How to choose The Best Returns management software for your ecommerce business

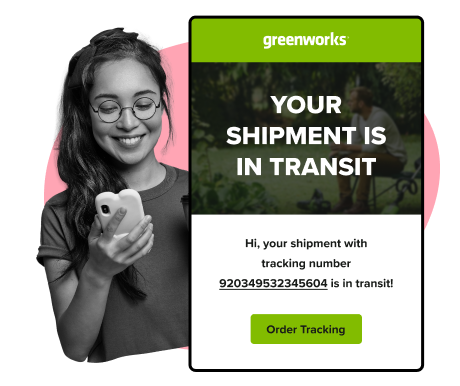

What does in transit mean and how long does it take? Read this article to find out & see how to answer your customers’ burning questions.

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

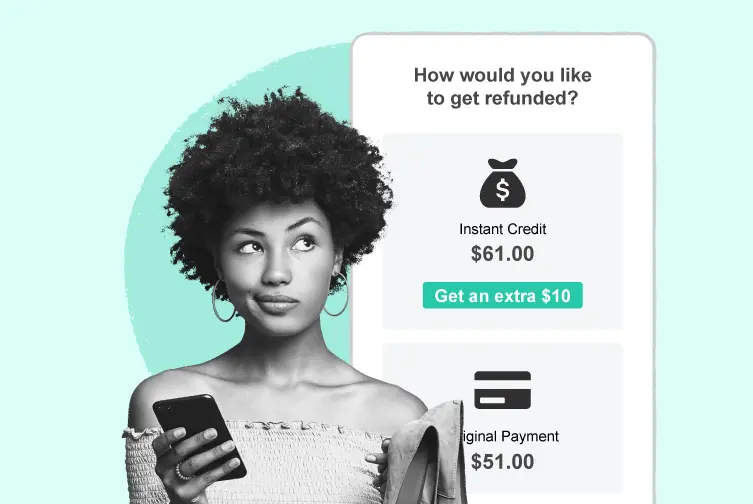

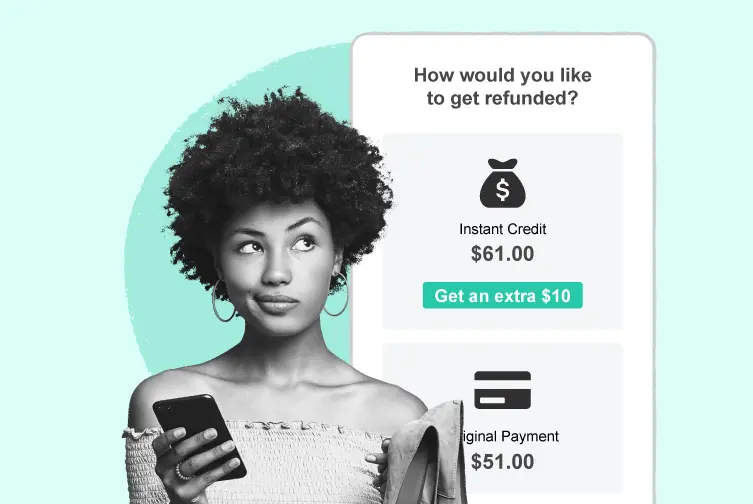

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Easy claims and smart upsells

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Equip your team for precise return checks.

Easy claims and smart upsells

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Find the answer to all your questions

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Find the answer to all your questions

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

Do you ever wonder how retail businesses manage their inventory levels and make informed purchasing decisions? The secret lies in knowing how to calculate ending inventory, a critical aspect of inventory management that can greatly impact a company’s financial success. In this blog post, we’ll explore the importance of ending inventory, the different valuation methods, and practical examples to help you gain a deeper understanding of this essential concept. Read on to unlock the potential of ending inventory management for your business success.

Ending inventory is a critical part of successful business operations, with 43% of small businesses facing difficulty in optimizing their inventory management.

The ending inventory formula must be accurately calculated to ensure financial reporting and optimize operations. Three main methods – FIFO, LIFO & WAC are used for this purpose.

Proper tracking and implementation of strategies can help mitigate the implications of overstated or understated inventories while leveraging technology provides an accurate method for managing stock levels.

Employing the right post-purchase software for efficient returns handling, including features for product restocking during the return flow, can simplify your inventory management process. Our tool, WeSupply offers a platform for self-managed returns and exchanges, transforming a major industry challenge into a potential advantage.

Ending inventory, sometimes called closing inventory, is the value of unsold goods or products a retail business has in its stock at the end of an accounting period. It plays a crucial role in making sound stock-related and financial decisions, ultimately impacting a business’s profitability and growth.

In fact, 43% of small businesses are currently struggling with optimizing their inventory management operations, which highlights the importance of accurate ending inventory calculation. We will further explore the pivotal role of ending inventory in bolstering business success and its relevance in fine-tuning operations for small businesses.

Ending inventory is of paramount importance for managing remaining inventory, financial stability, and demand forecasting. It helps businesses track the total market value of their stock that is ready to be sold at the end of an accounting period, and understand the influence of inventory cost on available working capital.

The key factors to consider when calculating ending inventory are beginning inventory and net purchases during the accounting period, as well as the cost of goods sold (COGS).

The distinction between beginning inventory and ending inventory is crucial. Beginning inventory is the value of goods or products a retail business has at the start of an accounting period. Ending inventory reflects the value of goods still in stock at the end of the same period.

Having knowledge of beginning inventory at the start of an accounting period, as well as the previous accounting period, facilitates informed purchasing decisions based on anticipated demand for the remainder of the period and helps in maintaining an accurate ending inventory balance at the end of the accounting period.

In today’s competitive market, a staggering 43% of small businesses face difficulty in optimizing their inventory management operations, including dealing with inventory shrinkage. This highlights the need for effective inventory management systems and accurate ending inventory calculations to ensure business expansion and success.

Optimizing inventory management is critical as it minimizes costs, increases efficiency, and enhances customer satisfaction. In addition, the relationship between ending inventory value and net income can help businesses determine if they are paying too much for their goods or not pricing their stock correctly.

Now that we understand the importance of ending inventory, let’s break down the ending inventory formula and its significance in inventory accounting. The formula for calculating ending inventory is: Beginning Inventory + ending inventory. Net Purchases – Cost of Goods Sold (COGS).

It’s essential to adhere to one ending inventory method to guarantee the accuracy of financial reports and reduce the likelihood of errors. We will dissect the core components of the ending inventory formula and scrutinize its significance in inventory accounting.

The core components of the ending inventory formula are:

Beginning Inventory: It shows the value of goods or products that a retail business had in its store at the commencement of an accounting period.

Net Purchases: It represents the total value of goods or products purchased by a retail business during an accounting period.

Cost of Goods Sold (COGS): It refers to the total cost incurred by a retail business in acquiring and selling its goods or products during an accounting period.

These components are crucial for determining the ending inventory of a retail business.

Net purchases refer to the total quantity of goods purchased during the accounting period, while COGS represents the total cost of goods sold during the same period. The correlation between the constituents of the ending inventory formula is that Beginning Inventory plus Goods Purchased minus Cost of Goods Sold is equivalent to Ending Inventory, which can also be used to calculate gross profit.

By employing this formula, businesses can accurately monitor their inventory levels and make informed purchasing decisions based on the anticipated demand for the remainder of the accounting period.

The ending inventory formula’s core concept is to determine the value of goods that remain available for sale at the end of an accounting period. This calculation helps businesses maintain precise balance sheets, produce consistent reports, and predict future inventory requirements.

By accurately calculating ending inventory, businesses can:

Optimize their operations

Maximize profits

Ensure that they are not overstocked or understocked

Meet customer demand efficiently.

There are three primary inventory valuation methods that businesses can use to calculate ending inventory: First In, First Out (FIFO), Last In, First Out (LIFO), and Weighted Average Cost (WAC). Each method has its own unique advantages and disadvantages, and the choice of method will depend on the specific needs and goals of the business.

We will examine each of these methods in detail and discuss their importance and application in the context of ending inventory calculation.

The FIFO (First In, First Out) method assumes that the oldest items in inventory are sold first. This method is widely used because it closely represents the actual flow of inventory in most businesses. By selling the oldest items first, businesses can minimize the risk of spoilage and waste, especially in the case of perishable goods.

In the FIFO method, the cost of goods sold is based on the cost of the oldest inventory items, and the ending inventory is based on the cost of the newest items. This method is particularly useful when inventory costs are rising, as it results in a lower cost of goods sold and a higher net income.

The LIFO (Last In, First Out) method assumes that the most recently acquired items in inventory are the first ones to be sold or used. In this method, the cost of goods sold is based on the cost of the most recent inventory purchases, which can result in a lower net income and a reduced final inventory value in periods of inflation.

Businesses may choose to use the LIFO method to reduce their tax burden, as a lower net income results in lower taxable income. However, it’s important to note that the LIFO method does not accurately reflect the actual flow of inventory and may not be suitable for businesses with perishable inventory or those that require precise inventory tracking.

The Weighted Average Cost (WAC) method calculates the average cost of all inventory units available for sale over a specific period by dividing the cost of goods sold (COGS) by the total number of units in inventory. This method provides an accurate blended average cost for tracking and valuing inventory, which can be particularly useful for businesses that have a large number of similar items in their inventory.

Unlike FIFO and LIFO, the WAC method smooths out cost fluctuations and provides a more consistent inventory valuation.

Calculating ending inventory is an advantageous practice for businesses, particularly in the eCommerce sector, and a vital step in the accounting process. It helps businesses accurately track their inventory levels, maximize operations, and forecast for the future.

We will elucidate on the indispensability of calculating ending inventory for successful business operations, net income tracking, and precise reporting and forecasting.

Inventory tracking is essential for businesses to guarantee accuracy in their financial statements, maximize operations, and forecast for the future. By conducting regular stock counts and using inventory management software, businesses can ensure that their inventory levels are accurate and avoid being overstocked or understocked.

This helps businesses optimize their operations, maximize profits, and ensure that they are accurately represented in their financial statements, including the balance sheet.

In the realm of eCommerce, managing returns efficiently is a critical component, especially the restocking process. Efficient restocking not only ensures that the inventory levels remain consistent but also reduces delays, keeping customer satisfaction high. Post-purchase solutions like WeSupply have become vital tools in this respect. By integrating the product restocking process directly into the return cycle, such software alleviates a significant administrative burden. This means that business owners and managers can redirect their time and energy towards other essential areas of their operation, ensuring smooth and optimized business performance.

The relationship between ending inventory value and net income can help businesses determine if they are paying too much for their goods or not pricing their stock correctly. By comparing ending inventory value to net income, businesses can identify inefficiencies in their operations and make adjustments to improve profitability.

Accurate ending inventory calculation is crucial for this process, as it helps businesses track their profitability and identify potential overpayments for supplies.

Ending inventory plays a crucial role in improving reporting, forecasting, budgeting, and identifying cost issues for future-proofing businesses. By accurately calculating ending inventory, businesses can plan ahead for future inventory requirements and identify potential cost concerns.

This helps businesses make informed decisions about their inventory and ensure that they are able to fulfill customer demand efficiently. In addition, accurate ending inventory records help businesses maintain precise balance sheets, generate consistent reports, and predict future inventory requirements.

We will delve into real-world scenarios that underscore the significance and application of the three main calculation methods for ending inventory: FIFO, LIFO, and WAC. These examples will demonstrate the importance of calculating ending inventory and how it can be applied to various business situations to help businesses make informed decisions about their inventory management.

By understanding the different methods of calculating ending inventory, businesses can make more informed decisions about their inventory.

For example, let’s consider a business that deals with perishable goods, such as a grocery store. In this case, the FIFO method would be the most appropriate choice for calculating ending inventory, as it ensures that the oldest items are sold first, minimizing the risk of spoilage and waste.

By using the FIFO method, the grocery store can:

Accurately calculate the cost of goods sold

Determine the value of ending inventory

Make informed purchasing decisions

Maintain optimal stock levels

In another example, a business that deals with non-perishable goods and experiences fluctuating costs, such as an electronics retailer, may choose to use the LIFO method for calculating ending inventory. By assuming that the most recently acquired items are the first ones to be sold, the LIFO method results in a lower net income and a reduced final inventory value during periods of inflation. This can benefit the business by reducing its tax burden and allowing it to adapt to changing market conditions.

Lastly, a business with a large number of similar items in its inventory, such as a clothing retailer, may opt for the Weighted Average Cost method to calculate ending inventory. This method provides an accurate blended average cost for tracking and valuing inventory, smoothing out cost fluctuations, and providing a more consistent inventory valuation. By using the WAC method, the clothing retailer can accurately track its inventory levels, make informed purchasing decisions, and maintain optimal stock levels.

Calculating ending inventory may present various challenges, such as incorrect data entry, inaccurate inventory counts, and incorrect pricing. We will address the potential pitfalls in ending inventory calculation and the ramifications of miscalculations on business operations.

We’ll also provide tips for identifying and managing potential pitfalls to ensure the accuracy of ending inventory records.

Businesses should be aware of potential risks when determining ending inventory, such as incorrect data entry, miscalculations, and incorrect inventory valuation methods. To identify potential pitfalls, it is recommended to carefully review the data entry process, double-check calculations, and confirm that the correct inventory valuation method is being applied. By doing so, businesses can ensure the accuracy of their inventory records and avoid costly stock discrepancies.

To manage potential pitfalls, businesses should:

Implement a system of checks and balances, such as verifying data entry and calculations, and periodically evaluating inventory valuation methods.

Conduct regular stock counts.

Use inventory management software to maintain accurate inventory records.

Ensure that businesses have a clear understanding of their stock levels and can make informed decisions about their inventory management.

Stock discrepancies can have a considerable cost, potentially resulting in inaccurate financial statements, incorrect inventory records, and costly errors. Inaccuracies in inventory can result in significant issues for the organization, including overspending on supplies or holding more funds in inventory than earned from sales. This can have a detrimental effect on the business’s operations and profitability, making it crucial for businesses to accurately calculate ending inventory.

To overcome challenges in ending inventory calculation, businesses should implement strategies such as regularly auditing inventory, tracking inventory movements, and utilizing barcode scanners. By ensuring the accuracy of ending inventory records, businesses can avoid the consequences of overstated or understated inventory and maintain a clear understanding of their stock levels.

In today’s fast-paced business environment, leveraging technology for inventory management is essential. RFID systems, inventory software, and multi-channel fulfillment are some examples of tools that businesses can use to accurately track their inventory and ensure that their ending inventory records are up-to-date.

We will delve into the embracement and importance of these technologies for accurate inventory management.

Returns management made easy for your team

Book a quick call with our experts to see how WeSupply can help you streamline your return management.

Radio frequency identification (RFID) systems are electronic tags that enable non-contact reading and writing of data through radio frequencies. They allow businesses to track and identify objects, animals, and people, providing a more efficient and accurate method of inventory management. Inventory software, such as WeSupply Labs, can help businesses automate their inventory management processes, guaranteeing accuracy and saving time.

Multi-channel fulfillment is a process that enables businesses to fulfill orders from multiple channels, including online stores, brick-and-mortar stores, and marketplaces. It assists businesses in optimizing their operations, cutting costs, and enhancing customer service. By leveraging these technologies, businesses can maintain accurate ending inventory records, minimize stock discrepancies, and ensure that they are able to meet customer demand efficiently.

Embracing technology for efficient returns and exchanges management offers businesses a plethora of benefits

Streamlined return workflows

Automated product restocking during the return process

Enhanced decision-making for exchanges

Operational cost savings

Elevated customer trust and satisfaction

By leveraging technology with solutions like WeSupply Labs, businesses can refine their returns and exchanges procedures, leading to quicker product restocking, reduced return-related costs, and amplified customer satisfaction. As businesses increasingly focus on these facets, technology-driven solutions position them at the forefront of customer-centric operations, setting the stage for continued growth and profitability

Maintaining accurate ending inventory records is essential for businesses to track their inventory levels accurately and avoid being overstocked or understocked.

We will share tips for maintaining accurate ending inventory records, shed light on the consequences of overstated vs. understated inventory, and offer strategies for ensuring consistency and accuracy in inventory records.

To ensure consistency and accuracy in inventory records, businesses should consider conducting regular stock counts and utilizing inventory management software. Regular stock counts help verify the accuracy of inventory records, allowing businesses to detect any discrepancies between physical and documented inventory.

Inventory management software can automate inventory tracking, reducing the likelihood of errors and ensuring that inventory levels are accurately reflected in financial statements.

Overstated inventory may result in increased costs due to excess stock, while understated inventory can lead to missed sales opportunities and customer dissatisfaction. Both scenarios can have a detrimental effect on the business’s operations and profitability, making it crucial for businesses to accurately calculate ending inventory.

By maintaining accurate inventory records and implementing strategies to ensure consistency in inventory management, businesses can avoid the consequences of overstated or understated inventory and maintain a clear understanding of their stock levels.

As we have seen throughout this blog post, ending inventory management is a critical aspect of inventory management that can greatly impact a company’s financial success. By accurately calculating ending inventory and leveraging technology such as RFID systems, inventory software, and multi-channel fulfillment, businesses can optimize their operations, maximize profits, and ensure that they are accurately represented in their financial statements.

As we look to the future, advancements in technology will continue to provide businesses with increased control over stock-related and financial decisions, paving the way for a more efficient and profitable future.

In today’s fast-paced eCommerce landscape, a streamlined returns and exchanges process is paramount for maintaining customer trust and ensuring operational efficiency. Efficiently managing returns directly correlates with effective inventory management, as products that are swiftly and systematically processed can be reintegrated into stock, ready for resale. This not only reduces potential revenue loss but also minimizes storage and administrative costs associated with prolonged or mishandled returns. WeSupply plays an instrumental role in bridging this gap. With its sophisticated system, it simplifies the complexities of returns and exchanges, seamlessly linking these processes to inventory management. By integrating WeSupply, businesses can ensure that returned products are restocked during the return process, keeping inventory levels accurate and enhancing overall customer satisfaction

The future of ending inventory management is likely to be driven by advancements in technology and the increased use of data for decision-making. Utilizing technology for precision and efficiency in inventory management will continue to be crucial for businesses to optimize their operations and maximize profits.

By ensuring the accuracy of ending inventory records and implementing strategies to ensure consistency in inventory management, businesses can future-proof their operations and continue to grow and succeed in an increasingly competitive market.

In summary, ending inventory management is a vital aspect of inventory management that plays a crucial role in a company’s financial success. Accurate calculation of ending inventory, leveraging technology, and maintaining accurate inventory records are all essential components of an effective inventory management strategy. By understanding the importance of ending inventory and utilizing the various inventory valuation methods, businesses can optimize their operations, maximize profits, and ensure their financial success in an ever-evolving market.

Ending inventory can be calculated by subtracting the cost of goods sold from the cost of goods available for sale. Thus, it is essential to first determine the cost of goods sold in order to calculate ending inventory.

To calculate the FIFO ending inventory, determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold.

This will provide the value of the remaining units of inventory at the end of the period.

When using the LIFO method, the oldest purchases of goods are assumed to be used first and remain as ending inventory.

This is due to the assumption that the first items purchased are the cost of the first products sold.

Ending inventory is the value of unsold goods or products a retail business has in its stock at the end of an accounting period, which is important for making sound decisions.

The three primary inventory valuation methods are FIFO, LIFO, and WAC.

Learn How To Create Successful Post Purchase Email Campaigns

Build an effective post-purchase email flow that helps you increase customer satisfaction and drive revenue growth!

What does in transit mean and how long does it take? Read this article to find out & see how to answer your customers’ burning questions.

In this post we’ll explore the RMA meaning, discussing what RMAs are, best practices for managing them effectively and more.

In this post, we’ll delve into the current state of warranty management and provide practical tips to enhance the warranty claims process.

Let’s dive into the challenges, opportunities, and best practices that will help you navigate the world of shipping and ensure your packages arrive on time.

We will walk you through the process of calculating inventory turnover and provide you with actionable strategies to improve your inventory management.

In this blog post, we’ll guide you through the secrets of successful parcel contract negotiation and how to overcome common challenges.

Shipping costs impact your business. Let’s explore how to accurately calculate shipping costs to boost sales and customer satisfaction.

In this guide, we’re going to help you understand how to work out your return rate and how to improve your returns process to increase profits.

In this blog post, we will delve into the various types of shipping exceptions, and how businesses can effectively manage them.