How to Display Accurate Real-Time Shipping Rates at Checkout

Learn how dynamic shipping rates at checkout can enhance pricing strategies and improve customer satisfaction. Discover practical tips in our article.

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

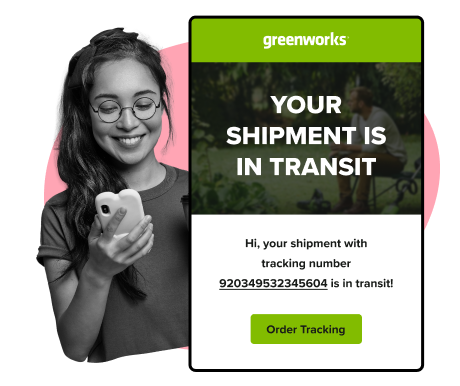

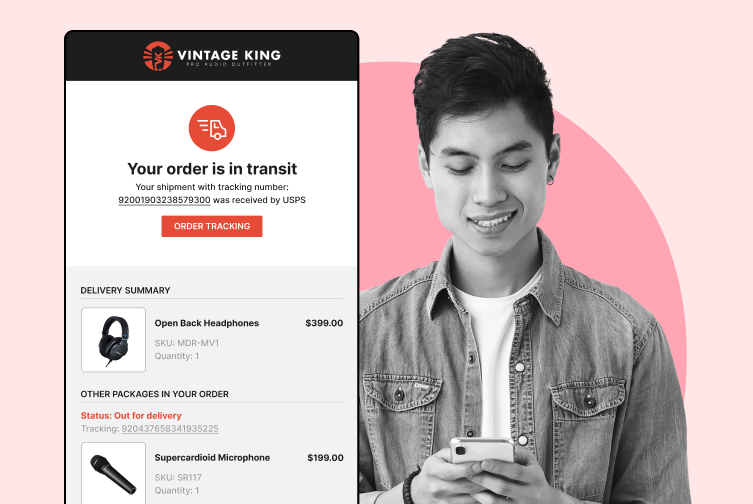

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Easy claims and smart upsells

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Equip your team for precise return checks.

Easy claims and smart upsells

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Find the answer to all your questions

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Find the answer to all your questions

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

In today’s ecommerce world, post-purchase experiences matter just as much as product quality and price. With customers expecting fast, safe deliveries and responsive support when something goes wrong, offering shipping insurance at checkout has evolved from a nice-to-have into a must-have feature.

Shipping insurance provides customers peace of mind and financial protection to merchants. Whether it’s a lost parcel, a package damaged in transit, package theft, or an item stolen from a front porch, problems during delivery can cost more than just money, they can cost brands their reputation. The good news? With optional shipping insurance, you can empower your customers to protect their orders and reduce your own risk at the same time. In fact, studies show that up to 70% of shoppers will opt in when given the opportunity.

In this guide, we’ll walk you through everything you need to know to implement optional shipping insurance at checkout, improve customer trust, and protect your bottom line.

Shipping insurance is a service that reimburses customers for the declared value of their order if it’s lost, stolen, or damaged during transit. Shipping insurance important for protecting both merchants and customers, as it safeguards profits and ensures customer satisfaction in case of issues during shipping. For ecommerce retailers, offering this protection at checkout is a simple but powerful way to improve customer satisfaction and reduce refund or replacement costs.

Rather than covering these losses out-of-pocket, merchants can rely on shipping insurance providers to handle claims and reimbursements. When positioned as an optional add-on during checkout, it gives customers the freedom to choose whether or not they want to pay a small fee for added protection. Some merchants also offer additional insurance for extra coverage beyond standard carrier liability, ensuring full claims for lost or damaged goods.

Any ecommerce site can integrate shipping insurance solutions at checkout, making it easy to enhance customer trust and experience across various ecommerce platforms.

Offering optional shipping insurance improves transparency, builds credibility, and reassures shoppers that their order is secure, even before it ships.

Adding an optional shipping insurance feature to your checkout flow isn’t just about minimizing your liability; it directly benefits both your customers and your business by providing financial security, increasing trust, and offering peace of mind.

Customer Peace of Mind: One of the biggest benefits is the psychological reassurance it offers shoppers. Especially when buying high-value, high monetary, or irreplaceable items, customers want to feel confident that their purchase is protected—particularly when those items are of high monetary value.

Reduced Financial Risk for Merchants: Instead of absorbing the full cost of reshipping or refunding an item, shipping insurance allows merchants to redirect that liability to the insurer. That means fewer losses on your balance sheet, a more sustainable operation, and the ability to save on unexpected expenses.

Improved Customer Experience and Loyalty: When issues do arise, the ability to offer a clear claims path backed by insurance shows customers you care about their satisfaction. That builds trust, enhances your brand reputation, encourages repeat business, and fosters customer loyalty.

Increased Average Order Value (AOV): When customers feel secure, they’re more likely to purchase more. Optional insurance can act as a trust badge, nudging customers to add that extra item to their cart.

Competitive Differentiation: Many small to mid-size retailers don’t yet offer this feature. Adding it gives you an edge, especially against competitors who might leave customers unprotected if something goes wrong.

Offering shipping insurance is a smart choice for merchants looking to differentiate themselves and provide added value to their customers.

To understand how shipping insurance work, it’s important to know what happens when you add it to your order.

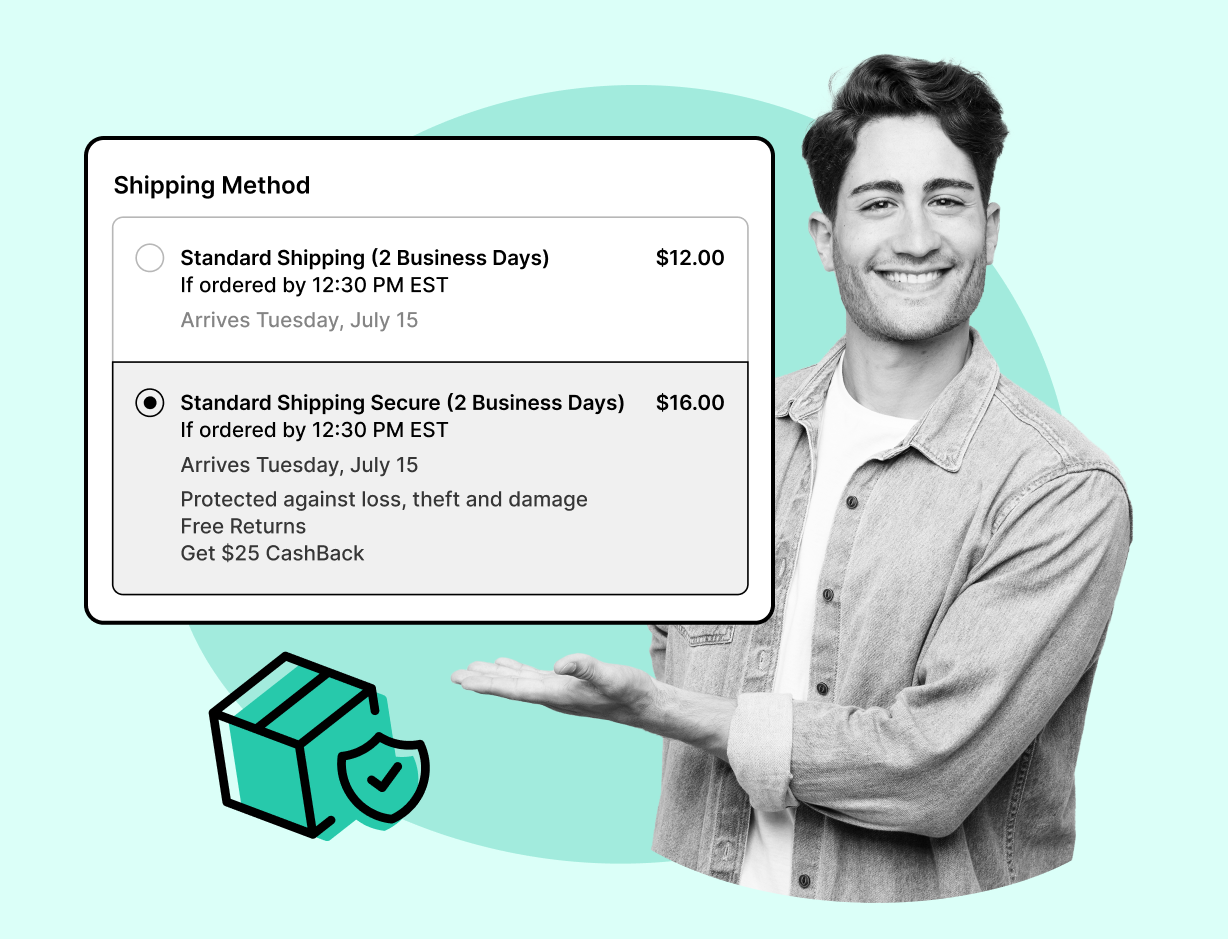

At checkout, customers are typically given the choice to add shipping insurance for a small fee, often calculated as 1-3% of their order value. The cost may also depend on the value of the items being shipped. This is usually presented as a checkbox or toggle in the shipping section.

Once a customer opts in, the insurance provider covers the declared value of that shipment. If a package is lost, stolen, or damaged in transit, the customer (or sometimes the merchant) will file a claim with the insurance provider. Documentation like proof of purchase, tracking details, and photos of damage are often required.

Upon claim approval, the customer is reimbursed directly or a replacement is sent. Many third-party insurers have streamlined digital processes and can file claims on behalf of merchants or customers, making the process simple and fast, sometimes resolving them in as little as 5-7 business days.

For merchants, offering insurance as an opt-in ensures transparency and avoids inflating product prices to cover potential shipping issues.

There are three main ways to implement shipping insurance at checkout, each with its pros and cons.

Third-Party Providers This is the most scalable and customer-friendly option, especially as your business handles more packages. Services like Route, Easyship, Shipsurance, ShipAid, and Norton Shopping Guarantee specialize in ecommerce shipping protection. These third-party providers are often shipping insurance experts who can guide merchants through the process and tailor solutions to their needs. They frequently work with multiple carriers, giving you broad coverage and flexibility.

These platforms typically offer integrations or apps that plug directly into your checkout flow. They calculate fees automatically, provide customer-facing UI, and manage the entire claims process independently, doing the heavy lifting of handling claims and customer service on your behalf.

Carrier Insurance Major carriers like USPS, FedEx, and UPS offer insurance during label creation. Most include basic coverage up to $100. To offer it as an opt-in checkout option, you’d need to manually calculate and add the insurance cost to customer shipping fees.

Carrier insurance may be slower to resolve claims and less flexible than third-party providers, but it can still be a viable solution, especially for smaller stores.

Self-Insurance This approach involves the merchant absorbing any loss and building the insurance cost into product pricing or offering it as an add-on. It’s risky for small businesses and better suited to high-volume retailers with tight controls and a low rate of shipping issues.

Selecting the right shipping insurance partner is a critical decision for ecommerce businesses aiming to deliver comprehensive protection and peace of mind to their customers. The ideal provider should offer robust coverage for lost or damaged packages, ensuring that both your business and your customers are safeguarded against unexpected shipping issues. Look for a partner with a proven track record of hassle-free claims processing, as a smooth claims experience can make all the difference when problems arise.

Cost is another important factor, competitive pricing allows you to offer valuable protection without significantly increasing shipping costs for your customers. Additionally, prioritize providers who are experts in shipping insurance and understand the unique challenges faced by ecommerce businesses. Their expertise can help you navigate complex situations and minimize financial losses from lost or damaged shipments.

A reliable shipping insurance partner not only protects your bottom line but also enhances your brand’s reputation by giving customers confidence that their packages are covered. By choosing a provider that delivers comprehensive protection, responsive customer service, and efficient claims handling, you can offer customers extra peace and strengthen your business for the long term.

Integrating shipping insurance into your ecommerce platform should be a smooth and straightforward process that enhances, rather than disrupts, the customer journey. Look for shipping insurance solutions that offer seamless integration with your existing checkout flow, whether through plugins, APIs, or built-in platform features. Automated processes and intuitive interfaces help ensure that adding insurance is effortless for both your team and your customers.

Thorough testing is essential before going live. Simulate different checkout scenarios to confirm that the insurance option displays correctly, calculates costs accurately, and doesn’t introduce friction or confusion. A well-integrated shipping insurance solution can boost customer confidence, leading to higher conversion rates and increased average order value. It also contributes to a positive post purchase experience, reducing the likelihood of cart abandonment and encouraging customers to complete their purchases.

By prioritizing a hassle-free checkout experience, you not only make it easier for customers to protect their orders but also position your business as trustworthy and customer-focused, key drivers of ecommerce success.

Let’s look at how to implement this feature across the most common platforms:

Shopify Shopify users can take advantage of Easyship’s free plugin, “Insurance at Checkout.”

Add the plugin through your Easyship account.

Insert a one-line code snippet into your cart template.

Customers can opt in with a single click.

Claims are processed by InsureShip, typically within 5-7 days.

WooCommerce WooCommerce doesn’t include insurance options by default. You have two options:

Add custom code (available on WordPress Stack Exchange) to include an optional insurance fee.

Install a third-party plugin like ShipAid or Norton Shopping Guarantee.

Other Platforms BigCommerce, Magento, and custom-built stores can integrate third-party APIs or apps from providers like Secursus, Pirate Ship, or InsureShield. Many offer platform-specific plugins or development support.

Your insurance option should be easy to understand and seamlessly integrated into the checkout process.

Placement: Display the option near the shipping method selection, where it’s contextually relevant.

Language: Use clear labels like “Protect your customer purchases from loss or damage.” This clarifies that insurance covers the items customers buy.

Cost Display: Show the price transparently (e.g., “Add insurance for $1.98” or “2% of your order total”).

Opt-In Design: Keep the box unchecked by default for transparency and compliance.

Trust Indicators: Add microcopy or icons to signal security and package protection, such as “Backed by InsureShip,” “Trusted by over 10,000 merchants,” or “Includes package protection for your order.”

A frictionless experience boosts opt-in rates and keeps checkout conversion high. Clear presentation of these options also streamlines issue resolution if problems like loss or damage occur.

Educating your customers about shipping insurance is essential for increasing adoption and ensuring customer satisfaction. Clear, accessible information about the benefits of shipping insurance, how it works, and what it covers can help customers make informed decisions at checkout. Use your website, email campaigns, and social media channels to explain how shipping insurance protects against lost, stolen, or damaged packages, and highlight the peace of mind it provides.

By proactively addressing common questions and outlining the claims process, you can boost purchase intent and reduce confusion or hesitation. Well-informed customers are more likely to see the value in adding protection to their orders, which can lead to fewer disputes and a smoother claims experience if issues arise.

Ultimately, customer education not only increases the uptake of shipping insurance but also strengthens trust in your brand, leading to higher satisfaction and long-term loyalty.

To support a smooth customer experience, you need strong policies and a well-informed support team.

Clear policies and empowered support can turn shipping problems into loyalty-building moments.

Managing customer enrollment in shipping insurance and overseeing ongoing administration are key to delivering a smooth, reliable experience. Make the opt-in process straightforward, allowing customers to easily select their preferred level of protection during checkout. Once enrolled, keep customers informed with regular updates on claim status, package tracking, and any relevant support information.

Efficient administration also means having a responsive customer service team ready to assist with questions, claims, or disputes. Ensure your team is trained to handle inquiries about shipping insurance, guide customers through the claims process, and provide timely updates. By offering clear communication and dependable support, you build trust and demonstrate your commitment to customer protection.

A well-managed shipping insurance program not only streamlines internal operations but also enhances customer satisfaction, turning a value-added service into a powerful driver of loyalty and repeat business.

Claims are an inevitable part of the process, and your goal should be to make them as painless as possible.

Third-party providers like InsureShip, Route, or InsureShield offer online forms and email automation to streamline claims. Customers typically need proof of loss (e.g., tracking showing “delivered” but item not received), photos of damage, and the order receipt.

Make sure your internal systems allow you to quickly retrieve order and tracking info. If your customers are filing claims themselves, provide guidance and support links in your help center or post-purchase email flows.

Shipping insurance isn’t just about reducing costs when things go wrong, it can actually improve your bottom line.

Protect Margins: Avoid refunding or reshipping from your own revenue.

Reduce Return Costs: Damaged orders covered by insurance reduce restocking losses.

Boost Revenue: Customers who feel secure are more likely to convert.

Optional Add-On Revenue: Some merchants add a small markup to insurance and generate modest revenue.

Operational Efficiency: Offloading claims to third parties saves time and reduces support burden.

All of this adds up to better margins, stronger cash flow, and more scalable operations.

To keep your shipping insurance offering effective and competitive, regular review and adjustment are essential. Monitor customer feedback, analyze claims data, and stay informed about market trends to identify opportunities for improvement. This ongoing optimization helps you address gaps in coverage, streamline the claims process, and ensure your protection remains relevant to your customers’ needs.

Consider expanding your insurance options to include additional coverage for high value or fragile items, providing extra peace of mind for customers with special shipping requirements. By adapting your shipping insurance program based on real-world insights, you can reduce financial losses, increase customer satisfaction, and maintain a reputation for comprehensive protection.

Continual review and adjustment not only help you stay ahead of the competition but also ensure your customers always receive the best possible coverage and support, reinforcing your brand’s commitment to their peace of mind.

As with any ecommerce feature, ongoing monitoring and optimization are key.

Track opt-in rates to see how customers are responding.

Monitor claim trends to identify recurring issues with carriers or packaging.

Survey customers who opt in (and those who don’t) to understand perceptions.

Reassess providers annually to ensure you’re getting the best rates and service.

Document claims and resolutions in your CRM or help desk platform to streamline future interactions.

By continuously refining your approach, you’ll maximize customer value and minimize risk over time.

In today’s ecommerce landscape, offering shipping insurance is essential, but the real game-changer? Combining it with return insurance to protect the entire post-purchase journey. That’s exactly what WeSupply helps you do.

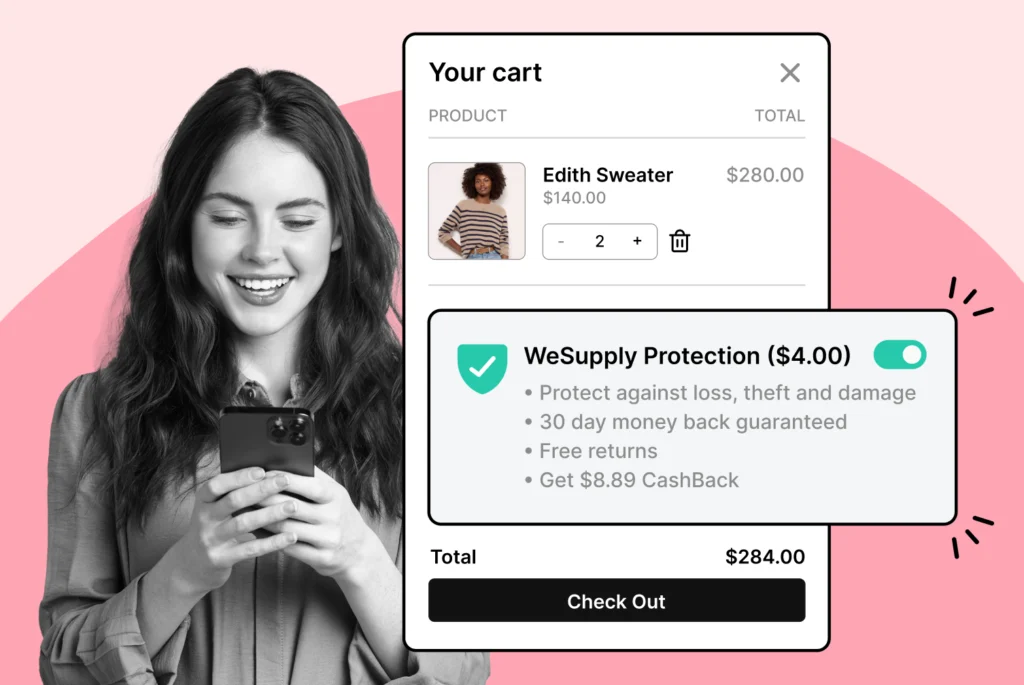

With WeSupply, ecommerce merchants can now offer optional shipping insurance at checkout and optional return insurance during the return process, giving customers full-circle protection and boosting trust, satisfaction, and loyalty without complicating your operations.

Norton Shopping Guarantee (NSG) Integration

Add another layer of trust with the Norton Shopping Guarantee, now supported via WeSupply for Magento and BigCommerce. NSG protects orders against lost, stolen, or damaged items and reassures shoppers with guaranteed timely delivery.

No-Code Setup with Full Customization

Add shipping and return insurance without developer resources. Just enable a few toggles in your Shopify theme, set your pricing (percentage-based or flat fee), and customize the design to match your brand’s look and feel.

Final Sale Detection for Smart Insurance Rules

Don’t want return insurance to apply to final sale items? WeSupply has you covered. Simply tag those products and WeSupply will automatically exclude them from the insurance option.

Final Sale Detection for Smart Insurance Rules

Don’t want return insurance to apply to final sale items? WeSupply has you covered. Simply tag those products and WeSupply will automatically exclude them from the insurance option.

Automated Claims, Minimal Support Load

Claims for insured shipments are handled by WeSupply streamlining the entire process. Return insurance also removes the financial burden of reshipping or refunding returns that go missing.

Boost AOV, Trust, and Customer Loyalty

When customers feel protected, they’re more likely to complete their purchase and come back again. Shipping and return insurance act as silent trust signals, helping you increase conversion rates, average order value, and long-term retention.

Clear Communication = Fewer Disputes

WeSupply supports branded messaging at checkout, post-purchase, and during returns ensuring customers know exactly what’s covered, how to file a claim, and what to expect.

Shipping issues and return mishaps don’t have to cost you customers or money.

With WeSupply’s dual-insurance support, you can offer a best-in-class customer experience that covers every leg of the journey from your warehouse to their doorstep, and back again if needed.

Now available for Shopify users, return insurance adds an extra layer of confidence and makes your brand stand out in a sea of “you’re on your own” competitors.

Let WeSupply help you turn optional insurance into a powerful post-purchase advantage. Book a demo today!

Combat inconvenience with proactivity & self service

Book a quick call with our experts to see how WeSupply can help you make returns easy for your customers with a beautiful, self-service solution that makes their experience easier while also providing new ways to lower costs and earn back revenue.

Predictive pre-purchase estimated delivery dates

Book a quick call with our experts to see how WeSupply can help you set the appropriate expectations from the start and boost your conversion along the way.

Offering optional shipping insurance at checkout is no longer just a nice-to-have—it’s a proven way to build trust, reduce risk, and elevate the post-purchase experience. But to truly stand out in 2025, forward-thinking retailers are going one step further by also offering return insurance.

With WeSupply, you can easily implement both. Their seamless integration for Shopify allows you to offer shipping insurance during checkout and return insurance during the returns process—all with customizable design, transparent pricing, and automated claims support.

The result? Fewer disputes, higher customer confidence, and a smarter, more resilient ecommerce operation from start to finish.

1. What is optional shipping insurance at checkout?

Optional shipping insurance allows customers to add protection for lost, stolen, or damaged packages during checkout, usually for a small fee. It helps reduce merchant liability and offers peace of mind to the shopper.

2. How does shipping insurance benefit ecommerce merchants?

It protects your bottom line by reducing refund and reshipping costs. It also boosts customer trust, conversion rates, and long-term loyalty through a better post-purchase experience.

3. How do customers file a shipping insurance claim?

Most providers offer an online form where customers submit proof of loss, tracking details, and photos of damage. Claims are usually resolved within 5–7 business days.

4. How does WeSupply help merchants offer shipping insurance at checkout?

WeSupply offers seamless integration on platforms like Shopify, allowing merchants to add optional shipping insurance with no code, automated claims, and full customization.

5. Can WeSupply also cover return shipments with insurance?

Yes. WeSupply’s Return Insurance feature protects customers during the return process—perfect for lost or damaged return shipments—directly from the cart on Shopify stores.

6. What makes WeSupply’s insurance options different?

WeSupply supports both shipping and return insurance in one platform, features automated claims, final sale detection, and branded customer communication for a stress-free experience.

7. Does WeSupply have an Official Shopify App?

Yes. WeSupply has an Official Shopify App. You can download it and start integrating with your Shopify Store.

8. Does WeSupply have an official Magento extension?

Yes, WeSupply has an official extension for Magento. The WeSupply x Magento integration allows for automating order tracking experiences, reducing customer inquiries, automating shipping email and SMS notifications, and providing a fully branded order tracking experience

9. Does WeSupply have an official BigCommerce App?

Yes, WeSupply has an official BigCommerce App. You can integrate WeSupply with your BigCommerce store to improve your post-purchase customer experience.

Learn How To Create Successful Post Purchase Email Campaigns

Build an effective post-purchase email flow that helps you increase customer satisfaction and drive revenue growth!

Learn how dynamic shipping rates at checkout can enhance pricing strategies and improve customer satisfaction. Discover practical tips in our article.

Effective strategies for communicating shipping delays to keep customers informed and satisfied. Enhance your customer service approach!

Discover effective strategies to manage split shipments, reduce delays, and enhance customer satisfaction. Practical solutions!

Discover how enhanced estimated delivery dates can boost your e-commerce sales. Learn practical strategies to improve customer satisfaction today!

Master unified tracking for split or multi shipment orders with our comprehensive guide. Streamline your process and improve efficiency—read more now!

Learn effective strategies for handling shipment exceptions and improving customer communication. Read the article for practical tips and insights.

Discover how effective shipping insurance integration can enhance your business efficiency and protect your assets. Read the article for practical insights.

Discover effective strategies to manage your shipments with ease. Streamline your process and enhance your shipping efficiency!

Discover how effective warranty returns management can enhance customer loyalty and strengthen your brand. Read on to transform your return process!