, airports, and border crossings, where they inspect goods and verify paperwork. Their mission is twofold: to keep dangerous or illegal items out of the country while also keeping legitimate trade flowing efficiently. Adhering to all applicable laws is essential to avoid penalties, ensure safety, and maintain trustworthy practices with regulatory agencies and customers.

Compliance starts with knowing the rules. One of the most important tools is the Harmonized Tariff Schedule of the United States (HTSUS). This schedule contains thousands of product codes, each linked to specific duty rates and rules. Getting this classification wrong can lead to overpaying, underpaying, or triggering penalties. Importers must also understand trade regulations as part of the legal framework governing international shipments.

Beyond CBP, many other government agencies also have a say in what can and cannot enter the country. For example, the Food and Drug Administration (FDA) oversees food, drugs, and cosmetics. The Environmental Protection Agency (EPA) controls chemicals and vehicles that may affect air quality. The U.S. Department of Agriculture (USDA) checks agricultural goods to prevent pests or diseases from spreading. Importers must be aware of which agencies apply to their goods. Shipments must meet both customs and partner government agency requirements to clear customs successfully.

Trade agreements also play a big role. Agreements like the United States-Mexico-Canada Agreement (USMCA) and other free trade agreements can lower or eliminate duties if goods qualify. But the savings only apply if importers follow the specific rules, such as proving the country of origin through a certificate, and comply with all related requirements.

One of the most common mistakes importers make is not knowing their products well enough. CBP expects importers to understand what they are shipping: what it is made of, how it is used, and where it comes from. Without this knowledge, it is almost impossible to achieve proper classification of products under the HTSUS, which is essential for compliance and accurate duty calculation.

For example, a jacket made of cotton may fall under a different code than one made of polyester. The difference in duty rates can be significant. In 2022, CBP reported that misclassification of goods was one of the top causes of penalties, accounting for millions of dollars in fines. Some products may also be subject to countervailing duties, which are imposed to offset foreign government subsidies and can further impact the total duties owed.

To avoid this, companies can request a binding ruling from CBP. This is a written decision that provides legal certainty on how a product should be classified. Binding rulings are especially useful for complex goods like electronics or textiles.

Country of origin is another key detail. Goods must be clearly labeled with where they were made, such as “Made in Vietnam” or “Made in Mexico.” This is not the same as the country of export, which might simply be where the goods were shipped from. Mislabeling can lead to shipments being stopped or rejected.

Errors in classification can result in overpaying or underpaying import duties, directly affecting a company’s bottom line. Finally, importers need to check whether their goods are prohibited or restricted. Items such as counterfeit products, ivory, or certain pesticides cannot enter the U.S. at all. Others, like alcohol, medical devices, or plants, require special permits. Knowing this in advance saves time and prevents losses.

Paperwork may not be exciting, but it is the backbone of customs compliance. Every shipment entering the U.S. must be supported by accurate documents and maintaining accurate records is essential to ensure compliance, prevent penalties, and avoid issues. These typically include:

Commercial Invoice: This shows what is being shipped, how much it is worth, and where it came from.

Bill of Lading or Airway Bill: This is the contract between the shipper and carrier, confirming the details of transport.

Packing List: This lists what is inside each package, including weights and dimensions.

Entry Summary (CBP Form 7501): This is filed by the importer or customs broker to officially declare the goods to CBP.

Consistency is key. If the invoice says the shipment contains “cotton shirts” but the packing list says “men’s jackets,” CBP will see a red flag. Inconsistent or vague descriptions can trigger an inspection or audit.

Many importers must also secure a customs bond. This is a type of insurance that guarantees payment of all duties, taxes, and fees owed to CBP. There are two main types: single-entry bonds, which cover one shipment, and continuous bonds, which cover all shipments over a year. Timely duty payments are essential to avoid penalties and ensure smooth clearance.

For ocean shipments, another requirement is the Importer Security Filing (ISF), often called “10+2.” This filing must be submitted at least 24 hours before the goods are loaded onto a ship bound for the U.S. Missing or late ISFs can lead to fines of up to $5,000 per shipment.

Incomplete or incorrect documentation can result in costly delays at the port.

Once goods are properly classified, importers must pay the correct duties and taxes. Duties are calculated as a percentage of the shipment’s value, based on the HTSUS code. In addition, importers may need to pay the Merchandise Processing Fee (MPF), which ranges from $27 to $528 per entry depending on the value of goods. Certain products are also subject to federal excise taxes, such as alcohol, tobacco, or fuel.

Trade agreements can reduce or eliminate these costs. For instance, under the USMCA, many goods made in North America enter duty-free. However, to benefit, importers must provide a Certificate of Origin proving that the goods qualify. Failure to do so means paying the standard duty rates. Identifying potential duty savings through proper classification and use of trade programs is essential for maximizing tariff benefits and ensuring customs compliance.

Another cost-saving tool is the duty drawback program, which allows businesses to recover duties paid on imported goods that are later exported. In 2021, CBP issued over $2 billion in duty drawback refunds, a reminder of how valuable this program can be for exporters.

CBP requires importers to keep all records related to their shipments for up to five years, as required by CBP. These records include invoices, packing lists, shipping documents, and correspondence with suppliers. The goal is to show that the importer exercised “reasonable care” in their dealings.

Good recordkeeping is more than just storage. It is about making sure all documents tell a consistent story. If an invoice lists 1,000 units but the packing list shows only 800, CBP may suspect underreporting. Similarly, if the declared value on a shipment is far lower than market prices, it could trigger an audit. Conducting regular audits helps ensure records are accurate and complete, proactively identifying and fixing compliance issues.

Digital tools can make recordkeeping easier. Many companies now use compliance software to scan, store, and track all import-related documents. This reduces human error and makes it simple to respond to a CBP request. During a CBP audit or a customs audit, authorities may review documentation for compliance over the required retention period.

Successful importers do not leave compliance to chance. They create formal programs that define how compliance is managed within the company. A good compliance program includes:

Written policies and procedures explaining who is responsible for what.

Regular internal audits to identify and fix problems early.

Training programs to keep staff informed about current rules.

However, businesses often face significant compliance challenges, especially when dealing with complex customs regulations and international shipping. Addressing these challenges proactively is essential to ensure smooth operations and regulatory adherence.

Internal audits are particularly important. CBP conducts thousands of audits every year, and companies that already have internal controls in place are better prepared. Audits can cover everything from classification accuracy to payment of duties.

Training should not be a one-time event. Regulations change frequently, and staff turnover means new employees need to be brought up to speed. Taking proactive steps, such as regularly reviewing and updating your compliance program, helps ensure it remains effective and accurate. Regular workshops, webinars, or even short refresher sessions can go a long way in keeping everyone aligned.

Customs brokers and legal experts can provide guidance on complex compliance issues and help navigate evolving customs regulations.

Even with the best systems in place, issues can arise. CBP may request additional information, question documentation, or place a shipment on hold. Certain shipments may be subject to heightened scrutiny, resulting in more rigorous inspections, stricter requirements, and potential delays. The best response is always speed and transparency. Prompt replies show CBP that the importer is serious about compliance.

Another practical step is to conduct restricted party screening. This means checking that suppliers, customers, or shipping partners are not on government watchlists. Doing business with a restricted party can lead to severe fines, legal action from authorities, or even criminal charges.

Working with customs brokers is another common practice. Brokers are licensed experts who understand the ins and outs of classification, valuation, and paperwork. They can also assist in protecting intellectual property rights by ensuring compliance with CBP enforcement actions against counterfeit or infringing goods. Importers should provide brokers with complete and accurate information to avoid mistakes.

Technology also plays a major role. From automated filing systems to shipment tracking apps, digital tools help importers streamline compliance and reduce risks.

In today’s fast-paced world of global trade, leveraging technology is a critical aspect of any successful customs compliance program. Modern compliance technology can automate many of the most time-consuming and error-prone tasks, such as preparing customs documentation, classifying goods, and calculating duties. By reducing the risk of human error, businesses can avoid costly penalties and ensure that every shipment meets the necessary regulations.

Technology also plays a vital role in restricted party screening and export controls. Automated systems can quickly check customers, suppliers, and partners against restricted party lists, helping companies stay compliant with export regulations and avoid doing business with sanctioned entities. Additionally, digital platforms provide real-time updates on customs regulations, making it easier for businesses to adapt to regulatory changes as they happen.

Investing in compliance technology not only streamlines customs processes but also strengthens the overall compliance program. With features like document management, audit trails, and automated alerts, companies can minimize the risk of non compliance and respond quickly to any compliance issues that arise. Ultimately, embracing technology helps businesses stay ahead of changing regulations, reduce manual workload, and maintain a strong reputation in the trade community.

As mentioned earlier, many goods fall under the jurisdiction of PGAs. For example, the FDA regulates pharmaceuticals, the USDA oversees plants and animals, and the EPA monitors chemicals. Importers dealing with these products must not only meet CBP’s requirements but also comply with PGA rules.

This often means securing permits, necessary licenses, or special approvals before goods are shipped. For example, importing certain fruits requires a USDA permit to ensure pests are not introduced into the U.S. Failing to secure the necessary approvals can result in goods being destroyed or returned at the importer’s expense.

Staying in touch with PGAs is a smart move. These agencies often provide updates, newsletters, or guidance documents to help importers stay compliant.

Additionally, some products may also be subject to Export Administration Regulations, which require further compliance steps such as obtaining specific licenses and documentation for export-controlled or dual-use items.

Stay compliant with Partner Government Agency requirements

Book a quick call to see how WeSupply streamlines shipping compliance to prevent costly customs delays.

Navigating the complexities of customs compliance often requires specialized knowledge and experience. Engaging with customs experts such as customs brokers and consultants can provide invaluable support in understanding customs regulations, trade agreements, and evolving compliance requirements. These professionals are well-versed in the latest regulatory requirements and can offer tailored guidance to ensure your compliance program is both effective and up to date.

Customs brokers play a key role in preparing and submitting accurate customs documentation, communicating with customs authorities, and resolving compliance issues that may arise during the import or export process. Their expertise can be especially helpful during customs audits or when dealing with detentions and other challenges, helping your business avoid costly mistakes and potential legal risks.

By partnering with experienced customs professionals, companies can build a robust compliance program that adapts to regulatory changes and minimizes the risk of non compliance. Whether you are new to international trade or managing a complex global supply chain, customs experts can provide the insights and support needed to ensure compliance and keep your operations running smoothly.

Not all customs compliance is mandatory. Some programs are voluntary but provide big benefits. One example is the Customs-Trade Partnership Against Terrorism (C-TPAT). Companies that join C-TPAT work with CBP to improve supply chain security. In return, they are considered “low risk,” which means fewer inspections and faster clearance times. Participation in C-TPAT also helps promote fair trade practices by encouraging adherence to ethical and equitable trading standards.

Another proactive measure is prior disclosure. If an importer discovers that they made a mistake, such as misclassifying goods or underpaying duties, they can file a prior disclosure with CBP. Doing this voluntarily usually results in lower penalties than if CBP finds the mistake during an audit.

These programs demonstrate good faith and strengthen relationships with CBP, which can be invaluable in the long run. Voluntary programs can also help companies comply with export control regulations by ensuring shipments meet U.S. legal requirements for sensitive goods and technology.

Simplify Returns for Your Customers and Support Team

Book a quick call with our experts to see how WeSupply can help you: simplify the Return experience with just a few clicks, reduce customer service calls and manual processing, notify your customer about their refund, automate returns and reduce user error.

Shipping across U.S. borders can feel like solving a giant puzzle customs forms, delivery delays, lost packages, and frustrated customers. That’s where WeSupply steps in. We don’t just help you ship; we help you ship smarter, faster, and more confidently, so you can focus on growing your business instead of worrying about customs headaches.

Here’s how WeSupply helps businesses master U.S. Customs compliance and stay ahead:

See Every Shipment in Real Time – Track packages across 1,000+ carriers worldwide, spot delays before customers do, and send instant updates.

Stay Proactive, Not Reactive – Identify stalled or undeliverable shipments early, reach out to customers in bulk, and prevent returns-to-sender.

Protect Against Customs Delays – Anticipate issues like paperwork errors, weather disruptions, or restricted items — and take action before they turn into costly problems.

Turn Problems into Positive Experiences – Lost or stolen packages? Customers can file claims directly on your branded tracking page, while your team resolves issues quickly.

Save on Shipping Costs – Access discounted rates (up to 83% off) from UPS, FedEx, USPS, DHL, and more — no contracts or minimums required.

One Dashboard, Total Control – From customs clearance to delivery notifications, manage everything in a single, easy-to-use platform.

Build Customer Trust – Automated SMS/email updates keep buyers informed, reducing “Where is my order?” calls and protecting your reviews.

✅ Why it matters: U.S. Customs compliance isn’t just about avoiding fines or delays it’s about delivering a reliable, worry-free shopping experience that builds loyalty and drives repeat sales.

💡 Unique insight: Most businesses lose profit not from customs penalties, but from the “silent costs” of customer frustration chargebacks, negative reviews, and lost trust. By making compliance visible and communication automatic, WeSupply turns a compliance challenge into a competitive advantage.

🚀 Bottom line: Whether you’re shipping a single parcel or managing thousands across borders, WeSupply helps you launch faster, save more, and keep customers happy. Book a demo now!

With over 150 stores fulfilling online orders, J.McLaughlin often had to split shipments a process that left customers confused and customer service teams overwhelmed with “Where is my order?” calls. Their ERP wasn’t designed to clearly manage or communicate split shipments, leading to frustration and inefficiencies.

WeSupply stepped in to centralize all shipments into a single, branded tracking experience. Customers could now see every package, its status, tracking events, and estimated delivery date all in one place. Proactive notifications further reduced confusion, kept customers engaged, and turned shipping updates into a positive brand touchpoint.

To build a culture of compliance, importers should adopt best practices that go beyond the basics. Understanding customs compliance is essential for building a strong foundation and ensuring all activities align with legal requirements. These include:

Conducting regular internal audits to catch problems early.

Providing ongoing training to employees at all levels.

Using technology solutions to reduce errors and improve efficiency.

Staying informed about regulatory changes through CBP updates, trade publications, and industry groups.

Maintaining open communication with brokers, suppliers, and PGAs.

CBP emphasizes that compliance is a shared responsibility. Importers who take a proactive approach are not only more likely to avoid penalties but also more likely to benefit from faster, smoother trade operations.

Mastering U.S. customs compliance isn’t just about forms it’s about protecting profits, avoiding delays, and delivering a seamless customer experience.

With WeSupply, businesses gain real-time visibility across 1,000+ carriers, instantly spot delays, resolve undeliverable or stalled shipments, and manage lost or stolen packages directly through a branded tracking page. Automated updates reduce “Where is my order?” calls, while discounted shipping labels up to 83% off cut costs without sacrificing speed. One intuitive dashboard connects orders, shipments, and customer communication, giving teams total control from customs clearance to final delivery. By combining proactive alerts, bulk outreach, and smart cost-saving tools, WeSupply transforms compliance from a risk into an advantage.

In a world where a single delay can cost both money and trust, WeSupply empowers businesses to ship faster, smarter, and more confidently turning challenges into growth opportunities.

1. Why is customs compliance important for businesses?

Customs compliance prevents delays, fines, and seizures, ensuring smooth supply chains. It also protects profits, maintains customer trust, and avoids costly disruptions in just-in-time shipping environments.

2. What documents are required for U.S. customs clearance?

Key documents include the commercial invoice, bill of lading or airway bill, packing list, and CBP Form 7501. Some shipments also require permits, certificates, or Importer Security Filing (ISF).

3. How are duties and taxes calculated on imports?

Duties and taxes are based on product classification under the Harmonized Tariff Schedule, declared value, and trade agreements. Importers may also pay Merchandise Processing Fees, excise taxes, or recover costs via duty drawback programs.

4. How does WeSupply help with U.S. customs compliance?

WeSupply provides real-time tracking, proactive alerts, and automated customer updates. It helps prevent customs delays, reduces “Where is my order?” calls, and ensures faster resolution of shipment issues.

5. Can WeSupply reduce costs on cross-border shipping?

Yes. WeSupply offers discounted rates up to 83% from carriers like UPS, FedEx, USPS, and DHL. Businesses save on labels while managing customs and delivery in one dashboard.

6. How does WeSupply improve customer experience during customs delays?

WeSupply notifies customers automatically via SMS/email, manages claims on branded tracking pages, and provides real-time updates turning potential customs issues into trust-building opportunities.

7. Does WeSupply have an Official Shopify App?

Yes. WeSupply has an Official Shopify App. You can download it and start integrating with your Shopify Store.

8. Does WeSupply have an official Magento extension?

Yes, WeSupply has an official extension for Magento. The WeSupply x Magento integration allows for automating order tracking experiences, reducing customer inquiries, automating shipping email and SMS notifications, and providing a fully branded order tracking experience

9. Does WeSupply have an official BigCommerce App?

Yes, WeSupply has an official BigCommerce App. You can integrate WeSupply with your BigCommerce store to improve your post-purchase customer experience.

Learn How To Create Successful Post Purchase Email Campaigns

Build an effective post-purchase email flow that helps you increase customer satisfaction and drive revenue growth!

Learn effective strategies to handle the holiday returns rush with ease. Get ready to streamline your process and minimize stress.

Prepare for the holiday returns rush with essential strategies to streamline your process and enhance customer satisfaction.

Discover top shipping API solutions that enhance your ecommerce fulfillment process. Simplify logistics and improve customer satisfaction.

Navigate the complexities of hazardous materials shipping compliance in ecommerce. Learn essential regulations and best practices.

Explore the key benefits of multi carrier shipping for your business. Enhance efficiency, cut costs, and improve customer satisfaction.

Discover the true costs of overnight shipping as we compare rates and options. Make informed choices for your shipping needs.

Discover top real-time package tracking solutions for seamless shipping experiences. Improve your logistics today!

Discover top shipping API solutions that enhance your ecommerce fulfillment process. Simplify logistics and improve customer satisfaction.

Master post-holiday returns management with effective strategies that streamline processes and enhance customer satisfaction.