BFCM Returns to Exchanges: How to Convert Them

Master the art of managing BFCM returns and exchanges with effective strategies that boost eCommerce success.

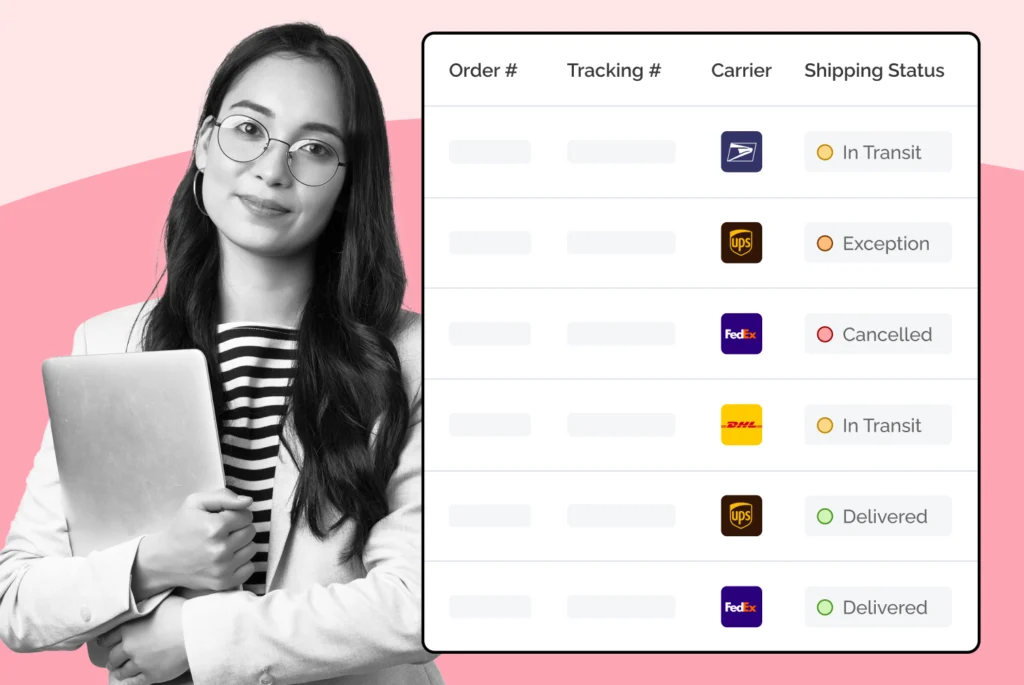

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

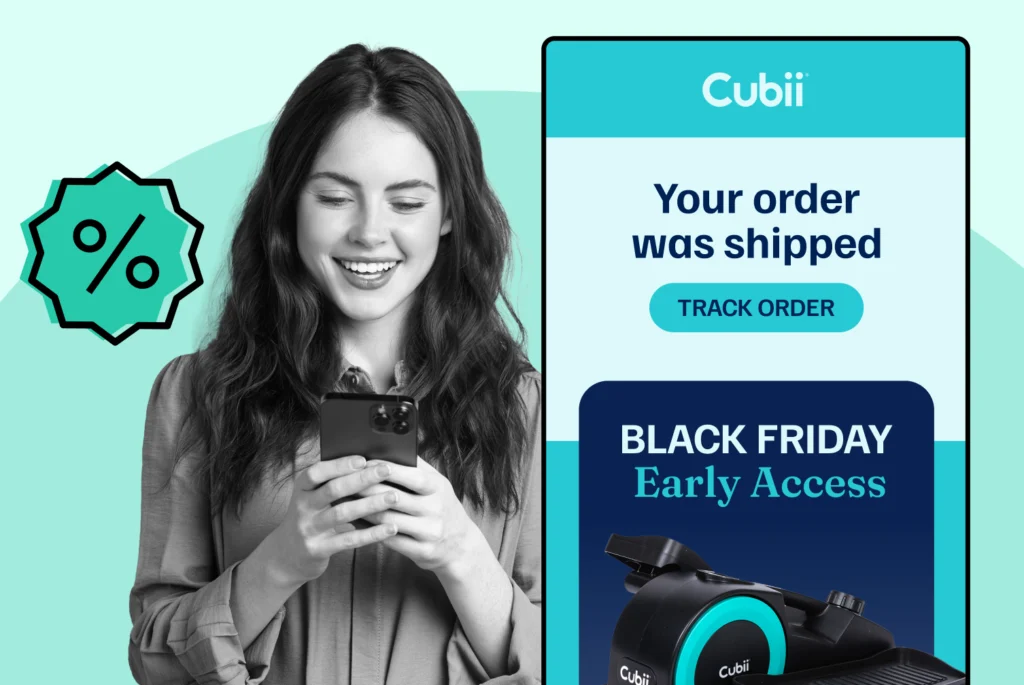

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

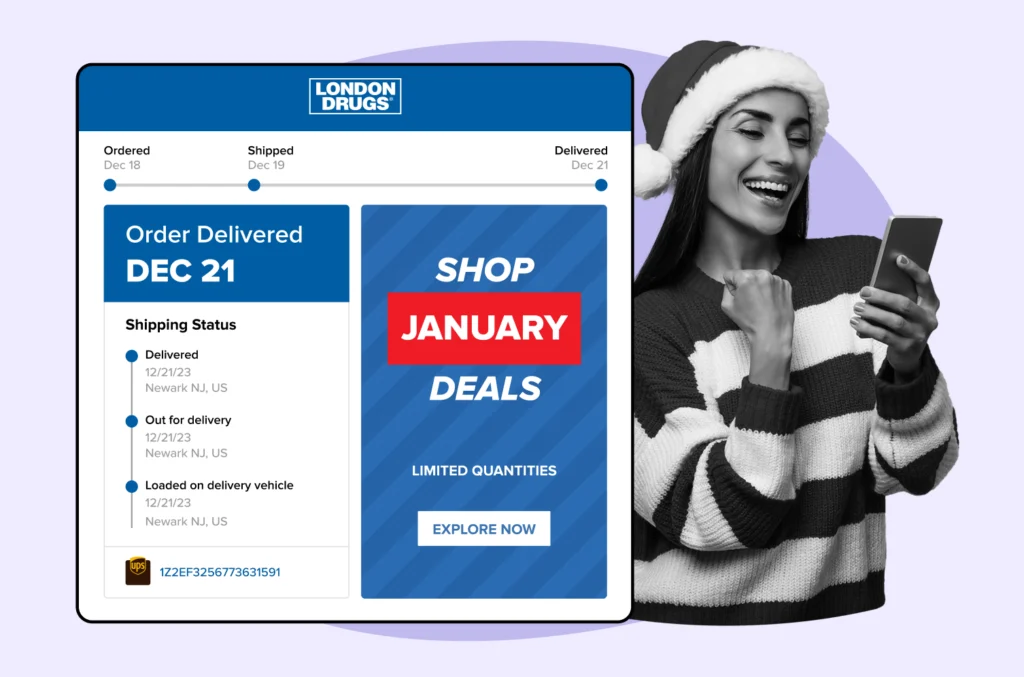

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

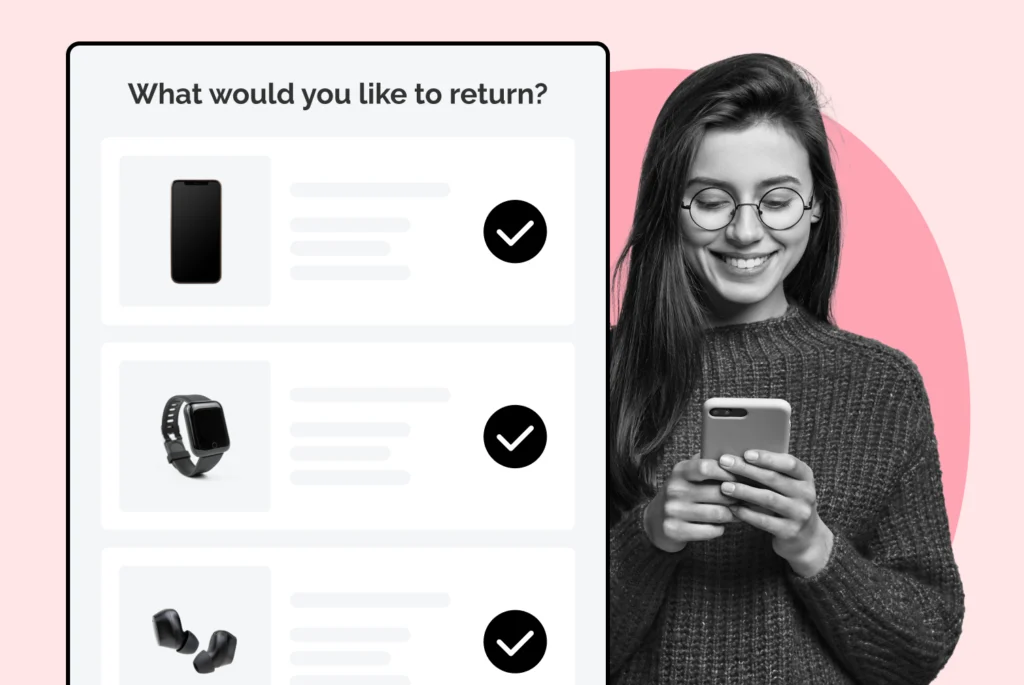

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

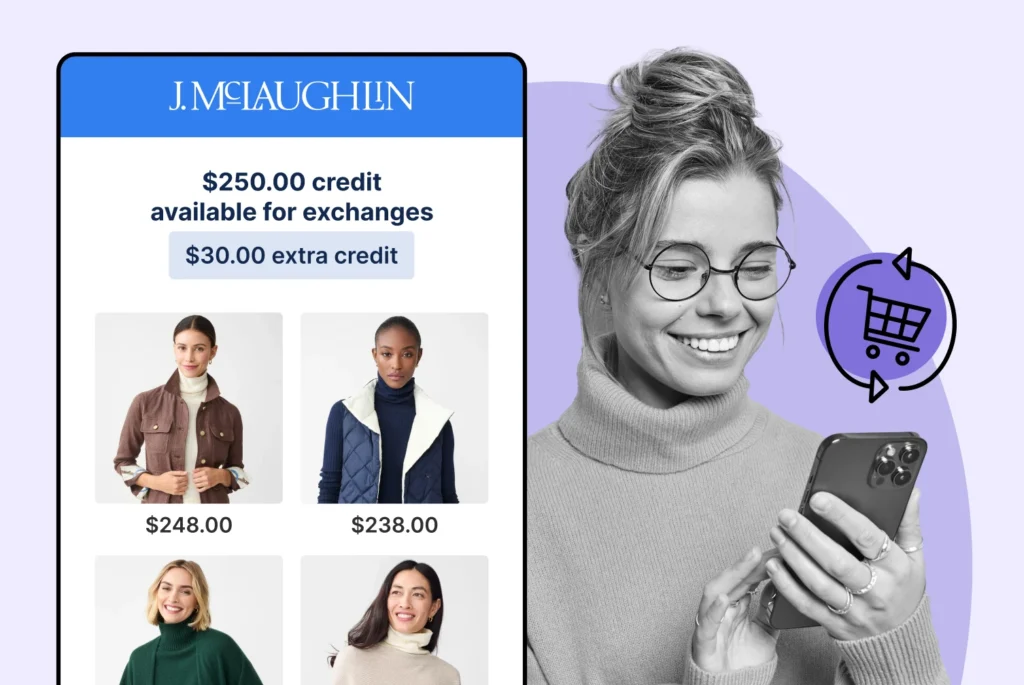

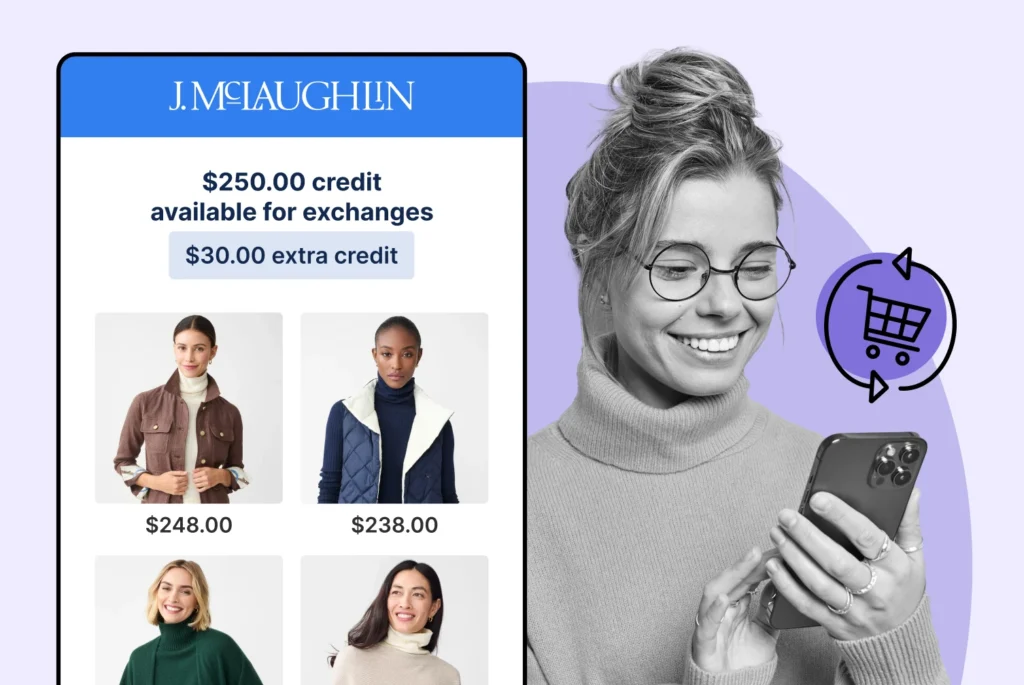

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

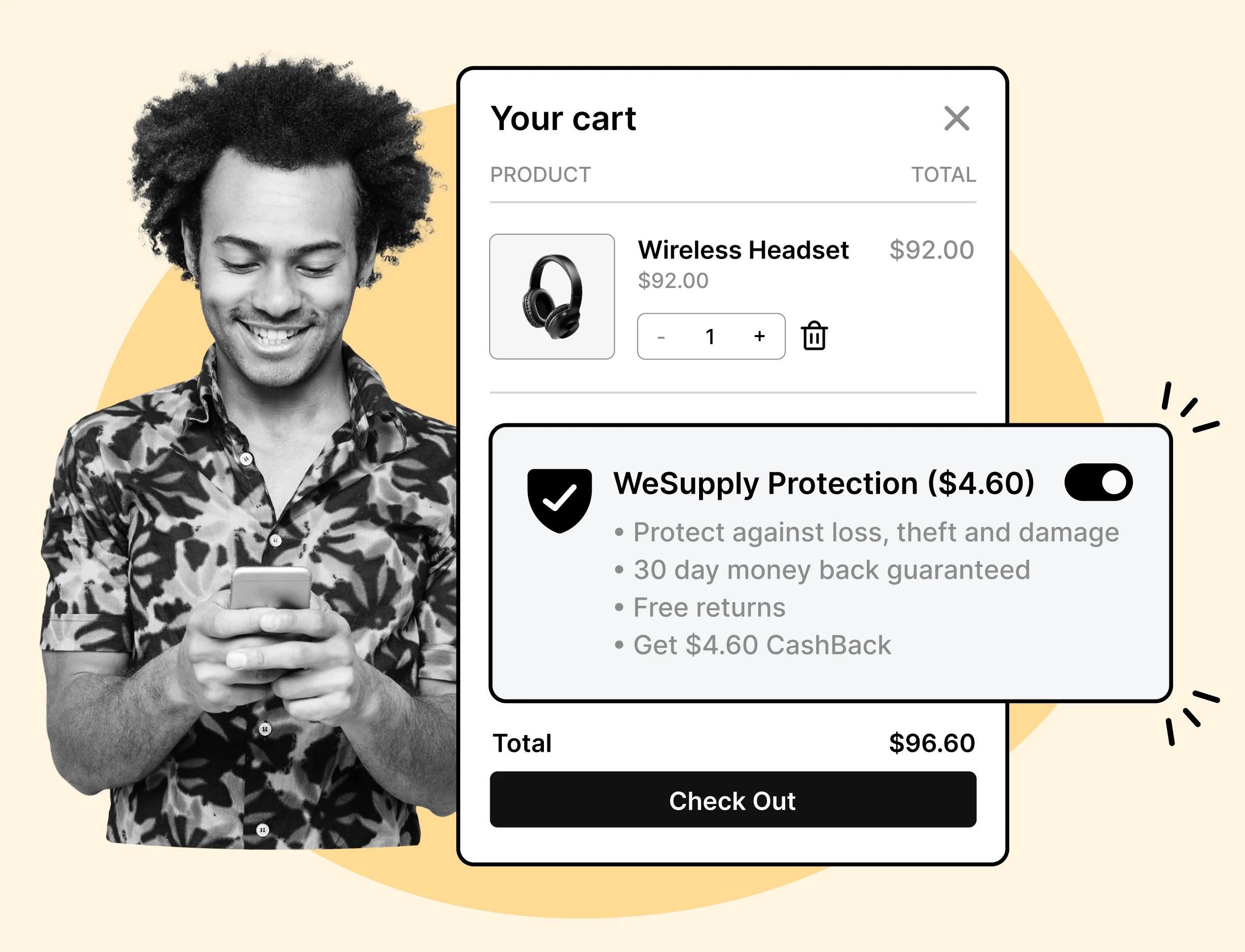

Easy claims and smart upsells

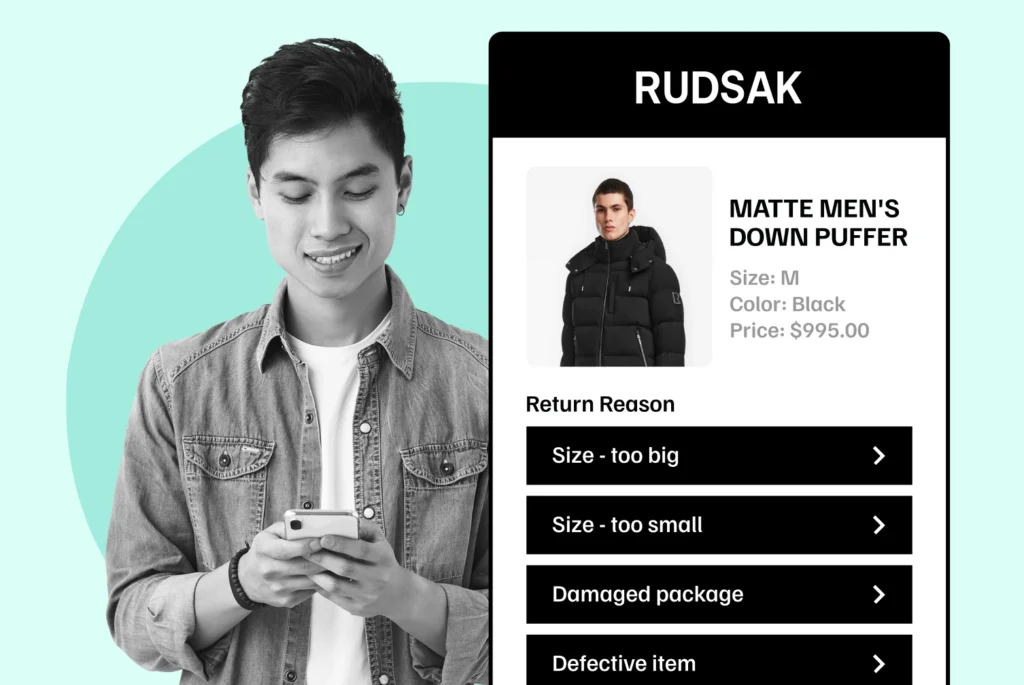

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

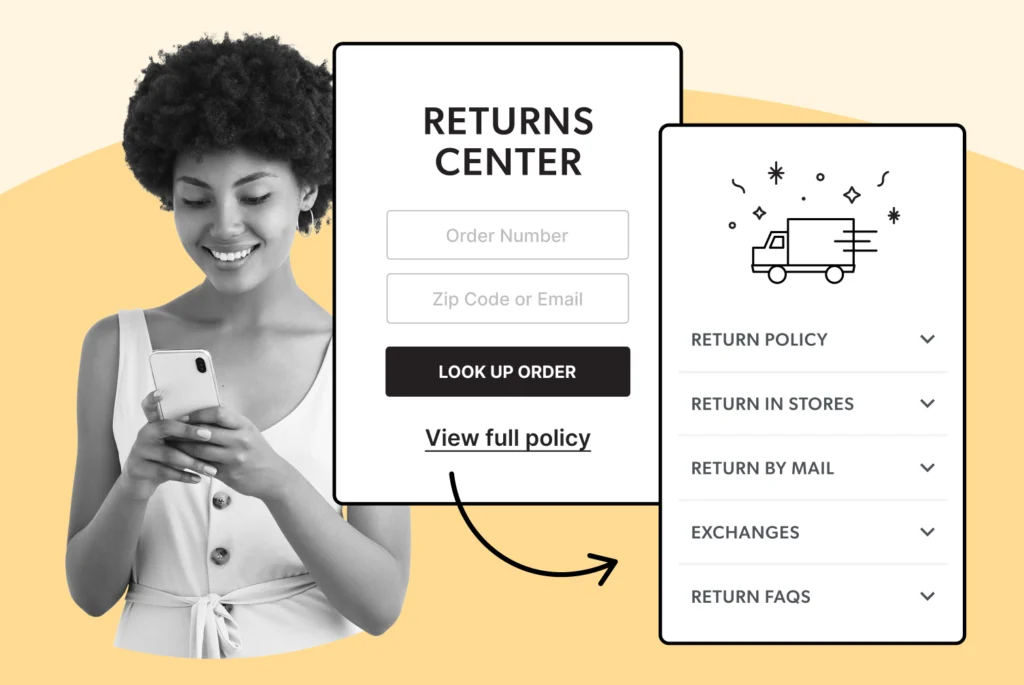

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Equip your team for precise return checks.

Easy claims and smart upsells

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Find the answer to all your questions

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Find the answer to all your questions

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

Online shopping has changed the way people buy and sell goods. It’s fast, convenient, and global. But with this growth comes one of the biggest headaches for online sellers: returns. Customers expect the process to be easy, free, and fast. For businesses, however, returns can eat away at profits and create operational and legal risks. Frequent returns are an increasingly common challenge for ecommerce merchants as online shopping continues to grow.

One solution that sometimes gets suggested is returns insurance. At first glance, it sounds like the perfect fix shift the financial risks of returns to an insurance policy, keep customers happy, and move on. But as with most things in business, it’s not that simple. Returns insurance comes with costs, complications, and risks of its own.

This article explores the hidden risks of returns insurance, the broader challenges of managing returns in ecommerce, and what merchants can do to protect themselves without sinking profitability. To succeed, merchants need to tackle the problem head on with strategic management and clear policies.

Returns insurance is a type of coverage designed to help businesses deal with the financial impact of customer returns. In theory, it works like this: the process typically begins with a customer submitting a return request. When a customer sends back a product (the returned item), the insurance helps cover costs such as shipping, restocking, or even the refund amount itself, depending on the policy terms. Insurance coverage generally applies once the returned item is received and inspected.

It’s important to understand how it differs from other forms of protection:

Shipping insurance usually covers lost or damaged goods during transit.

Returns insurance is meant to protect merchants from the costs associated with customers sending items back.

Standard return policies are just business promises, no third-party insurance involved.

Large platforms like Amazon and Walmart rarely provide returns insurance directly because of the complexity and cost. Instead, they require sellers to create clear return policies and sometimes mandate insurance in other areas, like liability.

The first big risk of returns insurance is simple: it may cost more than it saves. Insurance premiums are not cheap, and in ecommerce, where profit margins are already slim, the added cost can quickly eat into earnings.

For example, research from the National Retail Federation shows that over 16.5% of all retail sales were returned in 2022, representing $816 billion in lost revenue in the U.S. alone. On the surface, this makes returns insurance look appealing. However, returns insurance can introduce extra cost and significant financial implications for merchants, as it adds another layer of expense to the return process. But the reality is that many merchants especially those selling high-quality, low-return products may end up paying high premiums for little real benefit.

Insurance companies price policies based on risk. If you sell in a category with high return rates, such as fashion or electronics, your premiums will be high. Restocking costs and product price are also key factors that influence the overall profitability of different return insurance strategies, as higher-priced products and greater restocking expenses can make certain approaches less viable. If you sell in a low-risk category, your premiums may be cheaper but unnecessary. Either way, the balance between cost and benefit is tricky.

Returns insurance may sound like it would make shoppers more confident, but it doesn’t always reduce return rates. People return items for many reasons: wrong size, not what they expected, damaged in transit, buyer’s remorse, or receiving the wrong item. Insurance doesn’t fix most of these issues.

Interestingly, studies show that clothing has some of the highest return rates, averaging around 25–40% of online purchases. Customers order multiple sizes or colors and return what they don’t like. Insurance doesn’t stop this “try before you buy” behavior. Frequent returns can deter customers from future purchases and negatively impact seller reputation.

On the flip side, customers who buy low-quality goods may not even bother with return insurance, since they expect problems and may just accept the loss. That means the buyers who do use returns insurance may not be the ones who actually reduce your risks.

And then there’s psychology. Shoppers love free and easy returns. In fact, surveys show that 92% of consumers say they will buy again from a retailer if returns are easy. Returns insurance doesn’t necessarily provide that it often shifts costs back to the business while doing little to improve customer trust.

Handling returns isn’t just about lost profits it can also create legal and liability problems. For example, imagine a customer returns a defective electronic device that later causes a fire when resold. If that product was traced back to your store, you could face a product liability lawsuit, even if you weren’t the manufacturer.

Properly processing returns is essential to ensure that each returned item is handled according to policy and, if resold or redirected, reaches the intended recipient safely and accurately.

Returns can also lead to chargebacks if customers dispute the refund process with their bank. Chargebacks cost merchants money and can damage relationships with payment processors.

Another risk is advertising claims. If you promote “hassle-free insured returns” and customers feel misled, you could face lawsuits for false advertising. Insurance doesn’t protect you from misleading marketing it may actually create more exposure if you promise more than your policy delivers.

Every return is a small supply chain problem. Items move from the customer back to your warehouse or supplier, often with delays, damages, or losses along the way. Each step adds cost.

Returned items are often harder to resell. They may arrive damaged, opened, or unsellable as new. Perishable items are especially challenging, as their limited shelf life and risk of spoilage make them more prone to wastage when returned. The result? Inventory write-offs that cut into your bottom line.

Shipping carriers sometimes provide coverage for damaged or lost goods, but it rarely extends to the entire value chain of returns. Damages in transit are common, and inadequate packaging can increase the likelihood of product damage and returns. That’s why many merchants rely on commercial property insurance (to protect warehouse inventory) and inland marine insurance (to cover items in transit). These targeted coverages often do more for your business than returns insurance alone.

For international sales, specialized return services can help manage cross-border logistics and compliance. An efficient return service is crucial for ensuring that returned products are processed quickly and accurately.

If your business is large enough to have staff handling returns whether in a warehouse, office, or third-party logistics center there are risks here too. Workers lifting, sorting, or repackaging items face chances of injury.

In most countries, you’re required to carry workers’ compensation insurance to cover medical care and lost wages if someone gets hurt. Returns may seem like a simple process, but high volumes can increase workplace accidents, repetitive strain injuries, and other issues.

Returns insurance doesn’t address these employee risks, but they are part of the bigger picture of return-related costs.

For merchants selling internationally, returns get even more complicated. Different countries have different consumer protection laws. In the European Union, for example, shoppers have a 14-day “cooling-off” period where they can return almost any online purchase for a full refund. Global e commerce requires comprehensive insurance solutions to address the unique risks of cross-border transactions.

International returns often mean:

Higher shipping costs

Longer transit times

Customs delays

More complicated refund policies

Some businesses use specialized international return services, but these add costs as well. While insurance can help in some cases, it rarely eliminates the complexity of cross-border returns. Global e businesses must ensure reliable shipping protections to maintain customer trust in online commerce.

To really understand the scale of the problem, let’s look at a few numbers:

The average return rate for ecommerce is 18–30%, depending on the industry (UPS 2023). Frequent returns can strain operational resources and increase costs.

In fashion, returns can be as high as 40%, largely due to size and fit issues.

Electronics return rates average around 11%, often due to defects or customer confusion about features.

The National Retail Federation found that 10.7% of all returns in 2022 were fraudulent, adding another layer of cost and risk for merchants.

Each return request requires careful processing returns to ensure accuracy and minimize losses.

These numbers show why merchants are eager for solutions. But they also show why returns insurance can’t be a magic fix it doesn’t solve the root causes of returns.

Understand the real impact of ecommerce returns

Book a quick call with our experts to see how WeSupply helps you cut costly returns by tackling root causes and streamlining the process.

When it comes to ecommerce returns management, understanding the different types of returns insurance is essential for online retailers looking to protect their bottom line and enhance customer satisfaction. One of the most common forms is shipping insurance, which covers the loss, damage, or theft of goods during transit. Ecommerce businesses can purchase shipping insurance directly from major carriers like USPS, UPS, and FedEx, or opt for third-party insurance providers that may offer more tailored coverage options.

Another important consideration is the cost of return shipping. Many ecommerce businesses offer free return shipping as a way to boost customer loyalty and meet customer expectations for a hassle-free return process. While free return shipping can significantly enhance customer satisfaction and encourage repeat purchases, it also represents a substantial financial implication for the business. Returns insurance can help offset these costs, allowing merchants to provide a positive customer experience without absorbing the full burden of return shipping expenses.

Some returns insurance policies go beyond shipping, covering additional costs such as restocking fees or partial refunds, depending on the product categories and the declared value of returned items. By investing in the right type of returns insurance, ecommerce businesses can better manage the risks associated with ecommerce returns, maintain a competitive edge, and focus on building long-term customer relationships.

Reverse logistics the process of moving returned items from the customer back to the retailer plays a crucial role in ecommerce returns management. For ecommerce businesses, an efficient reverse logistics process is key to minimizing returns-related costs and ensuring a smooth customer journey. This starts with a clear and customer-friendly return policy, easy-to-navigate return services, and a commitment to ensure timely delivery of refunds or replacement products.

Customer feedback is invaluable in this process. By actively listening to customer concerns and analyzing return reasons, ecommerce businesses can identify pain points in the return process and make targeted improvements to their return policies and procedures. Streamlining the reverse logistics process not only reduces operational costs but also enhances customer satisfaction and builds customer loyalty, as shoppers are more likely to return to online retailers who handle returns efficiently.

Leveraging data and analytics is another powerful way to optimize reverse logistics. By tracking trends and patterns in customer returns, ecommerce businesses can make informed decisions to minimize returns, adjust product descriptions, and refine their return window or restocking fee policies. Taking a proactive approach to reverse logistics helps ecommerce businesses stay ahead of customer expectations, reduce unnecessary shipping costs, and deliver a superior customer experience throughout the entire returns process.

For merchants who do explore returns insurance, it’s important to understand the details:

Some policies cover full refunds, while others only cover partial refunds or store credit.

The declared value of the item may limit how much you can recover, and the refund amount may be further restricted by policy terms.

Policies often exclude certain categories, like perishable goods or custom-made items.

Restocking fees may not be reimbursed, meaning you still eat those costs.

Return shipping costs are often excluded from coverage, so merchants may remain responsible for these expenses.

Without careful review, you could end up paying for a policy that doesn’t actually cover your biggest risks.

Fortunately, there are practical ways to manage returns without relying too heavily on insurance. Many of these reduce return rates at the source:

Write clear product descriptions with accurate sizing, measurements, and photos, and optimize your product pages by including detailed information, high-quality images, size guides, AR features, and clear return policies.

Invest in better packaging to reduce damages in transit.

Use technology, like virtual try-on tools for apparel or augmented reality previews for home goods.

Offer store credit instead of refunds to keep revenue in your ecosystem.

These approaches directly cut down on unnecessary returns and improve customer satisfaction at the same time. A streamlined returns process can also positively influence purchasing decisions and encourage repeat business.

One of the most overlooked tools in returns management is listening to customers. Feedback from returns can reveal product flaws, misleading descriptions, or supplier issues. Addressing customer dissatisfaction by acting on this feedback can help improve overall satisfaction and reduce future returns.

For example, if multiple customers return an item citing “wrong size,” it may be a problem with your sizing chart. Fixing the description could save future sales and reduce returns.

Updating your return policies based on real customer experience makes them more effective and builds trust.

Every merchant wants to keep customers happy without going broke. Here are some best practices:

Offer returns strategically—consider making them free for high-value customers or repeat buyers.

Run the numbers—before adding returns insurance, calculate how much returns actually cost you compared to the premium.

Work with an insurance broker who understands ecommerce. They can help you find policies that fit your needs without overpaying.

Tailor your policies by product category—returns may make sense for clothing, but less so for bulky or low-margin items.

Running an online store means dealing with returns it’s part of the game. But returns can bring risks like fraud, high costs, and unhappy customers if they aren’t managed well. That’s where WeSupply steps in. We make returns easier, safer, and more profitable by turning challenges into opportunities.

Here’s how WeSupply helps merchants tackle the risks of Ecommerce Returns Insurance:

Spot the “Why” Behind Returns: With Returns Analytics, you’ll know which products are most often returned and why, so you can fix issues before they grow.

Encourage Exchanges, Not Refunds: Instant store credit nudges customers to swap instead of return helping you keep revenue and grow order value.

Stay in Control of Costs: Use partial refunds, restocking fees, or customized return rules to protect profit while still offering a smooth return experience.

Prevent Fraud and Abuse: Request proof, verify product condition, and track return activity to reduce costly fraudulent returns.

Simplify the Customer Journey: Easy lookups, automated labels, real-time updates, and bonus credits make returns stress-free for shoppers and less work for your support team.

Turn Returns into Loyalty: By making the process fair, fast, and flexible, you show customers you care keeping them coming back instead of shopping elsewhere.

Bottom line: Ecommerce returns don’t have to be risky. With WeSupply, you gain the tools to protect your business, save money, and improve the customer experience all while staying ahead of the challenges every merchant should know. See WeSupply in action, book your demo today!

Returns are part of ecommerce, but relying only on returns insurance can leave merchants exposed to high costs, gaps in coverage, and little improvement in customer satisfaction.

WeSupply offers a smarter approach: Norton Shopping Guarantee boosts trust at checkout, while powerful Returns Analytics reveal why products come back and how to prevent it. Instant store credit encourages exchanges over refunds, protecting revenue, and flexible rules let you balance customer care with costs through partial refunds, restocking fees, and fraud prevention. Automated labels, real-time updates, and easy lookups create a seamless experience that reduces support tickets, while bonus credits and exchanges turn returns into loyalty.

By focusing on transparency, efficiency, and customer trust, WeSupply helps merchants go beyond insurance building return strategies that protect profits and strengthen long-term relationships.

Returns Analytics for eCommerce Business

Book a quick call with our experts to see how WeSupply can help you understand why your customers are returning: Identify the most returned products, Understand why those products are returned, Identify which customers are serial returners, Reduce Return Rate with Actionable Insights, Returns data available in BigQuery.

1. What is ecommerce returns insurance?

Ecommerce returns insurance helps merchants cover costs from customer returns, such as shipping, restocking, or refunds. Unlike shipping insurance, which covers lost or damaged items in transit, returns insurance specifically addresses expenses when products are sent back.

2. Does returns insurance reduce return rates?

No. Returns insurance shifts financial risk but doesn’t solve root causes like sizing issues, buyer’s remorse, or product defects. High-return categories, such as fashion, often see little benefit since customer behavior drives frequent returns.

3. What are the risks of ecommerce returns insurance?

Risks include high premiums, limited coverage, and potential gaps for shipping or restocking costs. Merchants may overpay, especially if return rates are low. Insurance also doesn’t prevent fraud, customer dissatisfaction, or supply chain challenges.

4. How does WeSupply help manage ecommerce returns?

WeSupply provides automated returns, instant store credit, analytics, and fraud prevention tools. Merchants can reduce costs, streamline reverse logistics, and convert refunds into exchanges all while improving customer satisfaction.

5. Can WeSupply reduce return-related fraud?

Yes. WeSupply verifies return conditions, requires proof when needed, and tracks return activity. This reduces fraudulent claims, chargebacks, and costly abuse of “free return” policies.

6. Why choose WeSupply over returns insurance?

Unlike returns insurance, WeSupply tackles root causes. With analytics, flexible return rules, and customer-friendly tools, it protects profits while building trust and loyalty. It helps merchants save money and retain customers instead of paying high premiums.

7. Does WeSupply have an Official Shopify App?

Yes. WeSupply has an Official Shopify App. You can download it and start integrating with your Shopify Store.

8. Does WeSupply have an official Magento extension?

Yes, WeSupply has an official extension for Magento. The WeSupply x Magento integration allows for automating order tracking experiences, reducing customer inquiries, automating shipping email and SMS notifications, and providing a fully branded order tracking experience

9. Does WeSupply have an official BigCommerce App?

Yes, WeSupply has an official BigCommerce App. You can integrate WeSupply with your BigCommerce store to improve your post-purchase customer experience.

Learn How To Create Successful Post Purchase Email Campaigns

Build an effective post-purchase email flow that helps you increase customer satisfaction and drive revenue growth!

Negotiate better terms with suppliers. Partnering with reliable suppliers and carriers creates leverage in negotiations. For example, committing to steady shipping volume can lead to lower rates or priority service by securing discounts based on quantities shipped.

Master the art of managing BFCM returns and exchanges with effective strategies that boost eCommerce success.

Discover effective BFCM shipping strategies to enhance your sales this holiday season. Maximize efficiency and delight your customers.

Discover essential strategies to streamline bulk returns handling and enhance efficiency. Read the article for practical tips!

Master post-holiday returns management with effective strategies that streamline processes and enhance customer satisfaction.

Streamline your returns management with our guide to mastering the enterprise RMA process. Enhance efficiency and reduce hassle.

Discover effective strategies for managing returns in retail. Enhance customer satisfaction while minimizing costs. Read the article for practical insights.

Discover essential strategies to streamline bulk returns handling and enhance efficiency. Read the article for practical tips!

Discover proven best practices for designing an enterprise ecommerce returns policy that boosts customer satisfaction and long-term success.

Discover effective strategies for managing returns in retail. Enhance customer satisfaction while minimizing costs. Read the article for practical insights.