Shopify Returns Management: Best Practices for Efficient Handling

Shopify returns management best practices: practical tips to streamline your process and keep your customers coming back!

Boost customer experience and reduce support tickets

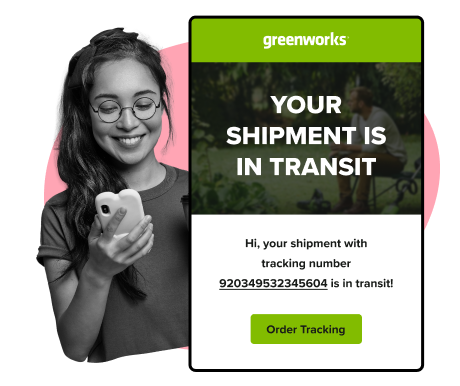

Realtime order and shipment tracking

Proactive order and shipping notifications

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Boost customer experience and reduce support tickets

Realtime order and shipment tracking

Proactive order and shipping notifications

AI-Enhanced Discounted Labels

Predictive pre-purchase estimated delivery dates

Self-Serivce branded order tracking

Effortless experience delivered

Make returns profitable and delight customers

Flexibility to define any return destinations & conditions

Simplify returns for your customers and team

Incentivize exchanges over returns

Returns management made easy for your team

Equip your team for precise return checks.

Understand why your customers are returning

Unify the online and the in-store experience

Hassle-free pickup experience for customers

In-Store Dashboard to keep operations streamlined

In-Store and Online orders unified

Drive foot-traffic to your stores

Find the answer to all your questions

Explore the most comon questions about WeSupply

Calculate the ROI that WeSupply can bring you

Request a no strings attached review of your current shopping experience and missed conversion opportunities

Take a step by step trip through our functionality to see how we can improve your ecommerce processes.

Read actionable articles on how to optimize your post-purchase experience and decrease support tickets

Get inspired by stories of how our customers implemented an effortless post-purchase experience

A Deep Dive into Top Companies' Order Tracking & Returns Strategy

Wondering if WeSupply is a good fit for you? Read through our use cases to see how we can help you increase conversion & improve CX!

If you’re a Shopify merchant, managing the accounting aspects of returns and exchanges can be challenging. You need to ensure accurate financial records while handling reversed transactions, additional costs, and potential discrepancies. In this article, we will discuss how to avoid Shopify accounting issues with returns exchanges by providing strategies and tools to help you maintain clear financial data.

Returns and exchanges significantly impact Shopify merchants’ financial records, necessitating precise bookkeeping to ensure accurate revenue reporting and tax compliance.

Inaccurate bookkeeping and failure to manage returns effectively can lead to costly discrepancies, such as misreported profits, inflated sales, and inefficient inventory management.

Utilizing third-party returns management software and adopting best practices for handling exchanges and store credits can enhance operational efficiency and improve customer satisfaction.

WeSupply helps Shopify stores avoid accounting issues by automating returns and exchanges. With real-time inventory updates, automated refunds, and seamless ERP integration, you can ensure accurate reporting and smooth financial management. Download the official WeSupply Shopify App today!

Returns and exchanges are a double-edged sword for Shopify merchants. While they are an essential part of a customer-centric business, they pose significant challenges to maintaining accurate financial records. Each return or exchange process reverses a sale, directly impacting recognized revenue and altering the financial health of your business.

The importance of precise bookkeeping cannot be overstated. Accurate accounting is crucial for understanding your financial position and making informed business decisions. It’s not just about knowing how much money you made; it’s about having a clear picture of your profitability after accounting for all returns and exchanges. Mismanaged returns can lead to underreporting taxes, misstated revenues, and ultimately, financial instability.

One of the major reconciliation challenges Shopify merchants face during returns and exchanges is aligning the reversed transactions with the original sales. This process can be complex, especially when dealing with multiple sales channels and various payment processors. Each return needs to be meticulously tracked and matched to its corresponding sale to ensure financial accuracy.

To mitigate these issues, a robust understanding of the impact of returns and exchanges on your financial statements is essential. It requires a strategic approach, combining the right tools and practices to streamline the process and maintain the integrity of your financial data.

Returns don’t just reverse sales; they come with a slew of additional expenses that can significantly impact your bottom line. Restocking fees, shipping costs, and the loss from unsellable inventory add up quickly. These return fees can eat into your profit margins, making it crucial to manage returns efficiently.

Accurate financial records are vital for understanding the true cost of returns. Inaccurate bookkeeping can lead to substantial accounting discrepancies, underreporting of taxes, and flawed finance summary reports. The time and cost required to reconcile sales reports and align financial data are immense. Every return must be logged correctly to ensure your finance summary reflects the actual financial state of your business.

One of the most overlooked aspects is how inaccurate inventory data can skew cost calculations and overall profitability. When returns are not properly accounted for, it disrupts inventory management. This misalignment can lead to overstocking or stockouts, both of which have detrimental effects on your business operations and finances.

To mitigate these issues, it’s essential to maintain accurate financial records, align your sales data meticulously, and ensure that every return is properly documented. This practice not only helps in managing returns effectively but also in maintaining a clear and precise finance summary that reflects your business’s true financial health.

To mitigate these issues, it’s essential to maintain accurate financial records, align your sales data meticulously, and ensure that every return is properly documented. This practice not only helps in managing returns effectively but also in maintaining a clear and precise finance summary that reflects your business’s true financial health.

Navigating the labyrinth of Shopify’s reporting system can be daunting, especially with the recent changes that have caused discrepancies in sales data. These discrepancies often lead to accounting headaches, where the recorded sales don’t match the actual financial transactions. This misalignment can result in significant financial inaccuracies and challenges in managing returns.

Exchanges present another layer of complexity. Unlike straightforward refunds, exchanges adjust orders without reversing the original transaction, which can skew sales reporting. This nuance often leads to confusion and misreported sales data. Using sales adjustment reports can help reconcile discounts, returns, and net sales accurately, but it requires a meticulous approach to ensure all data aligns correctly.

Another common issue is the impact of restocking fees and shipping costs on your financial records. These additional charges need to be accurately tracked and reported to avoid accounting discrepancies. When not properly managed, these can distort your finance summary reports, making it difficult to get a true picture of your business’s financial health.

Addressing these issues requires a keen eye for detail and a robust system for tracking all aspects of returns and exchanges. By understanding the common pitfalls and implementing effective tracking and reporting mechanisms, you can minimize these accounting discrepancies and maintain accurate financial records.

WeSupply can help Shopify businesses tackle common accounting issues related to returns and exchanges through streamlined processes and insightful analytics. By integrating with Shopify, WeSupply optimizes the returns management system, improving profitability and reducing operational overhead.

Key benefits include:

Collect product feedback: Use customer feedback to refine products, helping reduce return rates and enhance customer satisfaction.

Measure financial impact: Leverage WeSupply’s analytics to assess the financial impact of returns, enabling more data-driven decisions on return policies and pricing strategies.

Streamlined accounting: Automate refund processes, restocking fee calculations, and return label generation to simplify accounting and enhance efficiency.

Double-order entries and duplicate orders are a nightmare for any bookkeeper. They distort financial statements, creating a chaotic and inaccurate financial picture. These issues typically arise from secondary payment processors and their effect on financial reconciliation. When orders are recorded multiple times, it inflates sales figures and leads to significant accounting discrepancies.

The challenges posed by these double entries extend to tax reporting as well. Misreported taxes and incorrect revenue recognition can have serious legal and financial repercussions. It’s not just about maintaining accurate financial records; it’s about ensuring compliance with tax laws and avoiding hefty penalties.

To combat this, a rigorous system for tracking orders and payments is essential. Ensuring that each transaction is recorded accurately and reconciled promptly can help prevent these issues. Implementing such measures maintains a clear and precise financial picture, free from the chaos of double entries and duplicate orders.

A well-defined return process is the cornerstone of maintaining accurate financial records. A formal return policy not only standardizes returns but also enhances customer experience. Offering multiple return methods provides flexibility, boosting customer satisfaction and loyalty.

Connecting your e-commerce platform to accounting software is another crucial step. This integration ensures seamless reconciliation of returns and accurate financial records. When your sales and return data flow directly into your accounting system, it reduces the chances of errors and discrepancies, making your financial reporting more reliable.

By streamlining your return process, you not only retain revenue but also enhance the accuracy of your financial records. This approach helps in managing returns more effectively and ensures that your finance summary reports reflect the true state of your business.

WeSupply helps you streamline your return process through automation and seamless integration. By enhancing the customer experience and simplifying the returns process, WeSupply minimizes errors and boosts operational efficiency.

Key features include:

Branded Returns Portal: Provide a consistent, branded experience across channels instead of redirecting customers to generic courier pages.

Flexible Return Rules: Customize return policies to suit various scenarios, ensuring a hassle-free process for customers.

QR Code Return Labels: Simplify returns with auto-generated QR codes, eliminating the need for printing.

Returns Tracking: Allow customers to track their return status at any time, improving transparency and trust.

Post-Purchase Notifications: Send personalized emails and SMS notifications to keep customers informed and engaged.

Seamless Integrations: Connect order and return data with your existing tools for better financial oversight and operational efficiency.

Ready to simplify your return process and keep your financial records accurate? Discover how WeSupply can transform your returns management. Book a demo today and see the difference firsthand!

Automation is a game-changer when it comes to managing returns. Third-party apps like WeSupply, AfterShip Returns Center, and Loop Returns offer new features that enhance the returns process and save valuable resources. These returns platforms streamline the entire process, from initiating a return to restocking the returned item, making it more efficient and less prone to errors.

Key features of these apps include automated return labels, real-time tracking, and seamless integration with your Shopify store. These tools not only improve operational efficiency but also help prevent return fraud by verifying the legitimacy of returns. With automation, you can handle a higher volume of returns without compromising on accuracy or customer satisfaction.

Adopting these third-party apps can significantly reduce the manual workload involved in managing returns, allowing you to focus on other critical aspects of your business. Leveraging these tools ensures that your return process is efficient, accurate, and customer-friendly.

WeSupply helps you automate returns management seamlessly with third-party apps, saving your team time and minimizing errors. By integrating with your existing ERP, 3PL, or returns workflow, WeSupply optimizes the process for efficiency and accuracy.

Key features include:

Self-Service Returns: Allow customers to initiate returns anytime without contacting customer support, speeding up the process and reducing inquiries.

Streamline the Returns Workflow: Automatically apply vendor-specific return policies, prevent fraud by identifying abusers, and eliminate back-and-forth communication.

Reduce Human Errors: Automate manual tasks such as calculating restocking fees and validating returnable products, minimizing mistakes.

Integrations: Easily connect with your ERP, 3PL, and other third-party apps to ensure smooth, automated returns management across all systems.

Minimize RMA Costs: Reduce touchpoints, improve efficiency, and cut costs by transitioning from manual returns to automated, optimized processes.

With WeSupply, automating your returns management is simple and effective, helping you save time, reduce errors, and streamline your entire process.

Create custom return policies

There are many moving pieces in ecommerce logistics. Book a quick call with our experts to see how WeSupply can help you take control by creating custom policies to handle them all easily. You get to decide how you want to handle final sale items, return window lengths, return request approvals, and more.

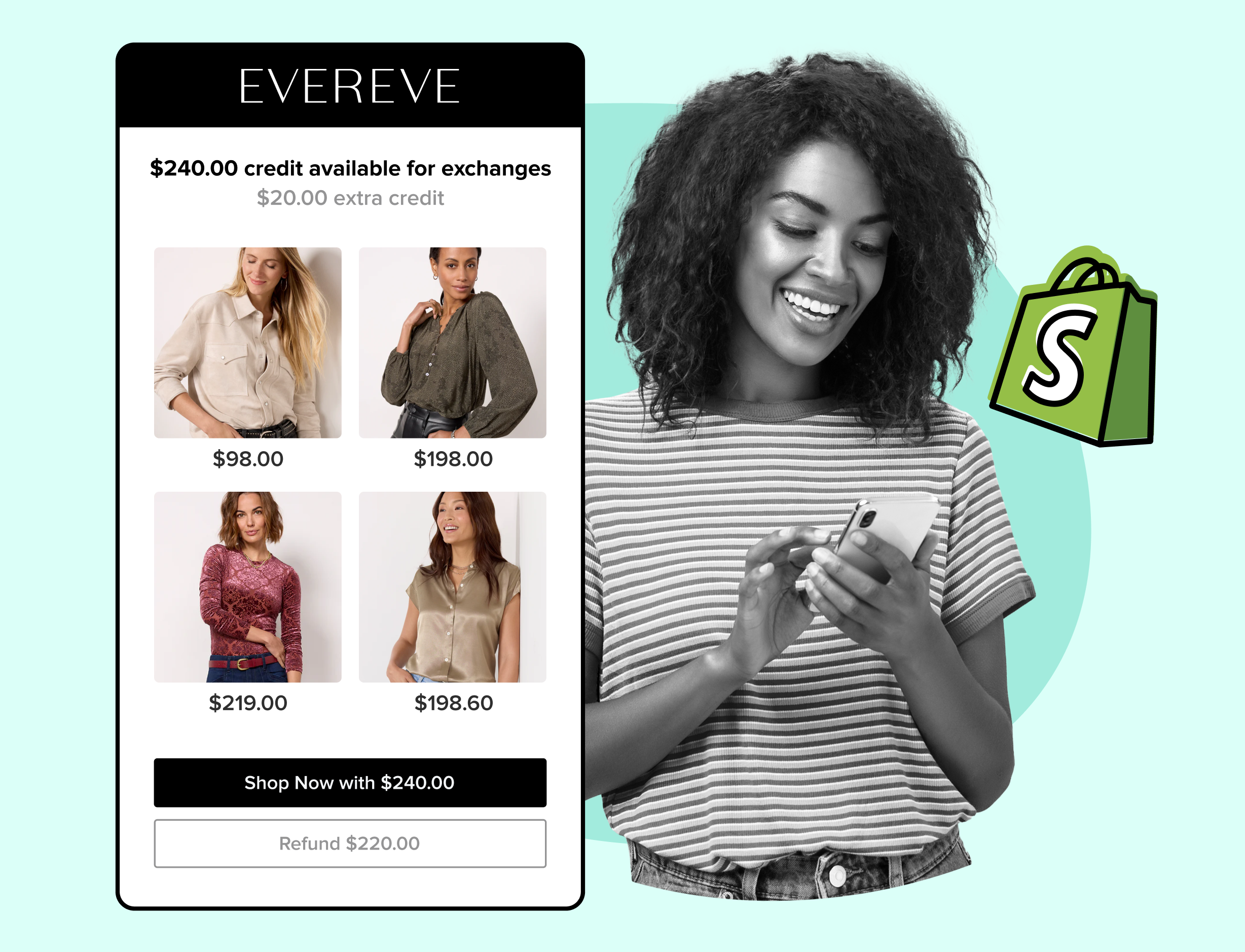

Handling store credit and exchange orders effectively can turn a potential loss into an opportunity for revenue retention. Offering incentives like Bonus Credit, Instant Exchanges, and a discount code can encourage customers to choose store credit over refunds, helping you retain revenue. These incentives not only provide immediate value to customers but also increase the likelihood of future purchases.

Using returns as opportunities to boost revenue is another best practice. Offering special discounts or gift cards for returned items can turn a negative experience into a positive one, enhancing customer satisfaction and loyalty. This approach helps in managing returns more strategically, ensuring that your business remains profitable even when dealing with exchanges and store credits.

Effective return management also involves maintaining clear and accurate records of each transaction. Tracking the original order and the exchange or store credit issued ensures that your financial data remains precise and reliable. This practice not only helps in managing returns but also in maintaining a clear and accurate financial picture.

WeSupply helps you implement best practices for handling store credit and exchange orders, enhancing the customer experience while boosting your sales. By making exchanges seamless and incentivizing store credit over refunds, WeSupply ensures you retain more sales and increase customer lifetime value.

Key features include:

Store Credit and Gift Cards: Offer store credits or gift cards as partial payment options, encouraging customers to return and shop more frequently.

Increased Order Value: Incentivize exchanges over returns, using instant store credit to boost average order value.

Flexible Exchange Options: Let customers exchange return items for any product, reship the same item, or upgrade to a higher value product.

With WeSupply, you can turn returns into opportunities for growth and customer retention through smart handling of store credit and exchanges.

Accurate reporting is the backbone of maintaining financial health in any business. Avoiding common reporting mistakes, such as mis recording returns or failing to update inventory, is crucial for maintaining accurate financial records. Proper handling of online returns processed in-store ensures that the revenue contribution is accurately reflected in your financial statements.

Recording refunds correctly is another critical aspect. Incorrectly recorded refunds can lead to negative invoices and significant reporting errors. Ensuring that all financial transactions are recorded accurately helps in maintaining precise financial data and avoiding accounting discrepancies.

Focusing on accurate reporting ensures that your Shopify reports provide a true picture of your business’s financial health. This practice helps in making informed business decisions and maintaining the integrity of your financial data.

WeSupply helps ensure accurate reporting in Shopify’s reporting system by seamlessly integrating with your ERP and providing powerful analytics tools that keep your financial data accurate and up to date. By automating return processes and synchronizing return data with your accounting systems, WeSupply minimizes errors and streamlines operations.

Key features include:

Seamless ERP Integration: Synchronize all return data with your existing ERP and accounting systems for precise financial tracking and reporting.

BigQuery Integration for Returns Data: Access detailed returns data in BigQuery, allowing for deep analysis and ensuring that all return transactions are correctly reflected in financial statements.

Returns Analytics for Actionable Insights: Use analytics to identify trends in product returns and customer behavior, helping to reduce return rates and prevent reporting discrepancies.

With WeSupply, you can confidently maintain the accuracy of your Shopify reports, ensuring that returns, exchanges, and refunds are properly accounted for and reflected in your financial data.

Returns software plays a pivotal role in improving inventory management. These tools help categorize returned products, ensuring efficient inventory allocation and better stock management. Real-time data provided by returns software allows for accurate forecasting and inventory planning, reducing the chances of overstocking or stockouts.

Automated inventory updates ensure that your financial records are precise and up-to-date, enabling you to make better business decisions. Leveraging returns software helps manage inventory more effectively and maintain accurate financial records, ultimately enhancing customer satisfaction and profitability.

WeSupply helps businesses improve inventory management by streamlining the inspection process and ensuring only high-quality products are restocked. By implementing defined quality control criteria and enabling seamless communication between teams, WeSupply optimizes both returns and inventory handling.

Key features include:

Collect Product Images and Feedback: Gather visual evidence and customer feedback on returns to make informed decisions about product conditions.

Warehouse Notes on Inspections: Allow warehouse staff to leave detailed notes on each return’s inspection, improving communication and inventory accuracy.

With WeSupply, you can ensure that returned products are thoroughly inspected and properly managed, leading to better inventory control and fewer errors.

Simplify Returns for Your Customers and Support Team

Book a quick call with our experts to see how WeSupply can help you: simplify the Return experience with just a few clicks, reduce customer service calls and manual processing, notify your customer about their refund, automate returns and reduce user error.

Monitoring return rates is essential for understanding the root causes of returns and improving customer satisfaction. Analyzing return rate data helps identify patterns and address issues that lead to high return rates. This proactive approach helps in reducing returns and enhancing customer loyalty.

Clear and accessible return policies also play a crucial role in enhancing customer satisfaction. Customers are more likely to trust and return to a store that offers straightforward and fair return policies. Using reviews and return rate analytics strategically can help in building trust and reducing the overall return rate.

Focusing on these aspects creates a customer-centric return process that enhances customer lifetime value and profitability.

WeSupply helps businesses monitor return rates and enhance customer satisfaction through powerful returns and logistics analytics. With WeSupply, you can gain deeper insights into why customers return products and how to improve their post-purchase experience.

Key features include:

Returns Analytics: Identify the most returned products, understand the reasons behind returns, and spot serial returners to reduce return rates.

Logistics Analytics: Track and measure key logistics performance to optimize processes and provide a seamless customer experience.

CSAT and NPS Tracking: Monitor Customer Satisfaction (CSAT) and Net Promoter Score (NPS) to gauge customer loyalty and identify areas for improvement.

By leveraging WeSupply’s analytics, you can drive actionable insights to reduce return rates and boost customer satisfaction.

Achieving financial accuracy and operational efficiency requires a strategic approach to managing returns and exchanges. Integrating the right returns management platform and maintaining accurate financial records are crucial steps in this process. Using the insights gained from returns to enhance operations can lead to significant improvements in customer satisfaction and profitability.

Implementing the discussed strategies helps avoid common accounting issues and maintain a clear and precise financial picture. This approach not only helps in managing returns more effectively but also in making informed business decisions that drive profitability.

In summary, mastering the art of managing returns and exchanges on Shopify involves understanding the financial impact, addressing common accounting issues, and leveraging automation tools. By implementing best practices and accurate reporting, you can maintain financial health and operational efficiency.

WeSupply simplifies managing returns and exchanges in Shopify, helping you avoid common accounting issues by automating critical processes. By integrating with your existing ERP and accounting systems, WeSupply ensures that all return and exchange data is accurately tracked and reported. Key features include real-time inventory updates, automated refund processing, and returns analytics, all of which prevent reporting errors and negative invoices. With WeSupply, you can seamlessly manage store credit, automate restocking, and track customer behavior to reduce return rates and boost customer satisfaction. Avoid accounting headaches and streamline your returns process today! Download the official WeSupply Shopify App and take control of your returns and exchanges.

Returns and exchanges significantly affect your Shopify accounting by reversing sales, which reduces recognized revenue and influences your overall financial health. It’s essential to account for these transactions accurately to maintain the integrity of your financial statements.

Common accounting issues with Shopify returns include discrepancies in sales data, particularly due to changes in reporting systems, and challenges with accurately tracking exchanges and restocking fees. It’s crucial to stay vigilant about these factors to ensure accurate financial reporting.

WeSupply automates the returns and exchanges process, reducing manual errors in recording refunds, restocking fees, and inventory updates. By syncing return data with your ERP or accounting system, WeSupply ensures all transactions are accurately reflected in Shopify’s financial reports.

Yes! WeSupply’s advanced analytics allow you to track which products are returned most frequently and why, helping you adjust your offerings and reduce financial discrepancies caused by excessive returns.

WeSupply integrates seamlessly with your existing ERP, 3PL, and accounting tools, ensuring all return data is synced across platforms for accurate financial reporting.

Yes. WeSupply has an Official Shopify App. You can download it and start integrating with your Shopify Store.

Yes, WeSupply has an official extension for Magento. The WeSupply x Magento integration allows for automating order tracking experiences, reducing customer inquiries, automating shipping email and SMS notifications, and providing a fully branded order tracking experience

Yes, WeSupply has an official BigCommerce App. You can integrate WeSupply with your BigCommerce store to improve your post-purchase customer experience.

Learn How To Create Successful Post Purchase Email Campaigns

Build an effective post-purchase email flow that helps you increase customer satisfaction and drive revenue growth!

Key Details:

Shopify returns management best practices: practical tips to streamline your process and keep your customers coming back!

Effective strategies to manage returns smoothly during the post-holiday period, avoiding chaos and keeping your customers satisfied!

Identify and select the best apps to optimize your Shopify store: boost sales, streamline operations, and enhance customer experience.

Let’s discover why third-party warranties are becoming a go-to option for eCommerce businesses and consumers!

How to enhance Shopify returns with efficient returns management software, making your business more competitive and customer-friendly!

How to find the best Shopify returns app: essential features and top-performing apps that meet various business needs!

How to make your eCommerce store more profitable by increasing your profit margins and ensuring your business thrives!

How to manage Shopify returns and exchanges through automation, clear return policies, and data analysis to streamline your return process!

Let’s explore the top Shopify product returns management software for 2024, to help you streamline returns and enhance customer satisfaction!