30-day Return Window: Weighing the Pros and Cons

Explore the pros and cons of a 30-day return window for buyers and sellers. Understand the impact on purchases and sales!

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Easy claims and smart upsells

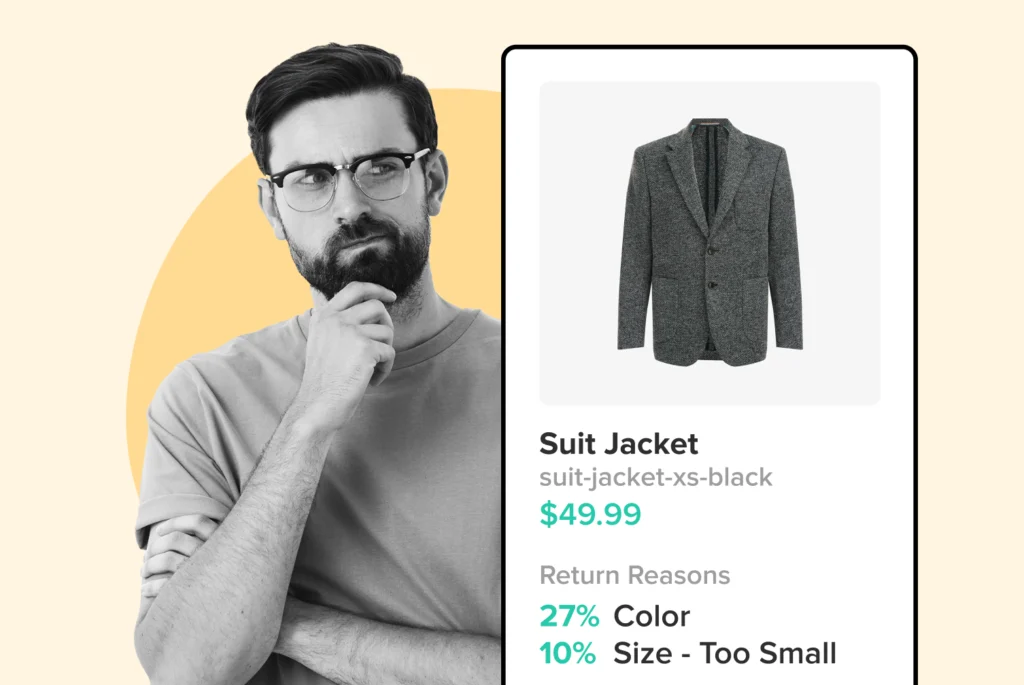

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

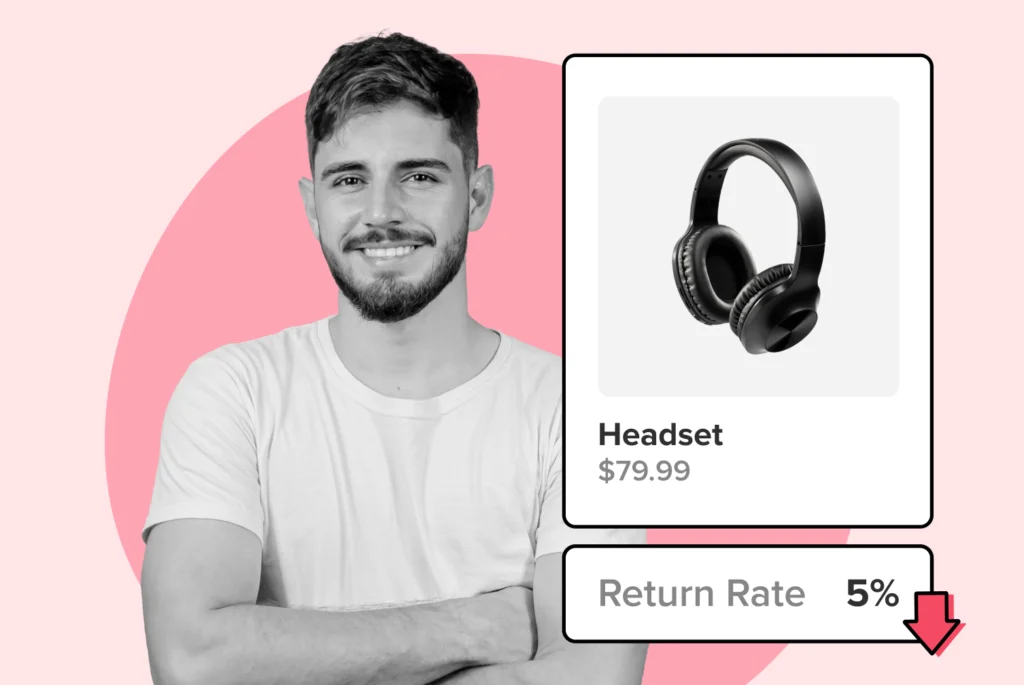

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

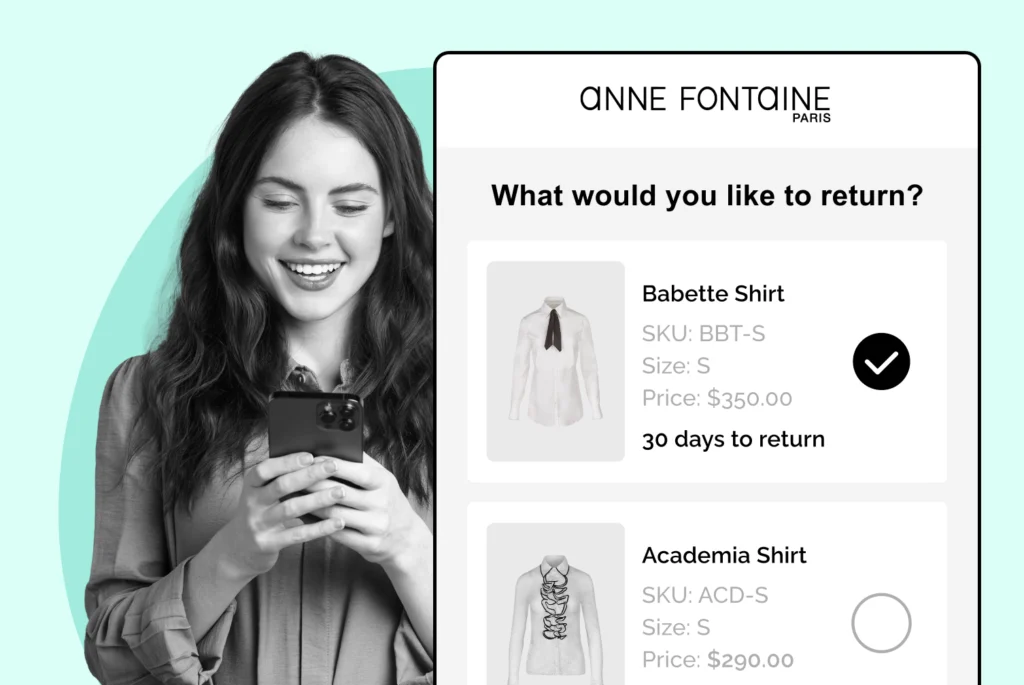

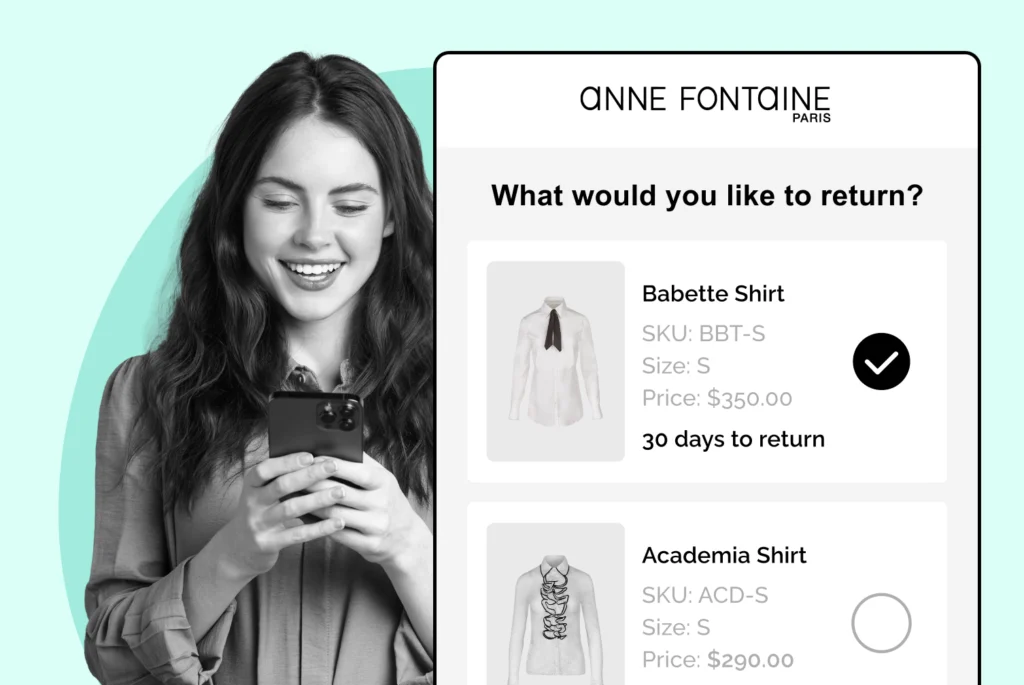

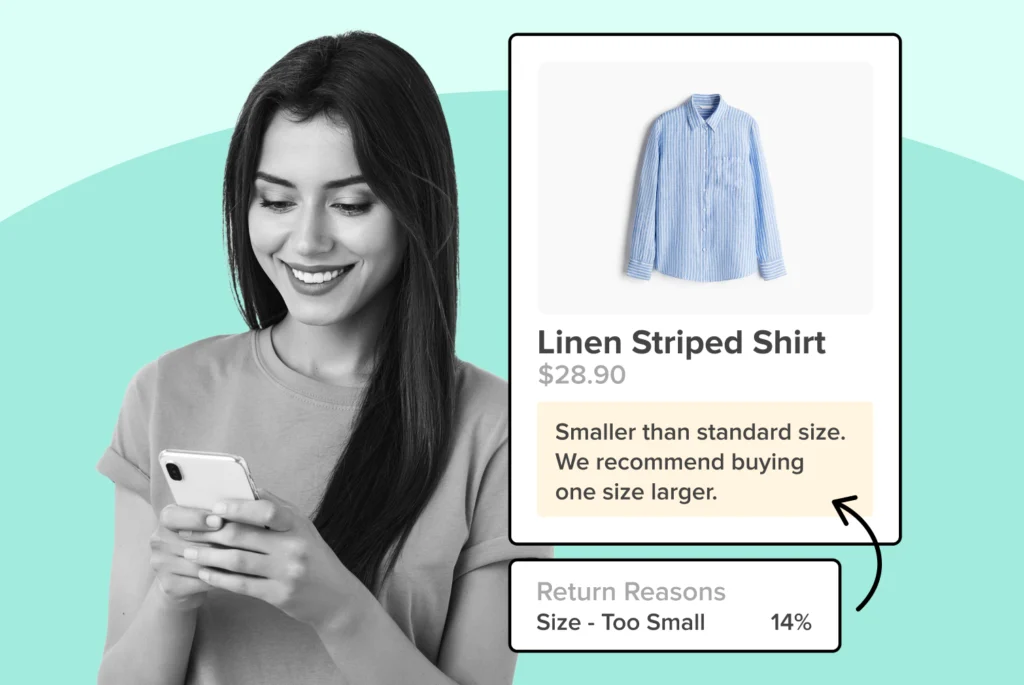

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

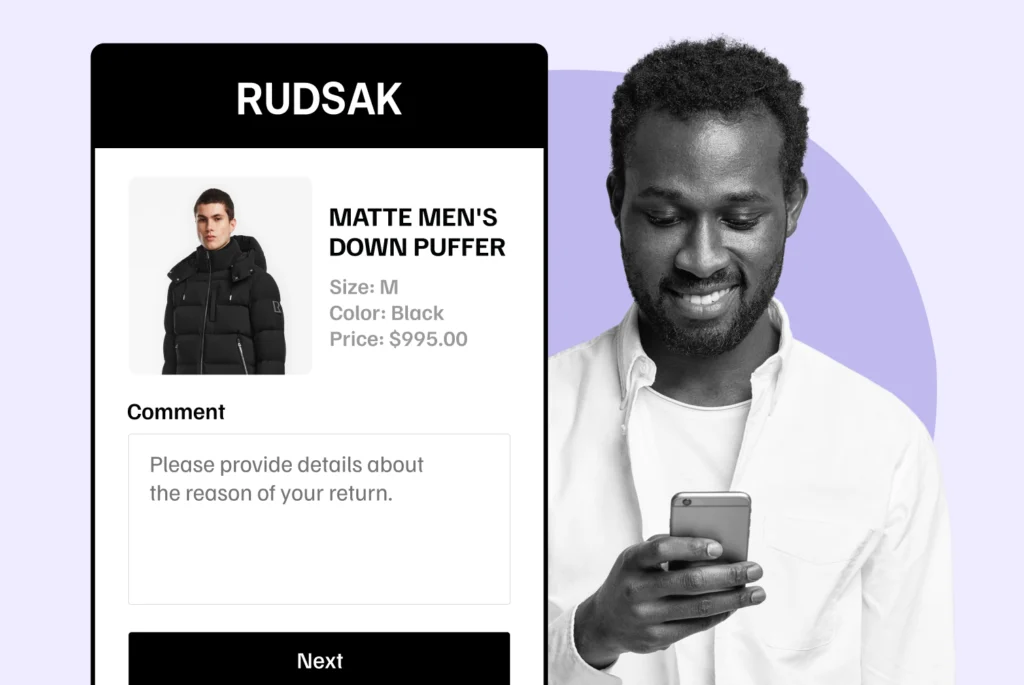

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Equip your team for precise return checks.

Easy claims and smart upsells

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Find the answer to all your questions

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Find the answer to all your questions

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

Buy Now, Pay Later (BNPL) services are transforming the way consumers shop online and in stores. The growth of BNPL services has been driven by the surge in online shopping activities, fueled by economic uncertainty and changing consumer expectations. These services allow customers to make purchases and pay for them in installments over time, often interest-free. With this flexible payment solution, customers no longer need to pay the full amount upfront, making it easier to afford larger or unexpected purchases. Businesses offering BNPL can enhance customer experience, increase average order values (AOV), and drive overall sales. This payment method is particularly attractive to younger generations, such as millennials and Gen Z, who value financial flexibility and digital-first shopping experiences.

The advantages of BNPL for businesses are significant. One of the primary benefits is its ability to increase sales. By reducing the financial burden on customers at checkout, BNPL encourages more purchases and lowers cart abandonment rates. Businesses often report a boost in conversion rates and AOV, with some studies indicating sales increases of up to 27% and AOV lifts of 20%-30%.

In addition to driving revenue, BNPL can also serve as a new customer acquisition channel, particularly appealing to younger demographics. With BNPL providers promoting participating retailers through their own digital platforms, businesses can reach new audiences and demographics. The flexibility of payment plans enhances customer satisfaction and can encourage repeat purchases, helping businesses build long-term loyalty.

The BNPL process is relatively straightforward for both businesses and customers. When a customer opts to use a BNPL service at checkout, the BNPL provider pays the merchant the full purchase amount upfront, minus a processing fee. Some BNPL providers conduct a soft credit check during the application process, which does not impact the consumer’s credit score. The customer then repays the BNPL provider in installments over time.

From a merchant’s perspective, this setup offers immediate revenue and reduced payment collection risk. The BNPL provider assumes responsibility for fraud and credit risk, allowing businesses to focus on operations rather than chasing down payments. This arrangement can improve cash flow and streamline financial planning.

Selecting the right BNPL provider is critical to ensuring a successful implementation. Businesses should evaluate several factors, including transaction fees, repayment terms, fixed fees, additional fees, and the provider’s customer support capabilities to ensure they align with the business model. It’s essential to partner with a reputable provider that aligns with your company’s values and customer needs.

Key considerations include the provider’s underwriting process, credit approval standards, and how they handle late payments or defaults. Additionally, the provider should offer seamless integration with your existing payment systems and website infrastructure. Popular BNPL providers include Affirm, Klarna, Afterpay, and Shop Pay Installments, each with unique features and fee structures.

Implementing a BNPL service is typically straightforward and doesn’t require extensive technical knowledge. Most providers offer simple plug-and-play solutions that integrate directly into e-commerce platforms like Shopify, WooCommerce, or Magento. Setup generally involves creating an account, configuring payment options, and ensuring a smooth checkout experience. Integrating flexible payment solutions is crucial to accommodate diverse customer needs and enhance overall satisfaction.

Training customer service teams is also essential, as they will be the frontline support for answering BNPL-related inquiries. Clear communication across departments ensures customers receive consistent and accurate information.

Offering BNPL can dramatically impact key business metrics. Businesses often see a surge in conversions and a decrease in cart abandonment. By allowing customers to pay in installments, businesses make higher-priced products more accessible, resulting in increased sales volume. Offering BNPL can significantly boost sales by making it easier for customers to make purchases without immediate payment.

Additionally, BNPL contributes to customer retention. Consumers who enjoy the flexibility of paying over time are more likely to return for future purchases. BNPL can also improve a business’s cash flow by providing immediate revenue. However, it’s important to be mindful of the potential downsides, such as transaction fees, which can range from 1.5% to 7%, and higher product return rates linked to impulse purchases.

Understanding customer expectations is crucial when offering BNPL. This service appeals particularly to younger shoppers and those without access to traditional credit lines. Offering BNPL caters to various payment preferences, enhancing the sales process. Customers are looking for transparent, flexible, and interest-free payment options.

To build trust, businesses should clearly display BNPL terms at checkout and provide detailed FAQs. Transparency around late fees, payment schedules, and the impact of missed payments on credit scores helps set realistic expectations and reduces the likelihood of dissatisfaction or disputes.

The BNPL market is competitive, with each provider offering distinct features. Affirm, for instance, focuses on transparency and credit-building opportunities, while Klarna emphasizes smooth user experience and branding. Afterpay is known for interest-free installments and is widely used by fashion and lifestyle retailers.

When comparing providers, look at fee structures, consumer experience, customer support, and technical compatibility. Consider which provider offers the best promotional support, fraud protection, and scalability to grow with your business needs. Additionally, evaluate the payment processing capabilities of BNPL providers to ensure they can effectively manage transactions and reduce financial risks. It’s also crucial to understand how buy now, pay later providers manage risks and adhere to emerging regulations to maintain transparent lending practices and support responsible financial behaviors.

Successful BNPL implementation involves more than just technical integration. Businesses must align internal teams, update customer policies, and actively market the new payment option. BNPL providers handle collecting payments, allowing businesses to focus on growth. Integration should ensure a frictionless experience across all sales channels—whether online, mobile, or in-store.

Training staff, especially in customer support and sales, is key. They need to understand the benefits and potential issues associated with BNPL and be able to communicate them effectively to customers. BNPL also serves as a new customer acquisition channel, particularly appealing to younger demographics. Ongoing monitoring and performance evaluation will help identify areas for improvement.

A significant benefit of BNPL is improved cash flow management. Merchants receive full payment from the provider at the time of sale, which can help stabilize operations and provide liquidity for reinvestment. This structure reduces the complexity and risk of managing customer payment plans internally.

However, it’s important to track the impact of BNPL fees on profit margins. BNPL transactions cost merchants between 1.5% to 7% of the total purchase amount. These fees can have significant financial implications, affecting cash flow and overall profitability. Businesses should account for these fees in their pricing strategy to maintain healthy margins while still offering competitive prices.

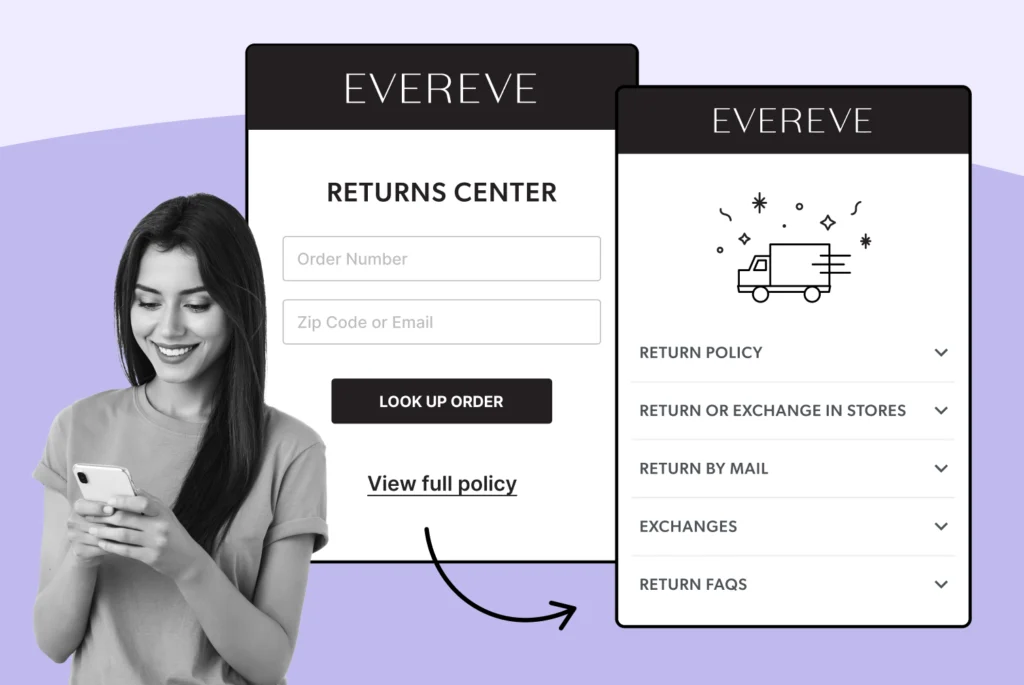

Simplify Returns for Your Customers and Support Team

Book a quick call with our experts to see how WeSupply can help you: simplify the Return experience with just a few clicks, reduce customer service calls and manual processing, notify your customer about their refund, automate returns and reduce user error.

Promotion is key to maximizing the impact of BNPL. Customers need to be aware that this payment option exists. Use banners, badges, and messaging on product pages and checkout screens to highlight BNPL availability as one of the popular payment methods. In-store signage and point-of-sale materials can also inform customers during their shopping journey.

Email marketing, social media campaigns, and remarketing ads are effective channels for driving awareness. Promoting BNPL can attract more customers and boost sales by positioning it as a solution for affordability, budgeting, and accessing premium products. Customer testimonials and case studies can further validate its value.

Real-world examples illustrate the power of BNPL. A fashion retailer that implemented BNPL saw a 35% increase in average order value and a 20% rise in repeat purchases. Customers appreciated the flexibility and convenience, which led to higher customer satisfaction scores. By making high-ticket items more accessible, BNPL can lead to larger purchases and boost overall sales.

A home goods brand used BNPL to successfully launch a new product line. The flexibility of installment payments attracted hesitant buyers, helping the brand exceed its sales targets within the first quarter of launch. Additionally, providing flexible payment options can enhance customer loyalty, leading to increased repeat purchases and improved brand loyalty.

If you’re considering BNPL, start by researching and comparing providers to find one that fits your needs. It’s crucial to evaluate merchant fees, as these can vary among providers and accumulate quickly for high-volume merchants. Prepare your website and staff for the integration and customer service implications. Ensure transparency in customer communications, and factor BNPL-related costs into your pricing strategy.

Additionally, consider how BNPL can serve as a customer acquisition channel, particularly appealing to younger demographics and enhancing customer engagement. With the right approach, BNPL can be a powerful growth lever for your business.

Beyond sales, BNPL plays a key role in customer acquisition. It attracts budget-conscious buyers and consumers without access to traditional credit, effectively broadening your market reach. Businesses that actively promote BNPL report an increase in first-time customers, who often become repeat buyers thanks to the convenience and flexibility offered. Additionally, BNPL can attract new customers by offering flexible payment options, increasing sales and stimulating customer growth.

BNPL also complements loyalty strategies. When customers associate a brand with flexible payment options, they’re more likely to return. By integrating BNPL into loyalty programs or bundling it with exclusive promotions, businesses can further enhance customer retention and satisfaction. Providing flexible payment methods through BNPL can lead to increased repeat purchases and improved customer loyalty, ultimately enhancing conversion rates and reducing cart abandonment for businesses.

The Buy Now Pay Later (BNPL) market is on a trajectory of significant growth, with an anticipated compound annual growth rate of 26.1% between 2023 and 2030. As consumers increasingly seek flexible payment options, BNPL services are expected to expand, catering to a broader range of customers and industries. One emerging trend is the integration of artificial intelligence (AI) and machine learning (ML) to enhance the underwriting process, making it more efficient and accurate. This technological advancement will allow BNPL providers to offer more personalized and risk-adjusted payment plans.

Additionally, there will be a greater emphasis on providing interest-free payments and transparent repayment terms to attract and retain customers. BNPL providers are also developing more sophisticated payment solutions, such as monthly payments and installment payments, to accommodate diverse customer needs. For businesses, offering flexible payment options, including BNPL services, will be crucial in attracting younger customers who prefer interest-free payments and flexible payment plans. Staying ahead of these trends will enable businesses to remain competitive and meet the evolving demands of their customer base.

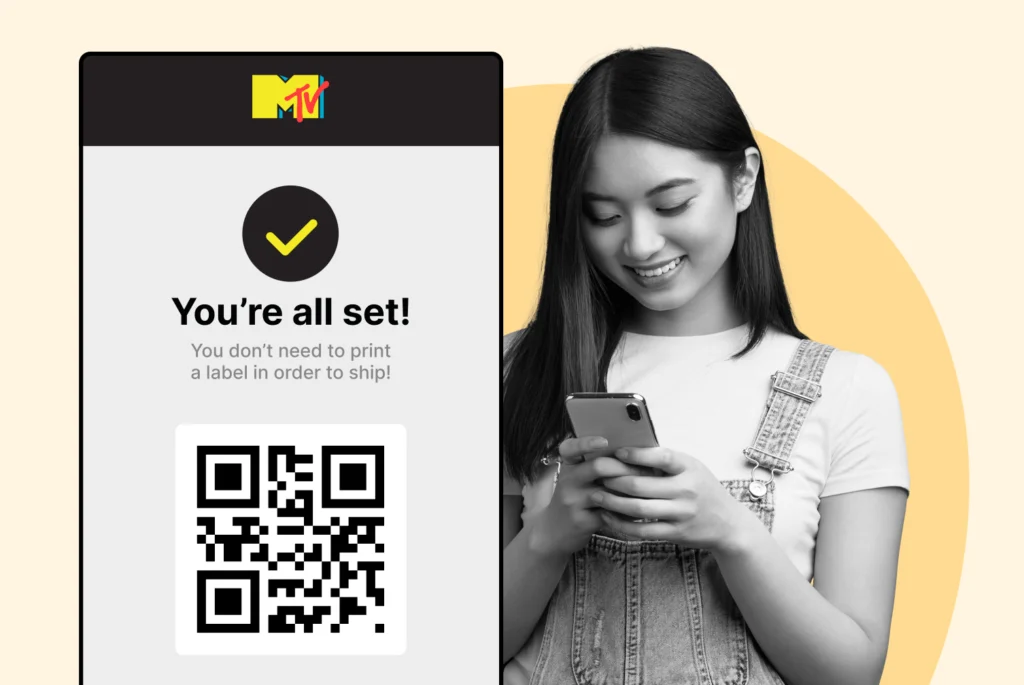

Combat inconvenience with proactivity & self service

Book a quick call with our experts to see how WeSupply can help you make returns easy for your customers with a beautiful, self-service solution that makes their experience easier while also providing new ways to lower costs and earn back revenue.

As the BNPL market continues to grow, regulatory compliance is becoming increasingly important. Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) and the Federal Reserve Bank are playing crucial roles in overseeing the industry and ensuring that BNPL providers comply with existing regulations. Businesses offering BNPL services must be aware of these regulatory requirements and ensure transparency in their fees, repayment terms, and credit limits.

Implementing robust underwriting processes is essential to minimize credit and fraud risk. BNPL providers must ensure they are not engaging in predatory lending practices and that customers are fully informed about the terms and conditions of their payment plans. By prioritizing regulatory compliance, businesses can maintain customer trust and avoid potential legal and financial repercussions. Staying informed about regulatory changes and adapting accordingly will help businesses offer BNPL services responsibly and sustainably.

When implementing BNPL services, businesses should be mindful of common mistakes that can hinder success. One significant error is failing to clearly disclose fees and repayment terms to customers, leading to confusion and mistrust. Properly assessing the creditworthiness of customers is also crucial; neglecting this can result in high default rates and financial losses.

Businesses should avoid offering BNPL services without a thorough understanding of the associated risks, such as credit and fraud risk. Monitoring and reporting transactions to credit bureaus is essential, as it can impact customers’ credit scores and overall satisfaction. Choosing the right BNPL provider is critical; factors such as transaction fees, repayment terms, and customer support should be carefully considered. Ensuring the provider is transparent about their fees and dispute resolution processes will help businesses offer flexible payment options that meet customer needs and drive business success. By avoiding these common mistakes, businesses can ensure a successful BNPL implementation, boost sales, and enhance customer satisfaction.

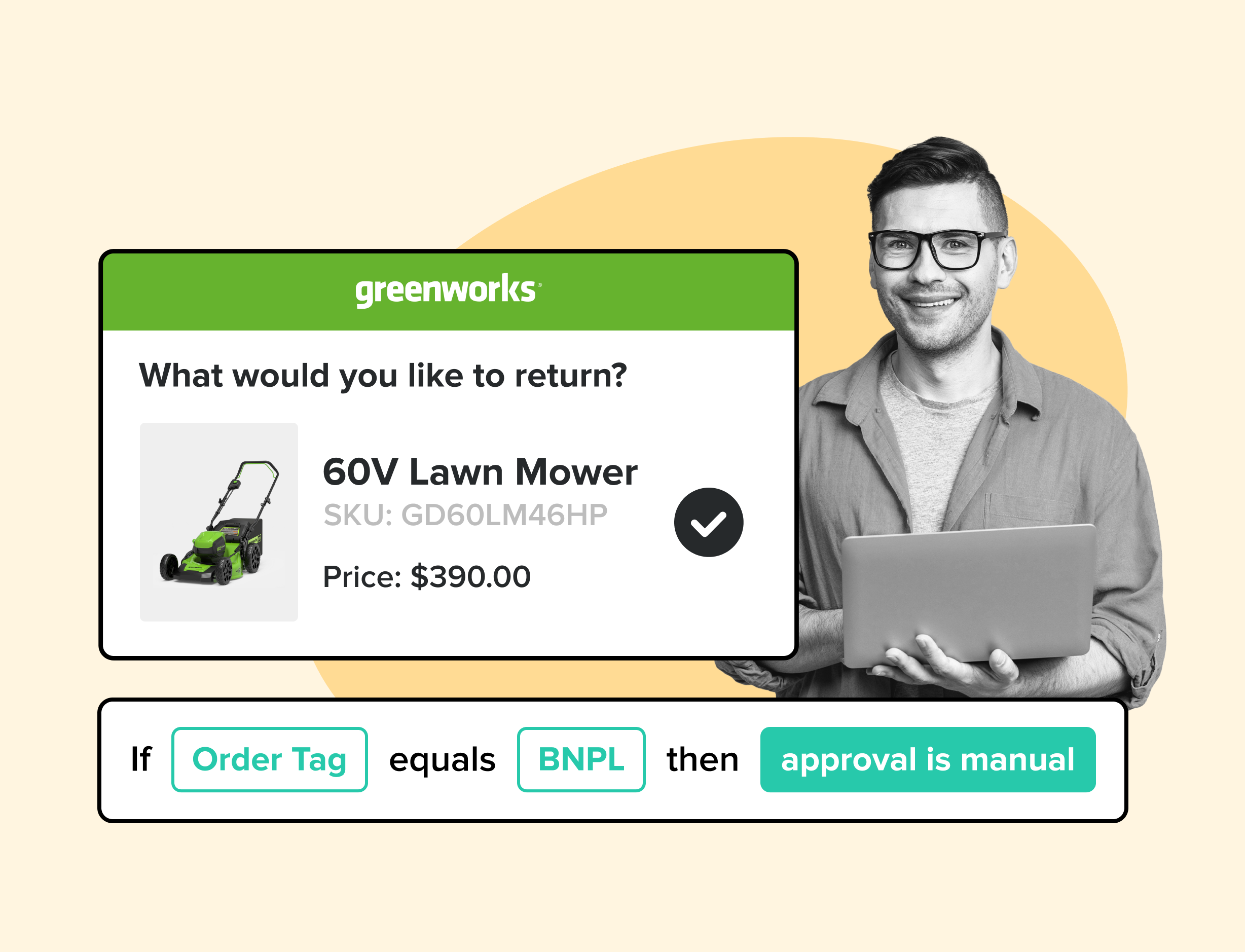

Implementing BNPL (Buy Now, Pay Later) can boost sales, attract younger customers, and increase average order value. However, managing returns for BNPL purchases can be tricky, especially with the potential for increased return rates linked to impulse buys. That’s where WeSupply comes in!

WeSupply, as a robust returns management software, makes handling BNPL returns simple and efficient. Here’s how:

Automated Return Workflows: Streamlines the entire return process, from request to refund.

Custom Return Policies: Set clear guidelines for BNPL returns to minimize confusion.

Enhanced Customer Experience: Offer self-service returns that are fast and transparent.

Detailed Reporting: Gain insights into return patterns specifically linked to BNPL transactions.

Real-Time Order Tracking: Allow customers to track BNPL purchases from order placement to delivery, enhancing transparency.

Automated Communication: Keep customers informed with automated notifications and updates related to BNPL transactions.

By integrating WeSupply with your BNPL offering, you ensure a hassle-free returns process that keeps customers happy while protecting your bottom line. Looking to improve your BNPL strategy? Start with WeSupply!

Deciding whether to offer BNPL depends on your business model, target audience, and financial health. For many retailers, especially those selling high-ticket or lifestyle products, BNPL offers a compelling way to increase sales and improve customer experience. However, it’s essential to evaluate the costs, risks, and operational impact before moving forward. With strategic implementation and ongoing monitoring, BNPL can be a powerful tool to drive growth and foster loyalty in today’s competitive retail landscape.

Buy Now, Pay Later (BNPL) plans are revolutionizing the shopping experience by offering flexible, interest-free installment payments. This payment method drives sales by increasing average order value (AOV) and reducing cart abandonment, especially among younger consumers. Implementing BNPL can attract new customers and boost loyalty through financial flexibility.

However, managing returns from BNPL purchases can be complex. That’s where WeSupply excels! WeSupply seamlessly integrates with leading e-commerce platforms and BNPL providers, automating the entire return process from initiation to refund. By enabling businesses to establish clear, BNPL-specific return policies, WeSupply ensures a transparent and hassle-free customer experience. Moreover, its self-service return options enhance convenience, while actionable insights help track BNPL-related return patterns for smarter decision-making.

Get started with WeSupply today and turn BNPL into a growth opportunity!

BNPL allows customers to split their payments into installments while the business receives full payment upfront from the BNPL provider.

Compare providers based on fees, customer support, reputation, integration ease, and alignment with your business model.

Highlight BNPL options during the shopping journey via your website, email campaigns, social media, and in-store materials.

Higher transaction fees, reputational risks if customers have a bad BNPL experience, and increased product returns due to impulse buys.

WeSupply automates the entire return process for BNPL transactions, from customer request to refund. It integrates seamlessly with popular BNPL providers and e-commerce platforms, allowing businesses to manage returns efficiently while offering a hassle-free experience for customers.

Yes, WeSupply enhances customer satisfaction by providing real-time order tracking from purchase to delivery. Customers receive automated notifications and updates related to their BNPL transactions, ensuring they are always informed and reducing support inquiries.

WeSupply’s detailed reporting tools help you track return patterns specifically linked to BNPL purchases. This data allows you to identify trends, reduce impulse-related returns, and refine your BNPL strategy for better profitability.

Yes, WeSupply does have an official Shopify App. You can download and begin to integrate it with your Shopify store.

Yes, WeSupply has an official extension for Magento. The WeSupply x Magento integration allows for automating order tracking experiences, reducing customer inquiries, automating shipping email and SMS notifications, and providing a fully branded order tracking experience

Yes, WeSupply has an official BigCommerce App. You can integrate WeSupply with your BigCommerce store to improve your post-purchase customer experience.

Learn How To Create Successful Post Purchase Email Campaigns

Build an effective post-purchase email flow that helps you increase customer satisfaction and drive revenue growth!

Explore the pros and cons of a 30-day return window for buyers and sellers. Understand the impact on purchases and sales!

Explore the legal aspects of return policies and whether they constitute a legal agreement. Learn how this impacts your shopping experience. Read more.

Discover why including Shopify returns labels in the box can be a costly mistake. Six compelling reasons to reconsider this practice!

Learn how to optimize packaging for hassle-free returns and exchanges. Enhance customer satisfaction and streamline your process. Read the guide now!

Learn effective communication strategies to improve sizing accuracy and reduce returns. Discover practical tips to enhance your online shopping experience.

Explore the legal aspects of return policies and whether they constitute a legal agreement. Learn how this impacts your shopping experience. Read more.

Discover 5 effective strategies to enhance your product photos and minimize returns. Improve customer satisfaction and boost sales—read the article now!

Learn how to optimize packaging for hassle-free returns and exchanges. Enhance customer satisfaction and streamline your process. Read the guide now!

This article demystifies dropshipping, offers clear steps for getting started, and divulges expert tactics for thriving in online retail!