Boosting Efficiency in Reverse Logistics by Going Green for Success

Discover how adopting green practices in reverse logistics can enhance efficiency and drive success. Transform your approach today!

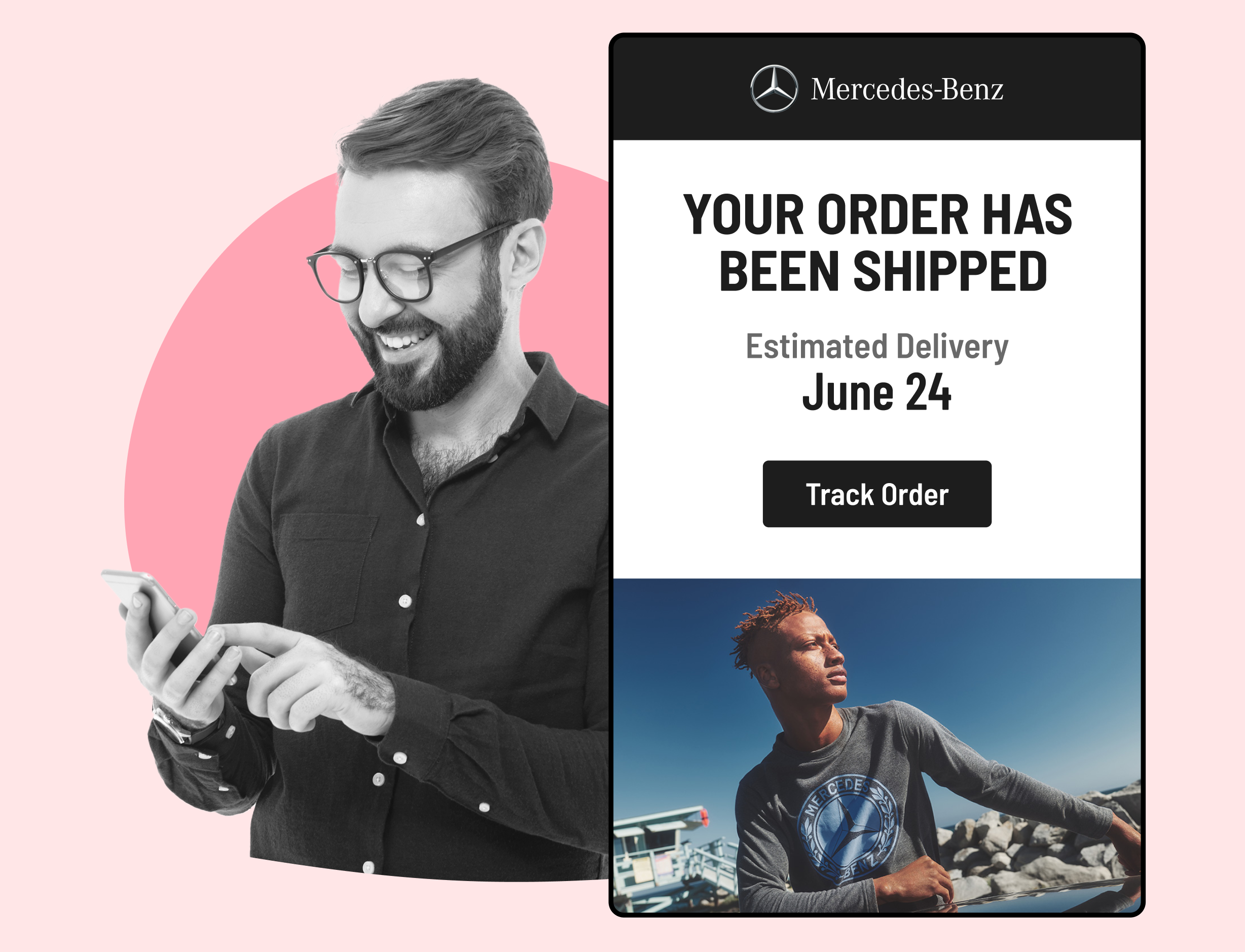

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Easy claims and smart upsells

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Shipping, Tracking & Notifications

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Identify and Resolve Order Issues

Realtime order and shipment tracking

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Returns management made easy for your team

Understand why your customers are returning

In-Store & Curbside Pickup

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Equip your team for precise return checks.

Easy claims and smart upsells

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Find the answer to all your questions

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Find the answer to all your questions

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

Chargebacks are a significant challenge for merchants, particularly in the eCommerce world, where fraud, customer dissatisfaction, and merchant errors can all contribute to disputes. Addressing customer complaints is crucial in preventing chargebacks, as neglecting feedback can lead to escalated issues and negative reviews. They disrupt cash flow, damage a business’s reputation, and strain day-to-day operations. Chargebacks can lead to significant losses for retailers, not only in terms of the revenue lost from the initial sale but also through additional chargeback fees incurred when customers dispute charges with their banks or credit card issuers. While chargebacks are a necessary safeguard for consumers, they can be costly and time-consuming for merchants. Understanding how they occur and implementing strategies to prevent and manage them effectively is key to revenue recovery.

This article explores 8 chargeback mistakes merchants must avoid to reduce disputes, safeguard their revenue, and improve their chargeback management processes.

Chargebacks occur when a customer disputes a transaction, prompting the card issuer to return the transaction amount to the customer and reverse the charge from the merchant’s account. Chargebacks typically result from fraud, friendly fraud, or merchant errors, and addressing issues like poor customer service and shipping delays is crucial in mitigating chargeback disputes. Each of these categories requires different prevention strategies.

For merchants, chargebacks can have far-reaching consequences. Beyond the direct loss of revenue, chargebacks can incur additional fees, disrupt operational budgets, and even lead to merchant account termination if they go unchecked. It’s essential for businesses to understand the challenges chargebacks present and develop a comprehensive strategy to reduce and manage them effectively. Prioritizing customer experience is also vital in preventing chargebacks, as it enhances customer satisfaction and loyalty.

Chargebacks are a consumer protection mechanism that allows customers to dispute a transaction and request a refund from their bank or credit card issuer. This process is initiated when a customer believes there has been an error or fraudulent activity associated with their purchase. Chargebacks can stem from various issues, including merchant errors, customer disputes, and billing or payment discrepancies. When a chargeback is filed, the merchant must provide compelling evidence to support the legitimacy of the transaction. If the evidence is deemed insufficient, the chargeback is upheld, resulting in a financial loss for the merchant. Understanding the chargeback process is crucial for merchants to effectively manage and mitigate these disputes.

Chargebacks can occur for a multitude of reasons, often rooted in merchant errors, customer disputes, and billing or payment issues. Merchant errors, such as incorrect billing information or failure to obtain proper authorization, can lead to chargebacks. Customer disputes are another common cause, arising from issues like damaged or defective products, incorrect orders, or dissatisfaction with the product or service. Additionally, billing or payment issues, such as unclear pricing or unexpected charges, can also trigger chargebacks. By understanding the common causes of chargebacks, merchants can implement strategies to address these issues proactively and reduce the likelihood of disputes.

One of the biggest mistakes a merchant can make when trying to prevent chargebacks is failing to establish a clear, accessible return policy. Addressing customer complaints through a clear return policy can prevent chargebacks. A well-written return policy can be the first line of defense against chargebacks, as customers are more likely to reach out for resolution if the process is straightforward.

A clear return policy should define what constitutes a final sale, outline the conditions under which returns are accepted, and explain the return procedure. By making it easy for customers to cancel or return an order, merchants can reduce the likelihood of customers bypassing them in favor of filing chargebacks. Additionally, merchants should ensure their return policies are visible and accessible, both online and in communication with customers, and that their staff is trained to handle returns according to the policy.

A clear and accessible return policy is essential to avoid chargebacks and foster customer trust. WeSupply makes managing returns straightforward for both merchants and customers by offering user-friendly tools and transparency. Here’s how:

Confusion-Free Return Windows: Clearly define when the return window starts to eliminate misunderstandings for customers and teams.

Non-Returnable Items Clarity: Highlight final sale products, non-re-sellable items, and blocked customers to avoid unnecessary back-and-forth.

Custom Return Policies: Tailor return rules, approval processes, and return windows to fit your unique business needs.

Streamlined Return Destinations: Send returns to specific warehouses, repair centers, or donation hubs to optimize logistics.

Dropshipping and International Returns: Manage vendor-specific returns or region-specific rules with ease.

Encourage Exchanges: Convert refunds to store credit or exchanges, protecting revenue and improving profitability.

With WeSupply, merchants ensure a seamless return experience while minimizing disputes and fostering customer satisfaction. Ready to transform your returns process? Book a demo today!

Simplify Returns for Your Customers and Support Team

Book a quick call with our experts to see how WeSupply can help you: simplify the Return experience with just a few clicks, reduce customer service calls and manual processing, notify your customer about their refund, automate returns and reduce user error.

Confusing pricing and billing information can lead to significant chargebacks, especially when customers feel they’ve been misled about the final price of their purchases. Confusing pricing and billing information can also lead to merchant error chargebacks, where customers believe a mistake has been made by the merchant. Hidden charges, such as shipping fees or taxes, can result in customers disputing the charge if they were not clearly disclosed at the time of purchase.

Merchants should ensure that the total cost of the transaction, including any additional charges, is communicated upfront. It’s also important that any promotional discounts or sales are clearly shown before payment, and that customers are aware of the final totals before they complete their purchase. Billing descriptors—what customers see on their statements—should match the merchant’s business name to avoid confusion. Including contact information on the billing descriptor can further help resolve disputes before they escalate.

Excellent customer service is a critical factor in reducing chargebacks. Poor customer service can lead to increased chargebacks, as ineffective responses and lack of empathy prompt customers to escalate their complaints. When customers encounter issues, whether with a product or service, they may resort to chargebacks if they don’t feel their concerns are being addressed. Ensuring that customers can easily contact the business and receive timely solutions can prevent disputes from escalating.

Merchants should focus on building strong customer relationships, addressing complaints promptly, and offering practical solutions to resolve problems before customers consider chargebacks. Providing clear communication and responsive support is key to maintaining customer satisfaction and reducing chargeback risk.

Failing to prioritize customer service can lead to chargeback disputes due to dissatisfied customers. WeSupply empowers merchants to elevate their customer service, addressing concerns proactively and minimizing friction in the post-purchase experience. Here’s how WeSupply supports seamless service:

Order Tracking: Offer real-time tracking and shipment updates to answer the #1 customer service query: “Where is my order?”

Proactive Notifications: Keep customers informed of any shipping changes or delays, ensuring transparency and trust.

Branded Tracking Pages: Deliver a unified, branded experience for customers to check package statuses directly, bypassing third-party sites.

By streamlining communication and offering proactive support, WeSupply enables your team to focus on critical tasks while fostering customer trust and loyalty.

Combat inconvenience with proactivity & self service

Book a quick call with our experts to see how WeSupply can help you make returns easy for your customers with a beautiful, self-service solution that makes their experience easier while also providing new ways to lower costs and earn back revenue.

Time is of the essence when it comes to chargeback disputes. Actively engaging in the process to fight chargebacks is crucial to avoid guaranteed losses and mitigate challenges. Each payment platform, such as Visa, MasterCard, or PayPal, sets specific time limits for merchants to respond to chargebacks. For instance, Visa typically provides 30 days, MasterCard 45 days, and PayPal only 10 days to submit evidence to contest a chargeback.

Failing to respond within these timeframes results in automatic loss of the dispute, regardless of the validity of the chargeback. Merchants must stay updated on the chargeback time limits for each platform they use and ensure they are prepared to submit documentation promptly. Missing these deadlines can significantly increase chargeback costs and prevent revenue recovery.

Chargeback reason codes are essential for understanding the nature of the dispute and determining the appropriate evidence to present in a representment case. Fraudulent chargebacks, often arising from fraudulent transactions like card-not-present and friendly fraud, pose a significant challenge for retailers. Merchants who fail to recognize or understand these codes may submit irrelevant evidence, which reduces their chances of winning the dispute.

Merchants should familiarize themselves with common chargeback reason codes and stay up-to-date on new or evolving codes. By understanding the specifics of the chargeback reason, merchants can gather the necessary documentation—whether it’s proof of delivery, customer communication, or product description—needed to effectively dispute the chargeback.

Inaccurate or misleading product information can lead to dissatisfaction, which can then escalate into chargebacks. Clear product information is crucial for preventing chargebacks. If a product doesn’t match its description or if customers feel they were misled about its features, they are more likely to file a chargeback.

To avoid this mistake, merchants must ensure that product descriptions are accurate, pricing is clear, and shipping terms are transparent. Customers should know exactly what they are purchasing, including any applicable fees or additional costs. Accurate product information reduces the likelihood of disputes and builds trust with customers.

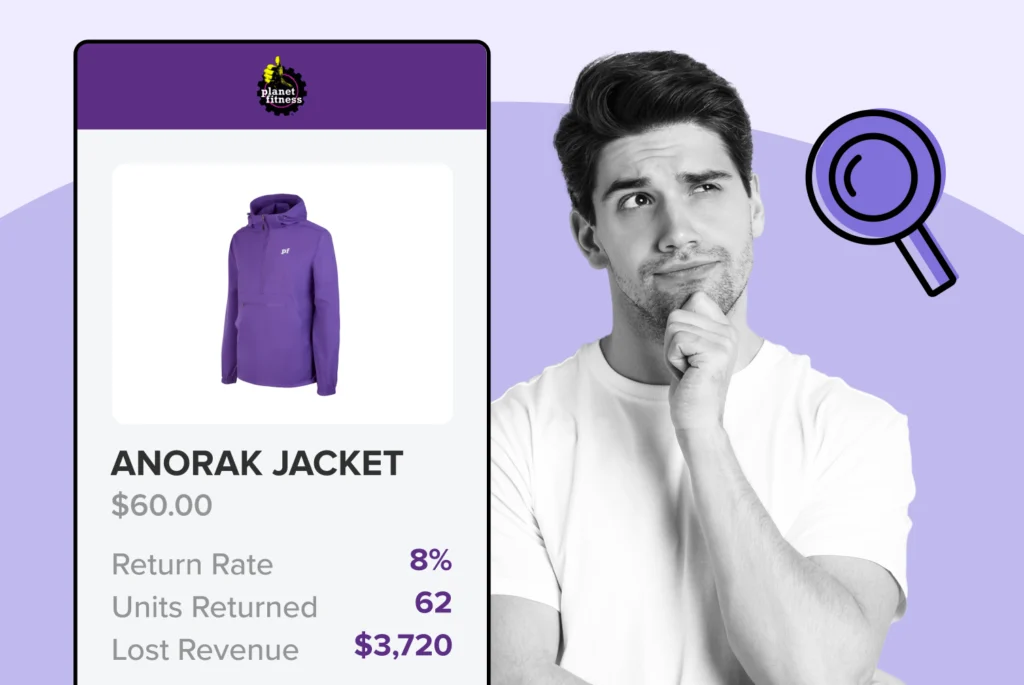

WeSupply is a vital tool for merchants looking to avoid chargeback mistakes, especially when it comes to ensuring clear product information. By leveraging SKU-level returns analytics, WeSupply enables you to identify specific issues—such as inaccuracies in sizing, quality discrepancies, or insufficient product details—leading to customer dissatisfaction and returns. Here’s how WeSupply can help:

Review Product Images: Highlight areas where visuals may fail to meet customer expectations.

Increase Product Reviews: Boost trust and transparency by encouraging customers to share their experiences.

Gather Fit Feedback: Understand customer perspectives on product fit to reduce misaligned expectations.

By addressing these aspects, WeSupply minimizes unclear product information’s role in returns and chargebacks, ensuring better customer satisfaction and fewer financial losses.

Credit card processors can be valuable allies when it comes to managing chargebacks. Working with payment processors can help manage situations where customers dispute transactions. They often have significant experience with disputes and can offer insights and tools that help merchants resolve chargebacks more efficiently.

Merchants should work closely with their payment processor to understand their chargeback management process. This includes utilizing the processor’s fraud detection tools, reviewing chargeback reports, and following best practices for dispute resolution. Having a trusted payment processor can make a significant difference in successfully managing chargebacks and preventing future issues.

Fighting chargebacks is time-consuming, and it’s easy to get caught up in the process of disputing every case. Merchant error can lead to chargebacks and should be managed efficiently. However, inefficiently allocating time and resources to chargeback disputes can drain valuable resources and prevent businesses from focusing on core operations.

Merchants should prioritize chargeback disputes that have the highest likelihood of success and avoid wasting time on disputes that are unlikely to be resolved in their favor. It’s important to evaluate each case thoroughly, assess the costs involved, and allocate resources accordingly. By managing time and resources wisely, merchants can maximize their chances of revenue recovery and minimize the impact of chargebacks.

Not disputing chargebacks can be a costly mistake for merchants. When a chargeback is filed, the merchant has the opportunity to provide evidence to support the transaction and dispute the chargeback. However, if the merchant fails to dispute the chargeback, it may be upheld, resulting in a loss for the merchant. Disputing chargebacks can help merchants recover lost revenue and protect their reputation. It is essential for merchants to have a robust process in place for responding to chargebacks promptly and effectively, ensuring that they present the necessary documentation and evidence to contest unjust disputes.

Ignoring fraud trends and red flags can put merchants at significant risk of further losses. Merchants should routinely review payment analytics to identify any patterns or suspicious activity that could indicate fraudulent transactions. By taking proactive steps to identify red flags and chargeback fraud patterns early on, businesses can adjust their fraud prevention tactics and solutions accordingly. Ignoring these trends can lead to repeat losses and damage to a merchant’s reputation. Implementing advanced fraud prevention tools and staying vigilant about emerging fraud trends are critical components of a comprehensive chargeback prevention strategy.

Chargebacks are an inevitable part of running an eCommerce business, but merchants can minimize their occurrence by avoiding common mistakes. Addressing fraudulent chargebacks is crucial as they often arise from fraudulent transactions, including card-not-present and friendly fraud. By establishing clear return policies, ensuring accurate pricing, prioritizing customer service, responding promptly to disputes, and understanding chargeback reason codes, merchants can reduce their exposure to chargebacks. Additionally, working with trusted payment processors, offering clear product information, and managing resources efficiently are key to protecting revenue and maintaining a healthy business.

Chargeback prevention and management require an ongoing commitment to improving internal processes, staying updated on industry trends, and fostering positive relationships with customers. With the right strategies in place, merchants can significantly reduce chargebacks and ensure better revenue recovery.

WeSupply helps merchants avoid chargeback mistakes by addressing key pain points with seamless, proactive solutions. It ensures clarity with SKU-level analytics, accessible return policies, and confusion-free return windows, reducing disputes from unclear product information or poor service. Features like branded tracking pages, proactive delivery notifications, and order lookup tools keep customers informed, fostering trust. Customizable policies and automated workflows streamline returns, clarify non-returnable items, and incentivize exchanges, protecting revenue while enhancing satisfaction. With WeSupply, merchants optimize operations, build loyalty, and avoid costly chargebacks.

Don’t let chargeback mistakes hold you back—Get started with WeSupply today!

WeSupply uses SKU-level returns analytics to identify issues like sizing inconsistencies and poor product details. This allows merchants to adjust sizing charts, improve product imagery, and encourage more reviews to meet customer expectations and reduce dissatisfaction.

WeSupply enhances customer service with real-time order tracking, branded post-purchase pages, and estimated delivery dates. These features keep customers informed, set clear expectations, and reduce frustrations that can lead to chargebacks.

WeSupply makes return policies clear by displaying them on order lookup pages and offering customizable return rules. It also highlights non-returnable items to prevent misunderstandings and encourages exchanges or store credits to protect revenue.

Yes, WeSupply does have an official Shopify App. You can download and begin to integrate it with your Shopify store.

Yes, WeSupply has an official extension for Magento. The WeSupply x Magento integration allows for automating order tracking experiences, reducing customer inquiries, automating shipping email and SMS notifications, and providing a fully branded order tracking experience

Yes, WeSupply has an official BigCommerce App. You can integrate WeSupply with your BigCommerce store to improve your post-purchase customer experience.

Learn How To Create Successful Post Purchase Email Campaigns

Build an effective post-purchase email flow that helps you increase customer satisfaction and drive revenue growth!

Discover how adopting green practices in reverse logistics can enhance efficiency and drive success. Transform your approach today!

Discover how to reduce product returns using data-driven strategies. Enhance your eCommerce success with our step-by-step guide!

Discover effective strategies to reduce buyer’s remorse in ecommerce and enhance customer satisfaction. Discover practical solutions today!

Discover how returns play a vital role in reducing e-waste and promoting sustainability. Learn practical steps to make a positive impact!

Discover 4 effective strategies for information sharing that can significantly reduce product returns. Enhance your customer experience!

Discover why a poor returns policy can hurt your business and learn how to create a customer-friendly approach!

Discover 5 effective strategies to minimize returns and reduce losses in your business. Improve your processes for greater success!

Discover effective returns strategies to minimize losses in ecommerce. Enhance your business’s resilience and improve customer satisfaction!

Discover how effective return strategies can enhance your ecommerce ROI. Actionable tips to transform returns into a profitable advantage!